Expectations were high before Nvidia‘s (NASDAQ: NVDA) Financial Report for the Second Quarter of FY25. The company has become a de facto standard bearer. artificial intelligence Artificial intelligence is a true revolution. Graphics processing units (GPUS) provide the computational power needed to create the large language models (LLMs) that make generative AI possible.

The growing demand for AI has sent Nvidia shares soaring. The company’s shares are up more than 150% so far this year and more than 750% since the rapid adoption of AI began early last year (as of this writing).

But in recent weeks, investors have become concerned that Nvidia has gone too far, too fast, and are wondering whether the frenetic pace of AI adoption can continue. Nvidia has answered that question with a resounding “yes,” but given the stock’s massive gains, the impressive results simply weren’t enough.

In numbers

In the second quarter, NVIDIA posted record revenue of $30 billion, up 122% year-over-year and 15% quarter-over-quarter. This led to Adjusted earnings Earnings per share (EPS) were $0.68. The results beat analysts’ consensus estimates of $28.6 billion in revenue and $0.64 in EPS. Revenue also topped management’s forecast of $28 billion.

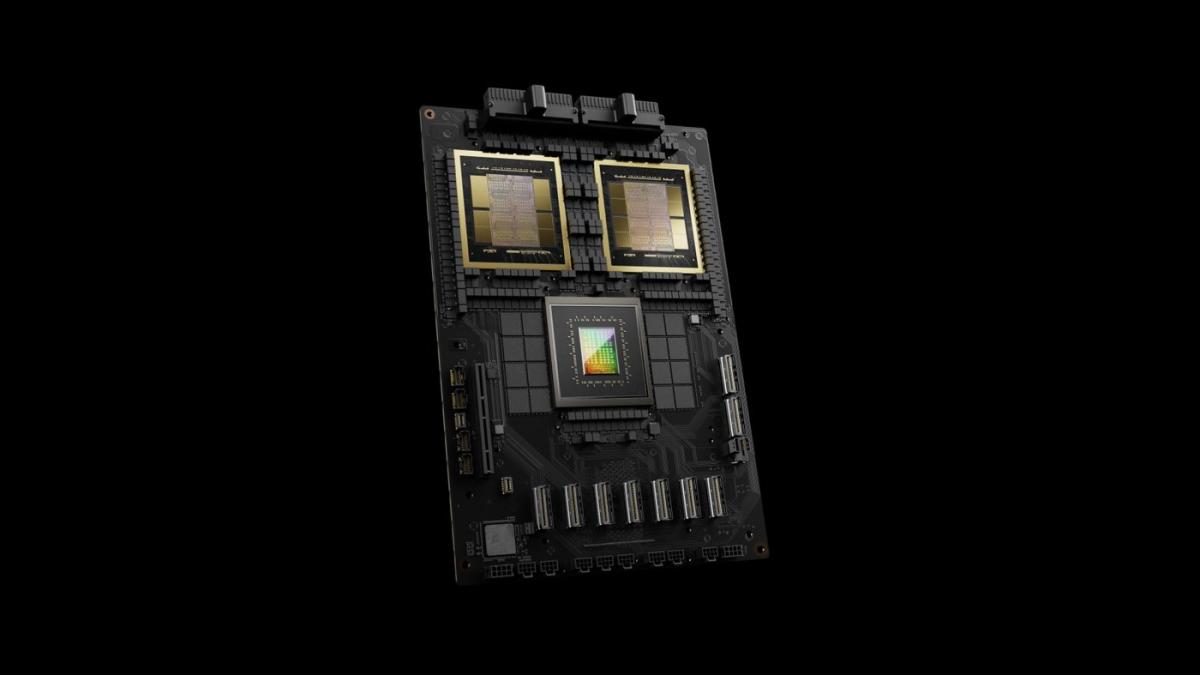

The headline was Nvidia’s data center segment — which includes chips used in artificial intelligence — where revenue rose to $26.3 billion, up 154% year over year and 16% quarter over quarter, helped by strong adoption of AI among cloud computing and big data center operators.

AI wasn’t the only factor fueling Nvidia’s growth, though the data center segment outperformed the company’s other segments (all segment gains year over year):

-

The gaming segment grew by 16% to reach $2.9 billion.

-

The professional visualization segment rose 20% to $454 million.

-

The automotive sector rose 37% to $346 million.

-

OEM sales rose 33% to $88 million.

Nvidia’s gross profit margin rose to 75.1% from 70.1% in the year-ago quarter, largely due to the company’s massive pricing power. However, the metric was down sequentially from 78.4% in the first quarter. The company had previously indicated that margins would moderate throughout the rest of the year. CFO Colette Kress cited Blackwell’s chip inventory and product mix for the decline.

What does the future hold?

CEO Jensen Huang noted that demand for the current Hopper chip “remains strong,” calling the outlook for the next-generation Blackwell architecture “amazing.” He went on to point out that in recent industry tests, Nvidia’s Hopper H200 and Blackwell B200 chips “swept” the MLPerf AI inference benchmark. Despite the efforts of its competitors, Nvidia chips remain the gold standard for AI processing.

Media reports have suggested that the new Blackwell chips could be delayed by up to three months due to design flaws, but Nvidia has brushed aside those concerns. “We shipped customer samples of our Blackwell architecture in Q2. We made a change to the Blackwell GPU mask to improve product yield. Blackwell production is scheduled to begin in Q4 and continue through FY26.”

Another byproduct of Nvidia’s growth trajectory is the company’s massive cash flow, with free cash flow more than doubling to $13.5 billion. As a result, Nvidia is increasing its returns to shareholders. The board has approved an additional $50 billion in share repurchases, in addition to the $7.5 billion remaining from its current authorization.

These factors have combined to fuel a strong outlook for the third quarter. Management is forecasting revenue of $32.5 billion, representing 80% year-over-year growth. That’s a slowdown from the triple-digit growth Nvidia has delivered in each of the past five quarters — but investors have long understood that growth of this magnitude can’t continue indefinitely. Still, the numbers show that investors appear to be underwhelmed.

Nvidia shares are down about 7% in after-hours trading (as of this writing), but it’s too early to tell what will happen tomorrow. Despite the decline, the company’s results continue to defy expectations, but a slowdown in its explosive growth rate was inevitable. Nvidia’s star is still shining, and the long-term investment thesis remains sound.

Given all of this, Nvidia’s enduring competitive advantage, strong results, and robust outlook show that the company still has a long way to go for growth in the future.

Should you invest $1,000 in Nvidia now?

Before you buy shares in Nvidia, keep the following in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are 10 stocks for investors to buy right now… and Nvidia wasn’t one of them. The 10 stocks that made the list could deliver massive returns in the years ahead.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $786,169.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of August 26, 2024

Danny in us The Motley Fool has positions in and recommends Nvidia. The Motley Fool has positions in and recommends Nvidia. Disclosure Policy.

Why did Nvidia stock drop after reporting parabolic growth? Originally posted by The Motley Fool