Bitcoin is trending higher in spot market prices, having surpassed $63,000 on June 30 before pulling back. Despite the momentum, the price action is a source of debate. However, some are skeptical, believing there is a reason for its value to rise to such exaggerated levels.

Analyst: Bitcoin Is Overvalued, Here’s Why

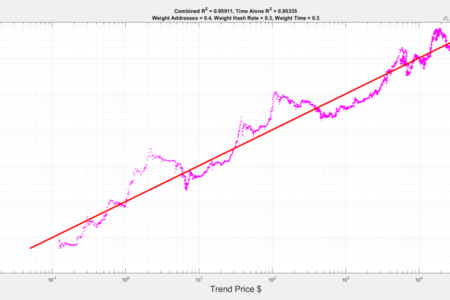

In a post on X, one analyst said, Argues The coin is likely to cool down, extending the 18% decline recorded in June. To conclude this, the analyst said the preview took into account several criteria, including time, the number of active Bitcoin addresses, and the hash rate.

With this pattern, the analyst said there was reason to doubt the upside, which has dampened the sentiment of bullish coin holders who expect the rally to continue. As of this writing, Bitcoin has returned to a multi-week range that saw all-time highs and support at $56,800 in May.

Related reading

From the price action, it is clear that the buyers are in control, at least from a top-down perspective. Despite the lower lows, especially in May when prices broke the $60,000 level, the bulls have a chance from a top-down perspective.

It is worth noting that prices are inside a bullish flag after the gains made in the first quarter of 2024. However, the failure of buyers to confirm the gains in mid-March is slowing the uptrend.

Buyers failed to break above $74,000 on the daily chart, and $72,000 is a strong filter line. In the short term, the trend could change if prices decisively break above $66,000, preferably on high volume.

Germany Sells as Bitcoin Rises Against US M1 Money Supply

Concerns are heightened by the recent dumping by the German government. On July 1, the German government transferred 1,500 bitcoins, worth over $94 million. Data The image shows 400 BTC being sent to three exchanges, including Bitstamp.

While it’s not immediately clear if they’ve sold the coins, sending them to an exchange suggests they’re keen to get rid of them — a clear reversal. The German government-linked address currently holds more than 44,000 bitcoins, worth more than $2.5 billion at spot market prices.

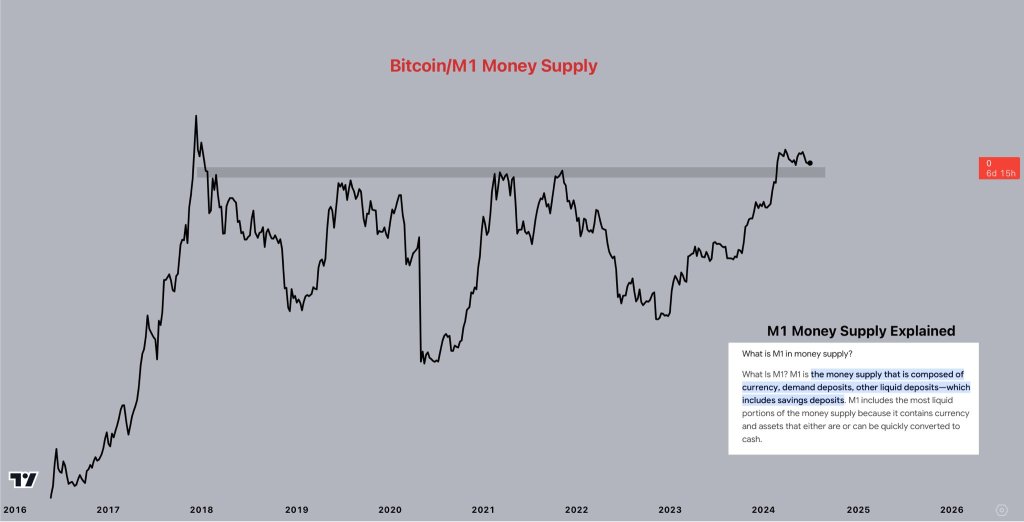

Despite these concerns, others are bullish on Bitcoin. Pointing to the relationship between the U.S. M1 money supply and Bitcoin prices, one analyst said the currency is poised for big gains.

Looking at the chart, the analyst Argues Bitcoin has not reached its all-time high relative to the US M1 money supply in more than six years.

Related reading

However, given the steady rise in BTC prices since mid-2023, it is highly likely that bulls will take over, pushing the coin to new all-time highs.

Featured image of DALLE, chart from TradingView