This is the takeaway from today's morning briefing, and what you can do subscription Received in your inbox every morning with:

Try to overthrow this king from the throne.

In the days following Nvidia's (NVDA) big quarter and Wednesday night's forecast, two paths have emerged.

Track One is owned and operated by Wall Street, and believes Nvidia will continue to achieve new profit levels this year and next. Consensus estimates (which can be tracked on Yahoo Finance here) are on the rise (again), and the Street remains firm in its appetite for higher price targets.

The other path is owned and operated by the media, and is increasingly looking to poke holes in Nvidia's investment thesis. Hey, I get it; Our job is to be skeptical of numbers, common narratives, and leaders.

But to be out there promoting that Nvidia stock is in a bubble because it's gone up too much, or that its financials might be in a bubble because of incredible growth rates, seems completely outside the norm to me.

Let me get this up front: I don't own a car in this race — I don't own stock in Nvidia and never have.

All I'm saying is that an asset bubble has some simple characteristics.

First: Assets whose value usually rises do not contain the fundamentals that justify this rise. Second: People blindly buy assets without understanding the assets – mainly because everyone is in on it.

I don't see any of these things for Nvidia.

Investors appear to be very familiar with Nvidia's business and are buying for the right reasons.

So, Nvidia's growth rates justify a higher valuation. This is a company that increased its profits by 461% in the first quarter! Sales exploded 262%!

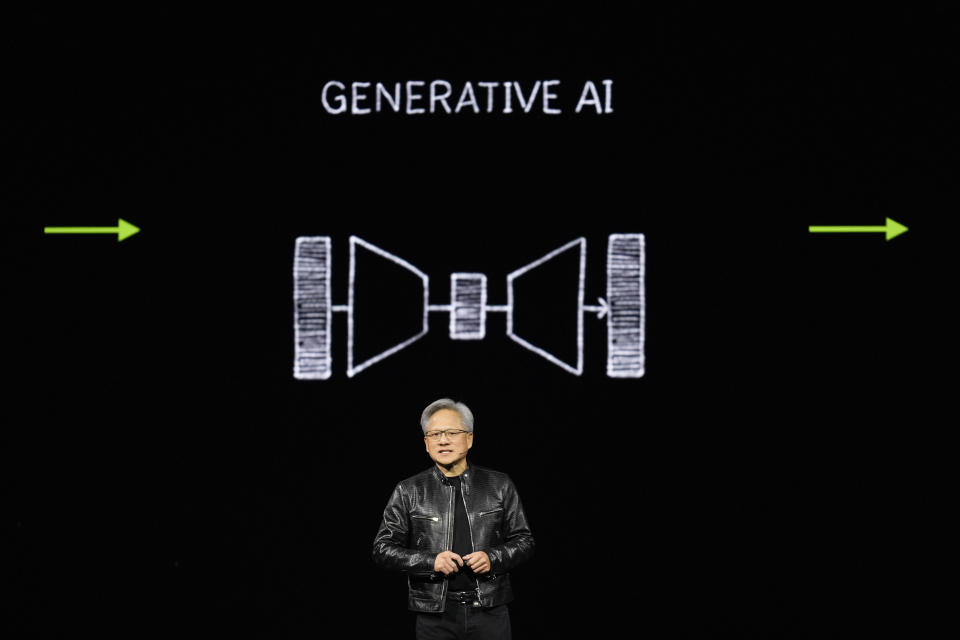

Why? Because we are witnessing a seismic shift in technology stacks at the hands of generative AI, powered by models powered by Nvidia chips. No one even comes close to this company's technology. It's great to discuss concerns about Amazon (AMZN) and Apple (AAPL) building their own AI chips, but Nvidia is doing so at scale, and is 27 miles ahead of those companies.

“People want to deploy these data centers right now,” Nvidia CEO Jensen Huang told Yahoo Finance's Julie Hyman and Dan Hawley in an exclusive post-earnings interview. “They want to turn on our (GPUs) now and start making money and start saving money. So the demand is very strong.”

Will Nvidia continue to increase its top and bottom lines by triple digits? No, but growth rates will still be impressive and faster than competitors.

bubble? Let's be real here, people!

Amazon AWS has started manufacturing AI chips to better control a supply chain hungry for these powerful pieces of technology. AWS CEO Adam Selipski discusses the strategy in a new episode of AWS Open the bid Podcast. Listen below.

Brian Susie He is the executive editor of Yahoo Finance. He is also a hostOpen the bidPodcast. Follow Sozzi on Twitter/X @Brian Susie and on LinkedIn. Advice on deals, mergers, activist positions, or anything else? Email brian.sozzi@yahoofinance.com. Are you an executive and want to join Yahoo Finance Live? Email Brian Susie.

Click here for the latest technology news that will impact the stock market.

Read the latest financial and business news from Yahoo Finance