This week, the Bank of Canada and the European Central Bank cut interest rates by 25 basis points each. For each, the initial cut was by the central bank.

The Bank of Canada announced its interest rate decision on Wednesday. The central bank has reduced what is seen as restrictive policy, but acknowledged that further cuts depend on upcoming data.

Review the Bank of Canada rate statement

- “The Bank of Canada today lowered its overnight interest rate target to 4¾%, with the bank rate at 5% and the deposit rate at 4¾%.”

- “The bank continues its policy of balance sheet normalization.”

- “The global economy grew by about 3% in the first quarter of 2024, broadly in line with expectations from the bank’s April Monetary Policy Report (MPR).

- “In the United States, the economy expanded more slowly than expected, as weak exports and inventories weighed on activity.”

- “Growth in private domestic demand remained strong but declined.”

- “In the euro area, activity rebounded in the first quarter of 2024.”

- “The Chinese economy was also stronger in the first quarter, supported by exports and industrial production, although domestic demand remained weak.”

- “Inflation in most advanced economies continues to decline, although progress toward price stability is bumpy and moving at different speeds across regions.”

- In Canada, economic growth resumed in the first quarter of 2024 after stopping in the second half of last year.

- “At 1.7%, first-quarter GDP growth was slower than expected in the monetary policy report.”

- “Consumption growth was strong at around 3%, and business investment and housing activity also increased.”

- “Labor market data show that companies continue to hire, although employment is growing at a slower pace than the working-age population.”

- “Wage pressures still exist but appear to be gradually easing.”

- “Overall, recent data suggests that the economy is still operating in excess supply.”

- “CPI inflation fell further in April to 2.7%.”

- “The bank’s preferred measures of core inflation have also slowed and three-month gauges point to continued downward momentum.”

- “Indicators of the breadth of price increases across CPI components have moved further downward and are approaching their historical average.”

- “However, shelter price inflation remains high.”

- “With continuing evidence that core inflation is declining, the Governing Council agreed that monetary policy no longer needed to be restrictive and cut interest rates by 25 basis points.”

- “Recent data has increased our confidence that inflation will continue to move towards the 2% target.”

- “The Governing Council closely monitors the development of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior.”

- “The Bank remains resolute in its commitment to restoring price stability for Canadians.”

BOC Macklems press conference summary:

Bank of Canada Governor Tiff Macklem stressed that interest rate decisions will be made on a meeting-by-meeting basis, depending on economic data. He said that if the economy continues to perform as expected and inflation declines, further interest rate cuts can be expected. Macklem is determined to bring inflation back to the 2% target but acknowledges the work is not yet done and will evolve with the situation.

Macklem noted that the economy developed broadly as expected, boosting confidence that inflation will gradually return to the 2% target. However, the timing of any further cuts will depend on the data received, recognizing potential risks and bumps along the way.

Macklem stated that their expectations indicate a gradual move towards the inflation target, but there are limits to how far their policy deviates from the United States, and they are not close to those limits. He also pointed to expectations of slowing population growth, which was factored into their forecasts. Population growth has eased employment pressures but has increased demand for housing.

He feels the economy appears to be heading for a soft landing, with room to grow above potential for a while. While the Bank of Canada normalizes its balance sheet, policy remains constrained by inflation being above target. Macklem stated that interest rates will not return to pre-Covid levels, and acknowledged past periods of significant disagreement with the US Federal Reserve.

On Thursday, the European Central Bank also cut interest rates, and like the Bank of Canada, the future path of interest rates depends on the data.

Review of the European Central Bank's rate statement

- “Today the Governing Council decided to cut the ECB’s three key interest rates by 25 basis points.”

- “Based on an updated assessment of inflation expectations, core inflation dynamics and the strength of monetary policy transmission, it is now appropriate to ease the degree of tightening of monetary policy after nine months of holding interest rates steady.”

- “Since the Governing Council meeting in September 2023, inflation has fallen by more than 2.5 percentage points and inflation expectations have improved significantly.”

- “Core inflation also eased, reinforcing evidence of weakening price pressures, and inflation expectations have softened across the board.”

- “Despite progress over recent quarters, domestic price pressures remain strong as wage growth picks up, and inflation is likely to remain above target into next year.”

- “The latest Eurosystem staff forecasts for both headline and core inflation for 2024 and 2025 have been revised compared to the March forecast.”

- “Staff now expect headline inflation to average 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026.”

- “For inflation excluding energy and food, experts expect it to average 2.8% in 2024, 2.2% in 2025, and 2.0% in 2026.”

- Economic growth is expected to recover to 0.9% in 2024, 1.4% in 2025, and 1.6% in 2026.

- “The Governing Council is determined to ensure that inflation returns to its medium-term target of 2% in due course.”

- “It will keep interest rates sufficiently tight for as long as necessary to achieve this goal.”

- “The Board will continue to take a data-driven, meeting-by-meeting approach to determine the appropriate level and duration of restriction.”

- “The Board also confirmed today that it will reduce Eurosystem holdings of securities under the Pandemic Emergency Purchase Program (PEPP) by €7.5 billion per month on average during the second half of the year.”

- “The Governing Council decided to cut the ECB’s three key interest rates by 25 basis points.”

- “The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility will decrease to 4.25%, 4.50% and 3.75%, respectively, effective June 12, 2024.”

Summary of the President of the European Central Bank. This was stated in the press conference held by Lagarde:

In October 2022, inflation peaked in double digits, but by September 2023, it had fallen to 5.2%, and currently stands at 2.6%. President Lagarde stressed the need for more data to confirm the contractionary path, noting that while restrictive measures were more pronounced in September, various factors such as base effects and wage trends could create uncertainty. Wages, especially in the service sector, play an important role in inflation. Although wages are still high, there are signs that they have recently declined, and the European Central Bank must take into account the variation in wages between countries and the impact on service prices.

The ECB's policy decisions and data releases are not perfectly synchronized, making future actions difficult to predict. Lagarde stated that market pricing of interest rate cuts is independent of the ECB's decisions, reducing expected interest rate cuts from 64 basis points to 36 basis points for the rest of the year, for a total of approximately 61 basis points. Despite numerous challenges, including unforeseen bumps in the fight against inflation, the ECB is committed to returning inflation to the 2% target in the medium term. The decision to ease the restrictive stance was almost unanimous, with the exception of one governor. The ECB will continue to take a serious approach to combating inflation, and will remain restrained until the 2% target is achieved. Lagarde stressed that the ECB is far from reaching the neutral rate, which remains a key goal.

The Federal Reserve and the Bank of Japan are next

Next week, the Federal Reserve will announce its interest rate decision on Wednesday, while the Bank of Japan will announce its intentions on Friday.

As for the Federal Reserve Bank, the Fed is expected to keep interest rates unchanged. Inflation remains steady, and although the latest CPI and PCE data were encouraging, they are still above target. A number of Fed officials — including Fed Chair Powell — expressed the need to keep interest rates unchanged given strong growth and higher-than-expected inflation in the first quarter. The Federal Reserve Bank of Atlanta's GDP growth estimate fell to 1.8% recently, but has bounced back to 3.1% thanks to today's US jobs report.

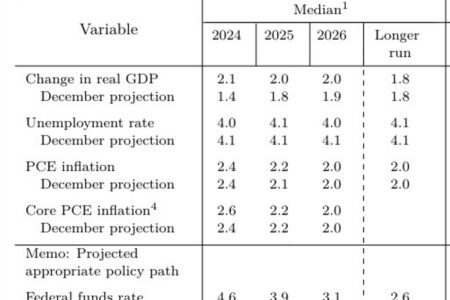

What will be interesting for markets on Wednesday are future GDP, inflation and employment forecasts, as well as interest rate forecasts at the end of 2024, 2025 and 2026.

Average growth, employment and inflation from March forecasts showed GDP at 2.1% in 2024, unemployment at 4.0%, and core personal consumption expenditures at 2.6%. GDP is higher than its current counterpart which may prompt a move to the upside. Unemployment has reached 4.0% and as a result may rise. Baseline PCE may be low.

Chart 3 predicts cuts by the end of the year in March. The market is currently pricing in around 40 basis points by the end of the year. Here's a look at the dot plot. It's hard to believe that at the end of the year, the Fed predicted 6 cuts in 2024.

A type of statistical graph

The Bank of Japan is on a different path as it may look to pull back on bond buying when it announces its interest rate decision on Friday.