WTI Crude Oil Price, Charts and Analysis:

Recommended by Zain Fouda

How to trade oil

Most read: Oil Price Outlook: WTI and Brent are facing challenges as the Chinese economy remains focused

WTI’s rally failed at the first hurdle yesterday as oil prices faced renewed selling pressure, posting its biggest drop in two weeks with a loss of around 3.9% on the day. This continued into the Asian session as well as the first part of the European session as WTI was down another 1.8% at the time of writing and was trading at $68.20 a barrel.

Central banks are still on the sidelines amid bullish concerns

Yesterday’s sudden rise by the BoE coupled with hawkish rhetoric from the central bank and rebound in the US dollar weighed on oil prices and sentiment. Market participants were hoping for interest rate cuts in the second half of 2023, but many central banks seem destined for more rate increases as well as keeping interest rates at a higher level for a longer period. This led to market participants assessing the potential impact of such a move on global growth with signs of a possible recession increasing by the day.

This morning brought a batch of PMI data from the Eurozone (read more here) which continued lower and weighed on the overall sentiment. Given today’s data, another quarter of negative GDP growth remains likely in the Eurozone and is likely to be the reason for the market reaction. The composite PMI fell from 52.8 to 50.3 while the manufacturing PMI fell from 46.4 to 44.6. The Services PMI remains above 50 but continues to slow, another sign of weakness in the economy as the services sector has been the best performer so far. The only positive for the Eurozone lies in a busy tourist season during the summer months which could help spur some growth at least in the short term, providing a more promising start to the third quarter.

Meanwhile, US crude oil inventories continued to fall below expectations again with a decline of 3.831 million barrels in the week ending June 16, 2023, according to data from Energy and Information Administration (EIA).

we Crude oil stock change

Source: TradingEconomics, EIA

The continued decline in oil stocks globally is expected to continue and could be a blessing in disguise for the black gold going forward. As noted by a group of asset managers over the past week, many of which have lowered their 2023 oil price forecasts, lower inventories combined with OPEC+ cuts could help keep oil prices supported in the third and fourth quarters of 2023.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

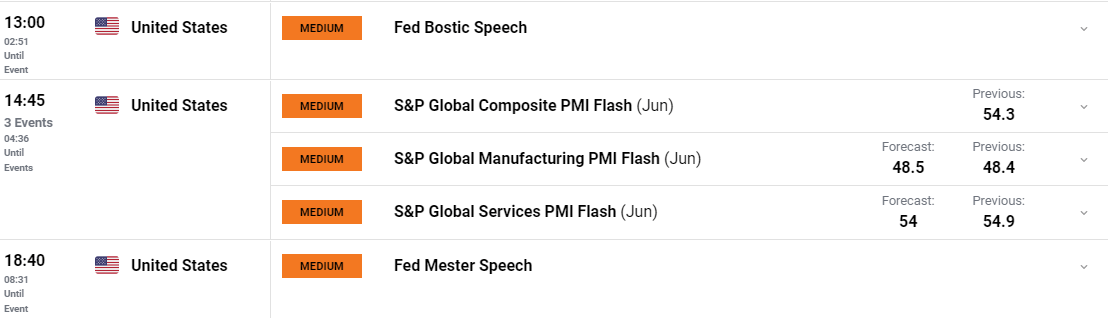

Economic calendar and risk events

Fed policy makers will keep market participants on their toes today ahead of the US PMI data. Similar signs of US economic weakness as seen in Euro-Zone data this morning could add pressure on Oil prices heading into the weekend.

For all the economic data and events that move the market, see DailyFX calendar

Technical outlook and final thoughts

From a technical perspective, both WTI and Brent are on their way to give back last week’s gains. The uptrend this week failed at the first major hurdle in its path, the 50-day moving average, around the $72.68 mark per barrel.

Oil is currently testing the lower trend line of the symmetrical triangle in action and could find some support in the short term. There is a high chance that WTI will continue to consolidate within the symmetrical triangle as the top approaches.

Alternatively, a break and a daily candle close below the symmetrical triangle could lead to a retest of the yearly lows around $63.60. However, for this to bear fruit from the support from the recent double bottom pattern around the $67.10 handle, it must be broken and could prove difficult to break.

Key levels to watch out for:

Support levels

- $67.10

- $66.00

- $63.60 (YTD Low)

resistance levels

- $70.00 (Psychological Level)

- $72.68 (50-day moving average)

- $74.28 (100-day moving average)

WTI Crude Oil Daily Chart – Jun 23, 2023

Source: TradingView

Customer Sense Data IG

IGCS shows that retail traders are currently going long on WTI, with 87% of traders currently holding long positions. At DailyFX, we usually take a view contrarian to crowd sentiment, and the fact that traders are long suggests that WTI may enjoy a brief rebound before continuing lower.

Introduction to technical analysis

Technical analysis chart patterns

Recommended by Zain Fouda

Written by: Zain Fouda, market writer for DailyFX.com

Connect with Zain and follow her on Twitter: @employee