USD/JPY PRICES, CHARTS AND ANALYSIS:

Most Read: S&P 500 and Gold (XAU/USD) Take Diverging Paths Ahead of a Raft of Data Releases

The Yen has put in two consecutive days of gains against the greenback for the first time since August. A sign of the pressure the Japanese currency has been under for a large part of Q3 and Q4 thus far. Markets have been waiting with bated breath for the threat of FX intervention to materialize which has kept USDJPY bereft of a clear direction.

Elevate your trading skills and gain a competitive edge. Get your hands on the Japanese Yen Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free JPY Forecast

NIKKEI NEWS AND BANK OF JAPAN (BoJ) INTEREST RATE MEETING

The Japanese Government has tried to use warnings of intervention to underpin the Yen in the second half of 2023. This approach does appear to be wearing thin however, as market participants have grown accustomed to the warnings being followed up by very little action from the Central Bank.

This morning however we saw a report from Nikkei Asia that the BoJ maybe preparing to adjust the Yield Curve Control policy once more and allow 10Y Japanese Government bond Yields to rise above 1%. The question on market participants minds will be whether the BoJ will follow through. The bigger picture is obvious, in that Governor Ueda was brought in to normalize monetary policy. Yet till now we have only heard the BoJ use comments to taper Yen weakness, but one fears more may need to be done if the US Dollar Index continues to hold the high ground.

RISK EVENTS AHEAD

A lot on the calendar this week with tomorrows BoJ meeting kicking things off. The BoJ meeting could be the most exciting one in recent memory if the BoJ do announce a shake up to their YCC policy which could stoke some serious volatility in Japanese Yen pairs.

Following the BoJ meeting the outlook for the USDJPY may be drastically different ahead of the FOMC meeting. The Federal Reserve are expected to hold rates steady but focus will be on the Fed outlook moving forward and a potential hike in December. The strong data from the US keeps the door open for now with market participants looking for further clarity.

For all market-moving economic releases and events, see the DailyFX Calendar

For Tips and Tricks on Trading USDJPY, Download the Guide Below

Recommended by Zain Vawda

How to Trade USD/JPY

FINAL THOUGHTS AND TECHNICAL OUTLOOK

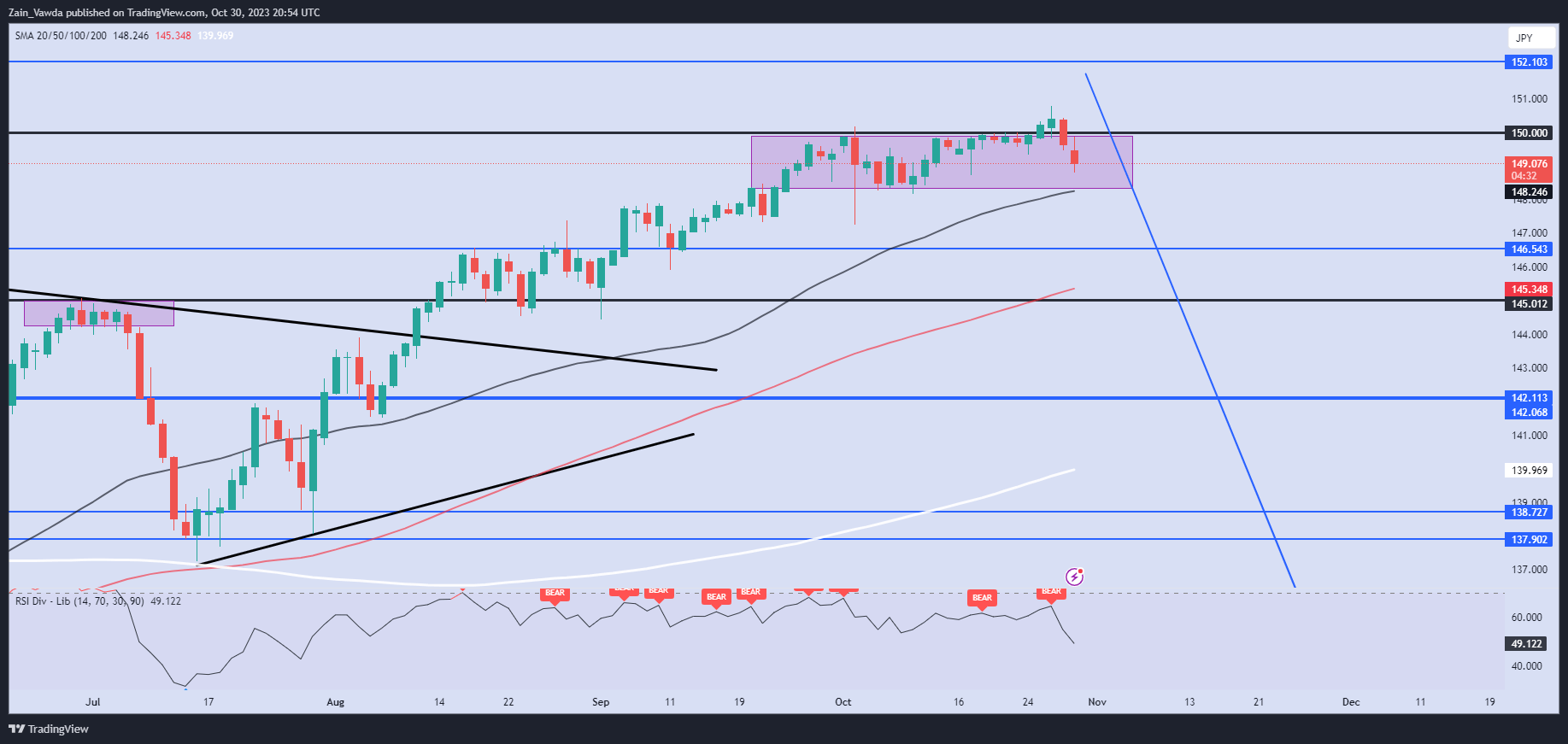

USD/JPY technical outlook remains complicated given the steep rise and long period of consolidation of late. We have however printed two successive days of losses for the first time since August, which could be a sign that further downside may be imminent. As we have discussed for months, without a change in monetary policy from the BoJ the likelihood of a sustained move to the downside may remain elusive.

A daily candle close below the recent range and 50-day MA resting around the 148.300 mark. This could be another sign that we are building bearish momentum. However, the question of how large a move we may get will depend solely on the BoJ meeting tomorrow and what changes/tweaks the Central Bank makes to monetary policy.

Key Intraday Levels to Keep an Eye On:

Support levels:

Resistance levels:

USD/JPY Daily Chart – October 30, 2023

Source: TradingView, Chart Created by Zain Vawda

IGCS shows retail traders are currently Net-Short on USDJPY, with 83% of traders currently holding SHORT positions. Given the contrarian view adopted here at DailyFX will we see a return to the 150.00 level and beyond?

To Get the Full IG Client Sentiment Breakdown as well as Tips on how to use it, Please Download the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 2% | 2% | 2% |

| Weekly | 9% | -13% | -10% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda