The Bank of Japan will raise interest rates again by October and may hike at a faster than expected with yen weakness among factors that may come into play, according to a Bloomberg survey of economists.

Article content

(Bloomberg) — The Bank of Japan will raise interest rates again by October and may hike at a faster than expected with yen weakness among factors that may come into play, according to a Bloomberg survey of economists.

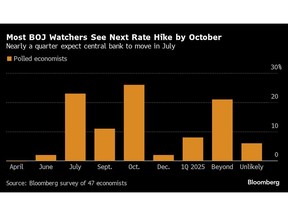

Following the central bank’s landmark decision to scrap its massive easing program this week, 70% of 47 polled analysts expect the BOJ to increase rates again by October, but their opinions diverge on the specific timing of the next move.

Advertisement 2

Article content

Article content

Some 23% said the hike will come in July, while 26% of respondents say the bank will raise the policy rate in October. Others see an earlier move, with 11% pinpointing June. Polled economists see the rate — now set with an upper limit of around 0.1% — rising to 0.25% by the end of the year, according to their median estimate.

For the full results, click here.

The poll shows economists are mindful of the risk that Governor Kazuo Ueda and his fellow board members may move again in the coming months despite the dovish messaging after Tuesday’s first rate hike in 17 years.

Following the decision, the yen weakened by more than 1% as investors likely focused on Ueda’s insistence that financial conditions would remain easy and the lack of penciled-in hikes in the BOJ’s guidance on policy.

“The BOJ is presenting the shift as a dovish rate hike but they are sprinkling hints of hawkishness around, too,” said Naka Matsuzawa, chief strategist at Nomura Securities. “The key point is the BOJ no longer has to wait for the release of its quarterly outlooks to move. Governor Ueda pointed out that a higher risk of changing the outlook can be a sufficient reason for changing policy.”

Article content

Advertisement 3

Article content

Some 70% said there was a risk to their main scenarios that the bank could move by July, with 17% specifically flagging June. Around 55% of the economists warned there was a greater risk of the governor moving faster than expected. That compared with around a fifth who took the view Ueda might end up going slower.

Ueda said Thursday that the BOJ moved this week partly because it wanted to avoid having to rapidly raise rates if it moved too late. That remark suggests a shift in his thinking was already underway in the run-up to this week’s gathering. He had previously maintained there was little risk of falling behind the curve, in contrast to the US and Europe.

Read more: Japan’s Speedier Inflation Pace Keeps BOJ’s Next Move in Focus

Despite the unclear policy path ahead, more than three-quarters of those polled said Ueda’s signaling of his intentions is good or very good compared with 9% who said it’s bad. The positive score was higher than the 62% he garnered after surprising market players with yield curve tweaks last July.

Ueda and his fellow board members dropped a series of hints that a policy shift was approaching this spring. As a result, this week’s move was widely expected in financial markets.

Advertisement 4

Article content

Economists arguing against the likelihood of an early hike, cited weakness in the economy.

“Japan’s economy isn’t in recession, but it’s not far from it either,” said Stefan Angrick, senior economist at Moody’s Analytics Japan. “All of this means the BOJ will proceed at a gradual pace.”

Striking the right balance between higher rates and managing a bloated balance sheet is one of the biggest challenges Ueda faces going forward. That task could get even more complicated by the yen if it weakens again, a direction that would also increase inflationary pressure in an economy dependent on energy and food imports.

Some 54% of respondents said there is a risk of a BOJ hike if the yen weakens again, though almost a third said they don’t see that.

Speaking Friday in parliament, Ueda said the massive easing program unleashed by his predecessor Haruhiko Kuroda had helped correct an overly strong yen. At his briefing after the policy decision on Tuesday, Ueda said the central bank would mull a policy response if currency moves started to have a big impact on the outlook for the economy and prices.

The yen reached 151.86 against the dollar Friday morning, close to the 151.95 level hit in October 2022 when the finance ministry intervened to prop it up. The currency briefly strengthened to 151.42 after this report.

Around 40% of respondents said the risk of a currency intervention by the ministry has risen following the yen’s drop after the BOJ’s normalization step. The median estimate of the yen level that would push the finance ministry to intervention is 155, according to the poll.

(Adds economist comments)

Article content