GBP/USD rates, charts and analysis

- The UK Bank Rate rose by 50 basis points to 5%.

- The Bank of England will rise further if inflationary pressures persist.

Recommended by Nick Cooley

How to trade GBP/USD

The Bank of England raised the bank rate by half a percentage point today to 5%, the highest level in 15 years. The panel voted 7-2, with Swati Dhingra and Silvana Tenreyro voting to keep the rates at 4.5%. The Monetary Policy Committee said it will continue to closely monitor signs of persistent inflationary pressures in the economy as a whole, including tightening labor market conditions, wage growth behavior and service price inflation. If there is evidence of further sustained pressures, further monetary policy tightening will be required.

The BoE added that it expects inflation to fall “significantly this year” due to lower energy prices, and the consumer price index for services is expected to remain broadly unchanged, while food price inflation is expected to decline further in the coming months.

See all market-moving events and data releases in real time DailyFX calendar

UK core inflation pierces 7% as forecast beats GBP/USD quote

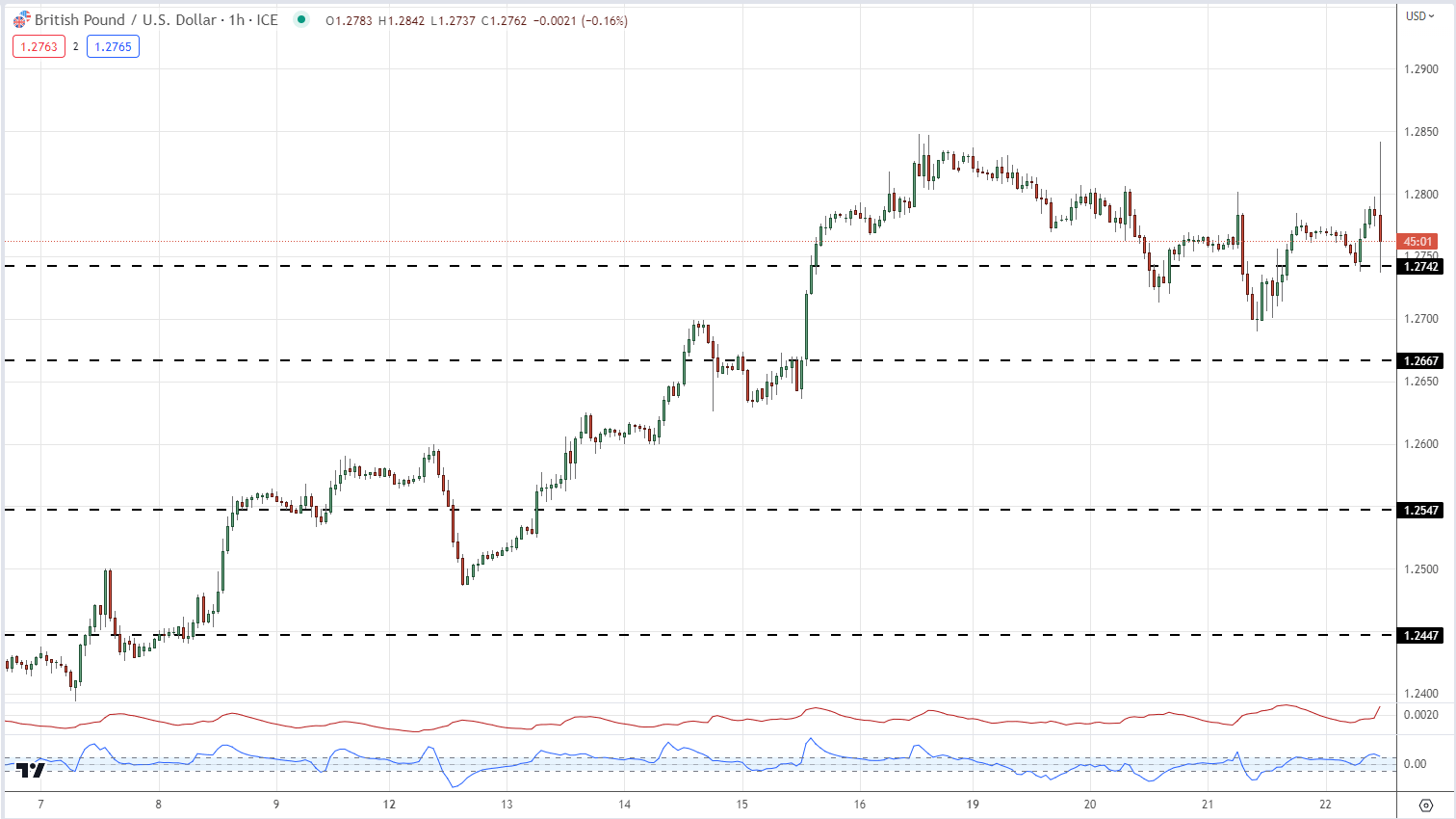

Sterling jumped at the release but has since returned to pre-release levels. GBP/USD touched 1.2842 before falling back to trade around 1.2750 in volatile market conditions.

1-hour GBP/USD price chart – Jun 22, 2023

Recommended by Nick Cooley

Trading Forex News: The Strategy

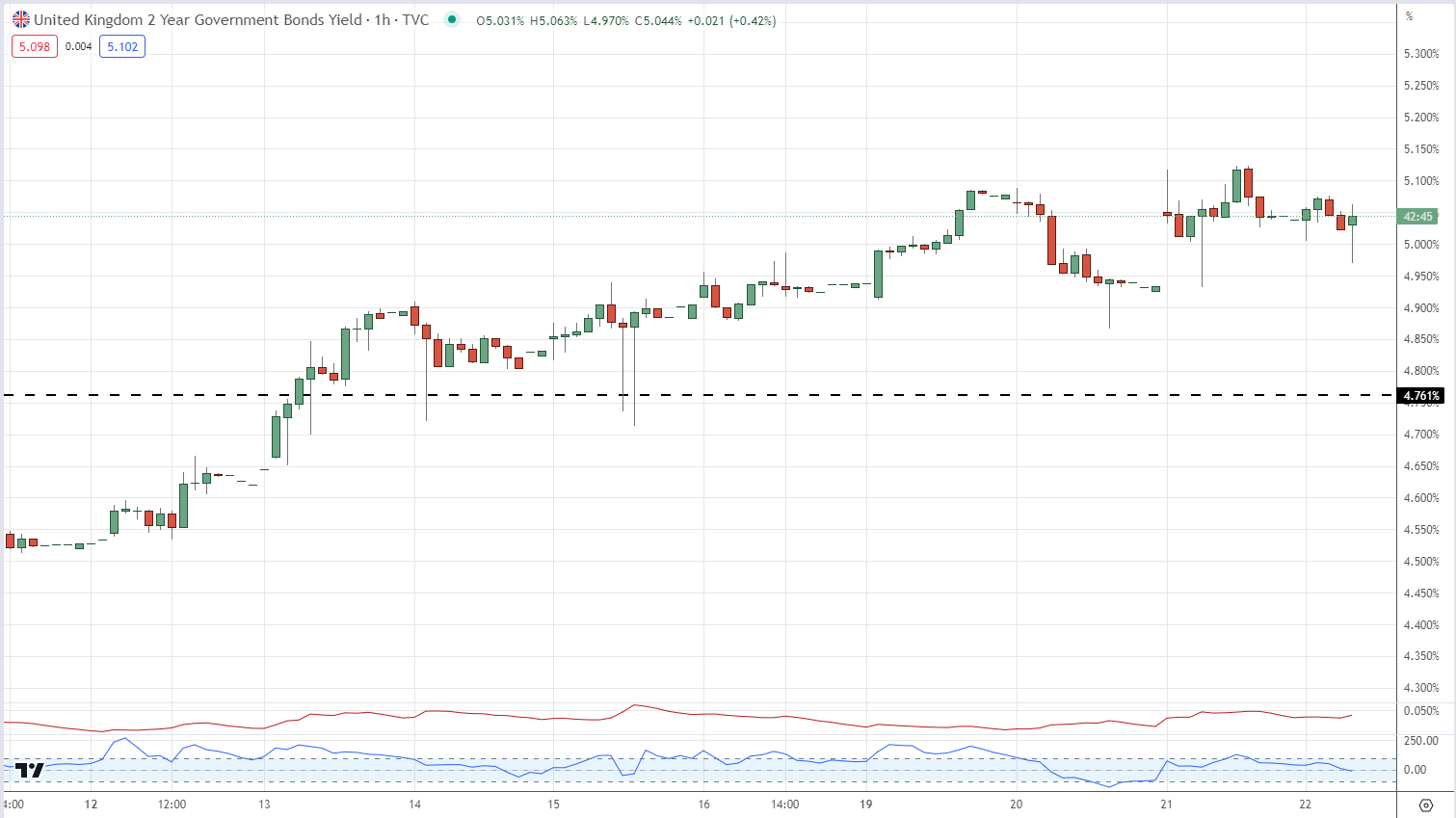

Short-term UK government bond yields fell by a handful of basis points at issuance, but look poised to rally.

1-Hour UK 2-Year Gold Dividend Chart – Jun 22, 2023

|

change in |

Longs |

Shorts |

Hey |

| Daily | 3% | 1% | 2% |

| weekly | 12% | -6% | 1% |

GBP/American dollar Retailers are short cable net

Retail trader data shows that 36.68% of traders are net long with the ratio of short to long trades at 1.73 to 1, the number of traders are net long is 5.89% higher than yesterday and 7.29% higher than last week, while the number of traders is net long Selling to traders is up 3.18% from yesterday and down by 1.30% from last week.

We usually take a view contrarian to crowd sentiment, and the fact that traders are short on the bargain suggests that GBP/USD prices may continue to rise. However, traders are net less than yesterday and compared to last week. Recent changes in feelings warn that the current GBP/USD price trend may reverse bearish soon despite the fact that traders are still squeamish.

what is your opinion of British pound Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.