According to the latest research conducted by Coinbase,… The relationship between cryptocurrencies and stocks The markets became noticeable. This reaction stands at about 50% as of September 2024, mostly due to global monetary easing initiatives implemented by major countries such as the United States and China. This study has important implications especially for investors trying to negotiate these interconnected markets.

The impact of monetary policy

The development of this link has been greatly influenced by the Fed’s aggressive approach to the issue Reducing the interest rate. After the recent 50 basis point drop in interest rates, Bitcoin and cryptocurrency-related stocks saw significant gains.

Bitcoin crossed the $64,000 level, while stocks like Microstrategy and Coinbase also showed increasing momentum. This synchronization indicates that when the Fed implements measures aimed at promoting economic development, both types of assets show positive feedback.

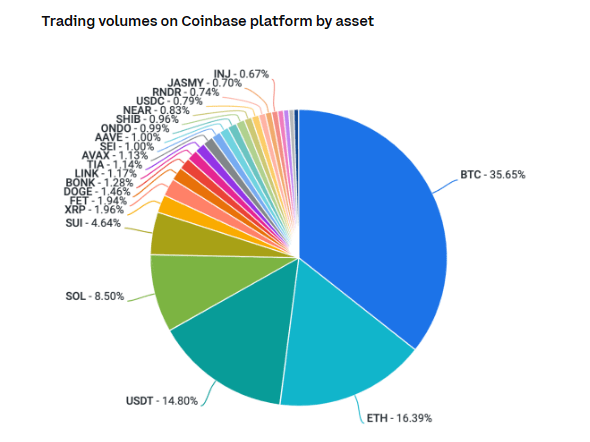

Source: Coinbase

Interestingly, Bloomberg data indicates that US stock futures prices have been fluctuating in tandem with cryptocurrency prices. For example, as Bitcoin prices rose, many US stocks also hit all-time highs.

This joint movement indicates a deeper relationship between the way investors evaluate risks in both markets. Carolyn Morrone, co-founder of Orbit Markets, notes that macroeconomic factors are currently driving cryptocurrency prices, a trend that is very likely to continue throughout the Fed’s easing cycle.

Crypto: changing market dynamics

in the past, Cryptocurrencies It operates independently of traditional financial markets. However, the sensitivity of these digital assets to macroeconomic conditions increases as they mature.

This shift is evident in findings from Coinbase, which indicate that Ethereum outperformed Bitcoin during this period of increased correlation. Ethereum’s 8% surge over Bitcoin in the week following the Federal Reserve’s announcement suggests that investor interest in altcoins may be changing.

Source: Coinbase

Despite Ethereum’s improved performance, investors are still concerned about the recent sell-off by the Ethereum Foundation. The foundation recently sold 100 Ethereum, bringing the total ETH sold this year to over 3,500. Actions like these have potential impacts on market sentiment as well as the continued growth of projects within the Ethereum network.

Future trends and investor sentiment

as connection Between the cryptocurrency market and the stock market getting stronger, investors are rethinking their plans. More and more people in the cryptocurrency space want to learn more about areas other than Bitcoin and Ethereum, such as options.

Memecoins like Shiba Inu and PEPE have recently gained popularity among investors, with certain sectors – such as gaming and second-layer solutions – recording impressive gains of up to 17% in just one week.

As October approaches – a traditionally strong month for cryptocurrencies – there is speculation that favorable market conditions could lead to further price increases across both types of assets.

The increasing involvement of institutional investors in cryptocurrency markets has also influenced this trend since their trading patterns usually match those of stocks.

Featured image from Pexels, chart from TradingView

Source:

Source:

Comments are closed, but trackbacks and pingbacks are open.