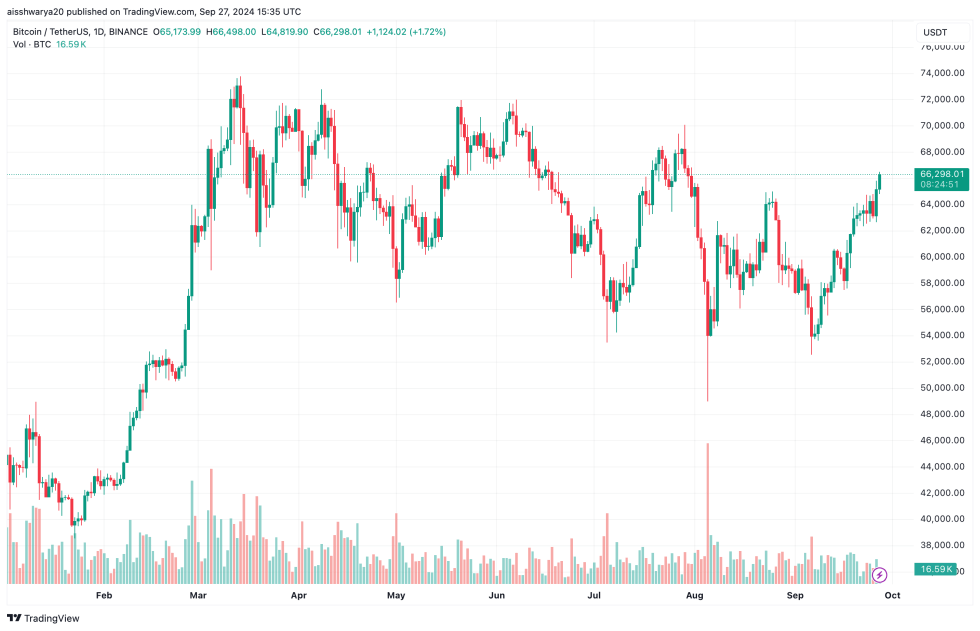

A Bitcoin (BTC) break above $65,000 could lead to “exceptionally high” chances for the cryptocurrency to rally more broadly in the fourth quarter of 2024, according to Markus Thelen, head of research at 10x Research.

A sustained Bitcoin rally could spark fear in altcoins

Recently a reportThielen explained several factors that could pave the way for a crypto rally in the last quarter of 2024. According to the report, a further rally in crypto markets could be on the cards due to two main factors.

First, the acceleration of stablecoin minting indicates increased interest among investors and traders in returning to the cryptocurrency market.

In the weeks following the Federal Open Market Committee (FOMC) meeting on July 31, nearly $10 billion in stablecoins were issued, boosting market liquidity and even outpacing Bitcoin exchange-traded fund (ETF) inflows.

The report stated:

Circle, which typically caters to more regulated institutions, has accounted for a disproportionate 40% of recent stablecoin flows, indicating increased allocation from larger players in the market. Unlike USDT mining on Tron, which is typically associated with capital preservation, USDC mining may indicate a rise in DeFi activity. Year-to-date, stablecoin inflows have reached $35 billion, bringing the total value of stablecoins outstanding to $160 billion.

Thielen underscores Bitcoin’s recent breakout above $65,000, noting that it could quickly move towards the psychologically important $70,000 price level before it attempts to print a new all-time high (ATH).

Another metric indicating a potential rise in altcoins later this year is decrease Bitcoin (BTC.D) dominates after the September FOMC meeting. BTC.D’s decline coincides with a rise in Ethereum (ETH) network gas fees, likely driven by increased altcoin activity on the smart contract blockchain.

The chart below shows Ethereum gas fees on the rise, rising from $1.89 million on August 13 to consistently above $7 million since September 22.

The report adds that assuming the US Federal Reserve (Fed) continues to lower interest rates, high-beta altcoins may become increasingly attractive to cryptocurrency traders.

Encouraging cryptocurrency trends in South Korea and China

The report highlights cryptocurrency trading activity in South Korea as a factor fueling the altcoin trend. Daily trading volume in the country is now around $2 billion, with altcoins dominating trading activities ahead of Bitcoin.

Notably, the Shiba Inu (SHIB) has regained the top spot in terms of trading volume in South Korea, indicating… Enhanced Speculating and setting the stage for a potential market dominated by altcoins in the fourth quarter.

Finally, Thelen highlights that Chinese OTC brokers have reported regular quarterly inflows of about $20 billion over the past six quarters, for a total of $120 billion.

As recently reported, China’s central bank reduced The Reserve Requirement Ratio (RRR) of 50 basis points will inject liquidity into the market, which could lead to a corresponding rise in digital asset prices later this year.

The report concludes by predicting that Bitcoin’s next target will be $70,000 within two weeks, with a new ATH likely by late October. Bitcoin is trading at $66,298 at press time, up 1.4% in the past 24 hours.

Featured image from Unsplash.com, charts from DefiLlama.com and TradingView.com

Comments are closed, but trackbacks and pingbacks are open.