The dollar fell on Monday as a change in the Federal Reserve’s interest rate forecasts weighed on the currency, while safe-haven flows into gold and oil rose amid escalating tensions between Russia and Ukraine.

Despite geopolitical tensions, risk sentiment has held up surprisingly well, with US stocks rising as investors remain focused on key technology earnings due later this week.

Here’s what moved the major assets at the start of the week:

Titles:

- New Zealand’s BusinessNZ services index improved from 45.7 to 46.0 in October

- New Zealand PPI inputs for Q3 2024 jumped from 1.4% q/q to 1.9% q/q (1.0% expected); PPI output accelerated from 1.1% to 1.5% (expected 0.9%)

- Core machinery orders in Japan fell another 0.7% year-on-year in September after a 1.9% decline in August.

- Rightmove: UK seller prices for new homes fell 1.4% in November after rising 0.3% in October, likely due to post-Budget jitters

- Bank of Japan Governor Ueda spoke of progress in wage-driven inflation, keeping the door open for a near-term rate hike

- Eurozone trade surplus jumped from €10.8 billion to €13.6 billion (€7.9 billion expected) as exports (0.6%) outpaced imports (-0.6%) in September

- Housing starts in Canada rose from 223,000 to 241,000 (expected 239,000) in October

- The US NAHB Housing Market Index improved from 43 to 46 (expected 42) in November

- The United States allowed Ukraine to launch limited strikes on Russia using American-made long-range missiles

- President Zelenskyy ‘massive’ Russian missile and drone attack targets energy infrastructure across Ukraine

Broad market price movement:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Yields, Bitcoin Overlay Chart by TradingView

The major asset was on display on all charts yesterday, as gold ended a six-day losing streak and rose to $2,610. This increase came as escalating tensions between Russia and Ukraine made headlines, following a massive Russian missile strike on Ukrainian infrastructure, and the United States giving Ukraine the green light to use long-range missiles against Russian targets.

The US dollar took a hit as traders backed away from their hawkish interest rate expectations, moving away from recent aggressive bets on interest rate cuts. Meanwhile, WTI jumped above $69.00, benefiting from a weaker dollar and geopolitical tensions, with an added boost from the production halt at Norway’s Johan Sverdrup oil field.

Meanwhile, US 10-year Treasury yields saw some drama during the day, hitting 4.49% before falling to 4.41%, likely as investors looked for safe havens. Bitcoin had a tough day as well, but is struggling to maintain its position above $90,000.

Global stocks were mixed, but US indices rose overall, with Tesla stock rising 5.6% on news that Trump’s transition team may ease rules on self-driving cars. Market sentiment was largely shaped by anticipation around Nvidia’s earnings and ongoing speculation about how the Trump administration’s policies would be implemented.

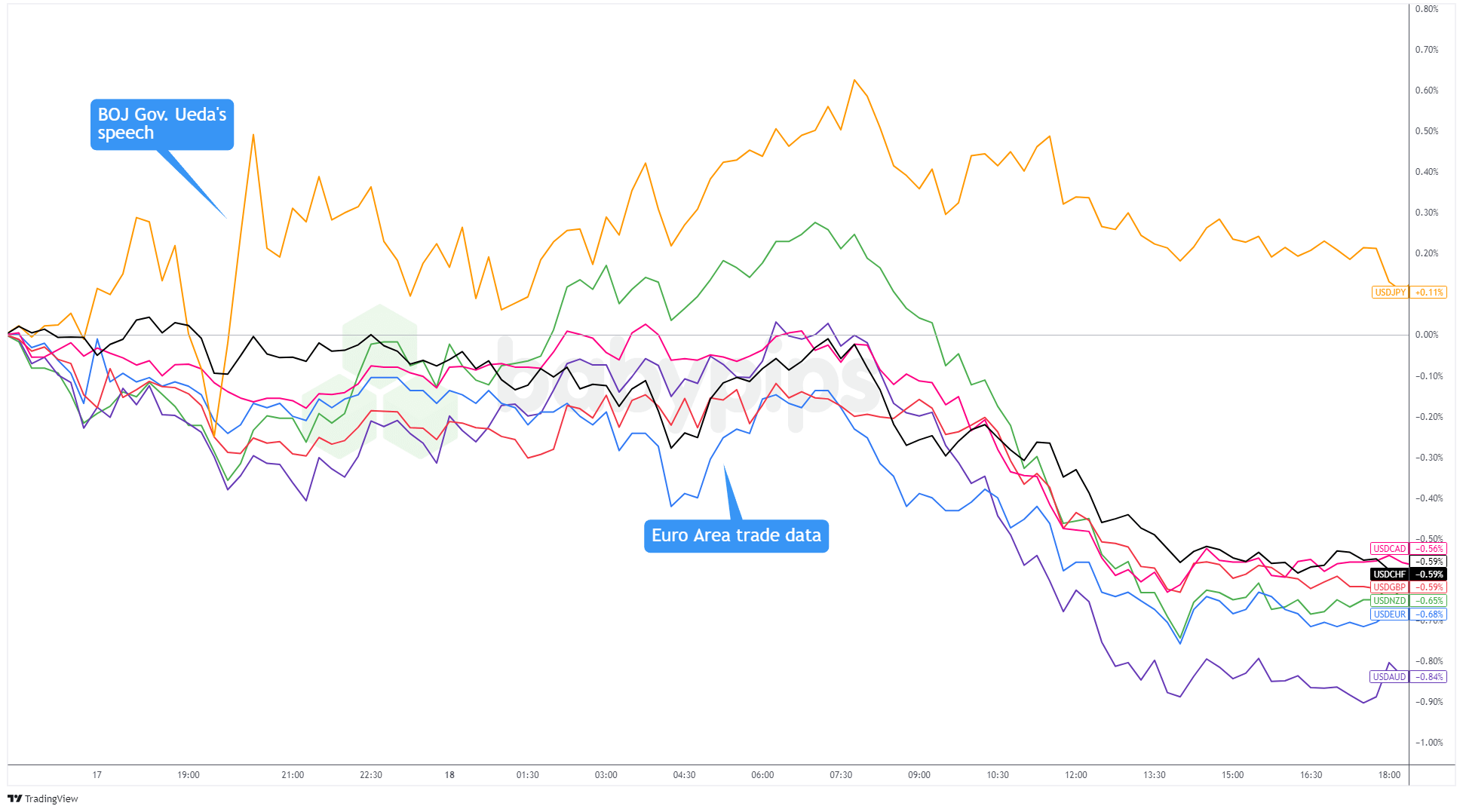

Forex market behavior: US dollar against major currencies:

Overlay of the US dollar against major currencies Chart by TradingView

The US dollar struggled across the board on Monday, showing mixed but contained price action during the Asian session. Bank of Japan Governor Ueda’s comments on wage inflation and measures to support China’s real estate market may have influenced these moves.

The dollar’s decline gained momentum in the European session as traders awaited European Central Bank speeches, including Christine Lagarde’s. Selling pressure accelerated during the US session, with the greenback falling against all major currencies except the yen. The Australian dollar led the decline, followed by the euro, British pound and Canadian dollar.

The dollar’s decline likely resulted from traders unwinding hawkish Fed rate bets following recent fluctuations in expectations. Improving risk sentiment, driven by gains in stocks – especially Tesla’s rise – and safe-haven flows into gold and bonds amid escalating tensions between Russia and Ukraine, also likely contributed to dollar weakness.

Potential catalysts coming on the economic calendar:

- Swiss trade balance at 7:00 am GMT

- Eurozone current account balance at 9:00 AM GMT

- The final Eurozone CPI will be announced at 10:00 AM GMT

- Bank of England monetary policy report hearings

- The Canadian Consumer Price Index will be released at 1:30 PM GMT

- US building permits at 1:30pm GMT

- US Housing starts at 1:30pm GMT

- FOMC Member Schmid will speak at 6:10 PM GMT

- Australia’s main MI index at 10:30pm GMT

- Japan Trade Balance at 11:50 PM GMT

The European session begins with Swiss trade balance data and final Eurozone inflation data, setting the tone for euro and franc traders early.

As the US session approaches, focus turns to Canadian inflation reports and US housing data, with additional volatility likely from FOMC member Schmid’s speech later in the day.

Don’t forget to check our currency correlation tool when making any trades!

Comments are closed, but trackbacks and pingbacks are open.