Analysis and speaking points in US dollars

- The issue of the US debt ceiling is the main driver for the markets.

- Will the US PMI push manufacturing below 50?

- DXY is showing hesitation around the 103.42 resistance level.

Recommended by Warren Vinkitas

Get free forecasts in US dollars

Basic information in US dollars

The Dollar Index (DXY) was dancing to the tune of the US debt ceiling negotiations and yesterday’s discussions led to renewed optimism in the global markets. The dollar rose slightly and traded relatively flat on Tuesday morning. While no agreement was reached, both representatives (President Joe Biden and House Speaker Kevin McCarthy) said the talks were constructive; However, further negotiations will be required to avoid default.

Yesterday featured a slew of Fed speakers with Fed’s Bullard surprising markets by calling for two rate hikes while Mr. Kashkari opted for a more dovish tone unsure of a pause or rally in the June meeting. This slightly upbeat rhetoric has now lowered expectations of a rate cut as evidenced by the Fed’s implied futures contracts below. Money markets are now priced approx 34 bits per second From year-end price cuts vs 41 bits per second Just yesterday. Limiting the dollar’s upside were hawkish ECB officials who intensified the hawkish monetary policy dialogue – the Eurozone PMI will also add to the economic outlook for the region later this morning.

Foundational knowledge of the trade

Macro basics

Recommended by Warren Vinkitas

Federal Reserve interest rate prospects

Source: Refinitiv

However, the upcoming week contains many high impact economic data from the US including GDP, Durable Goods Orders, Consumer Confidence, and Core PCE; All of which will give markets and the Fed valuable data to guide guidance. Later today, more Fed talk will provide short-term volatility as well as the US S&P Purchasing Managers’ Index. Both manufacturing and services are expected to contract which could push manufacturing into contraction territory if the actual numbers are lower.

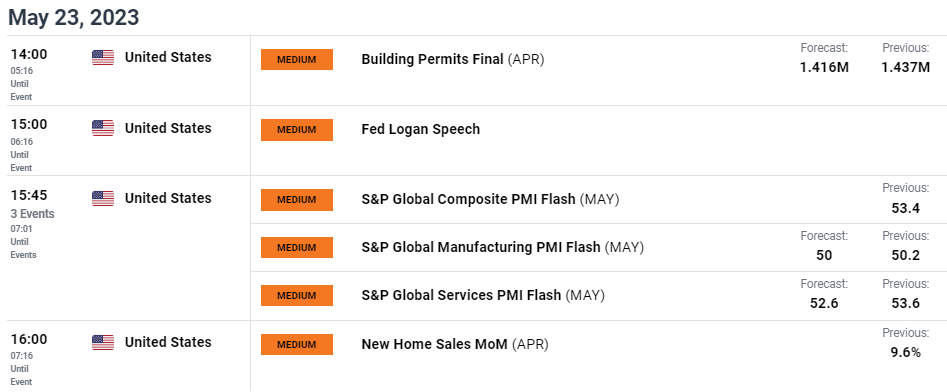

Economic calendar

source: DailyFX Economic Calendar

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

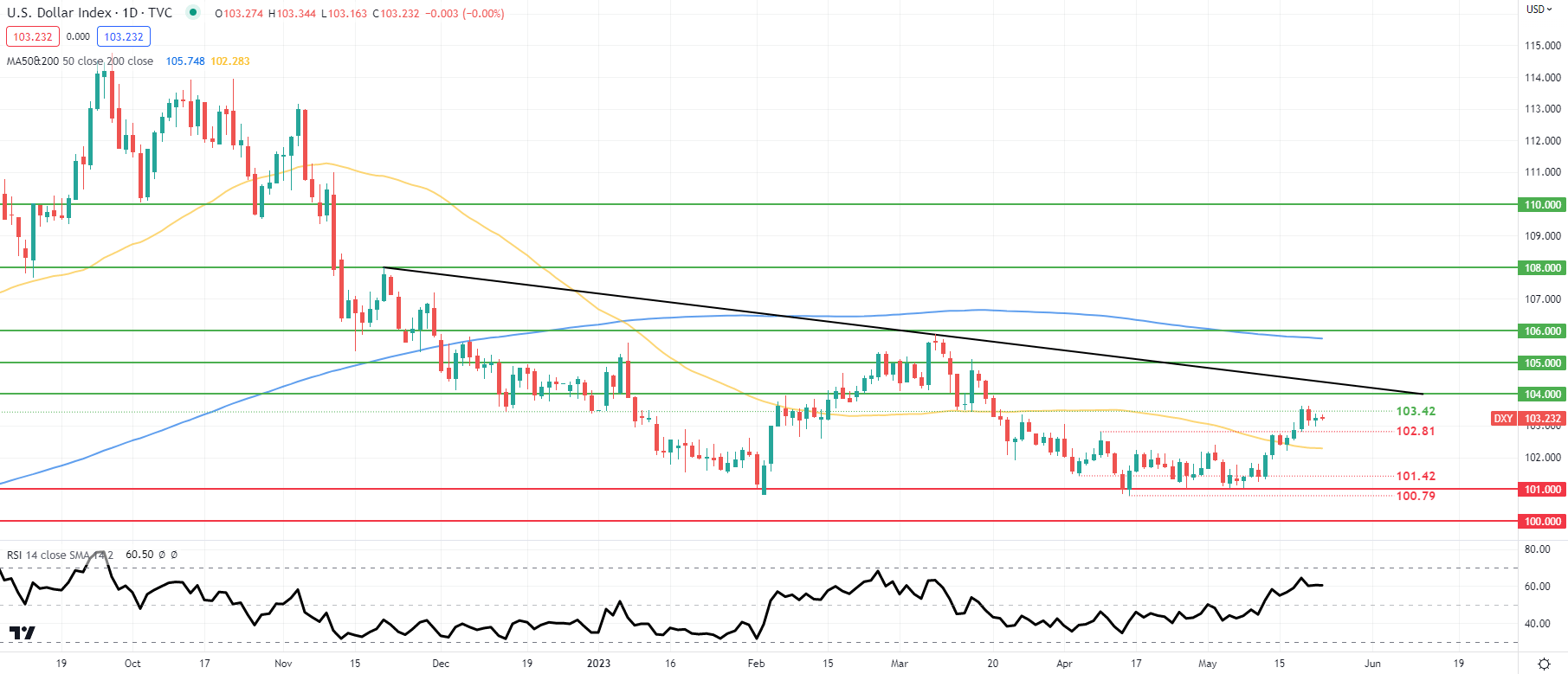

Technical Analysis

Daily chart of the US dollar index

Chart created by Warren VenkitasI.G

DXY’s daily price action has slowed regarding its bullish momentum as the indicator is approaching the over-bought territory according to the Relative Strength Index (RSI). While there is still more room for an extended height, this can be capped around 104.00 Psychological resistance handle. Right now, price action is dependent on debt ceiling updates (as is the case with most markets) and the earlier there is clarity, the sooner markets will focus on Fed and US economic data.

resistance levels:

- trendline resistance

- 104.00

- 103.42

Support levels:

- 102.81

- 50 day moving average (yellow)

- 101.42

- 101.00

Contact and follow up@tweet