GBP/USD analysis

- Dollar pushes GBP/USD higher ahead of important UK CPI reading next week

- GBP/USD technical levels should be watched as fresh ground is broken above 1.3000

- Sentiment data indicates a continuation of the bullish trend as retail sentiment is betting on a reversal

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Find out what’s in store for the pound in the third quarter

Dollar leads GBP/USD higher ahead of crucial UK CPI print

The recent cable performance contrasts with what we saw in the days after last month’s BoE hike of 50 basis points. At the time, prices fell as traders assessed what higher interest rates would mean for the broader economy, as more and more homeowners are set to see fixed-rate mortgage expiration dates.

The fresh bullish recovery is largely due to the massive sell-off in the US dollar that occurred after a series of encouraging inflation data from the US. Traders this week were filled with more conviction that last May’s low reading was not a one-off, which led to a sharp decline in the dollar.

Next week, the cable outlook becomes somewhat complicated as UK inflation data is due out on Wednesday morning. Core inflation in the UK, unlike in the US, has seen price pressures accelerate despite the Bank of England’s hawkish stance. Pressure is mounting on Governor Andrew Bailey who has often stated that inflation will fall sharply from the second quarter onwards. It doesn’t. Instead, broad-based price pressures are gaining momentum, providing sustained support for the pound.

Customize and filter live economic data via DailyFX Economic calendar

GBP/USD Technical Considerations

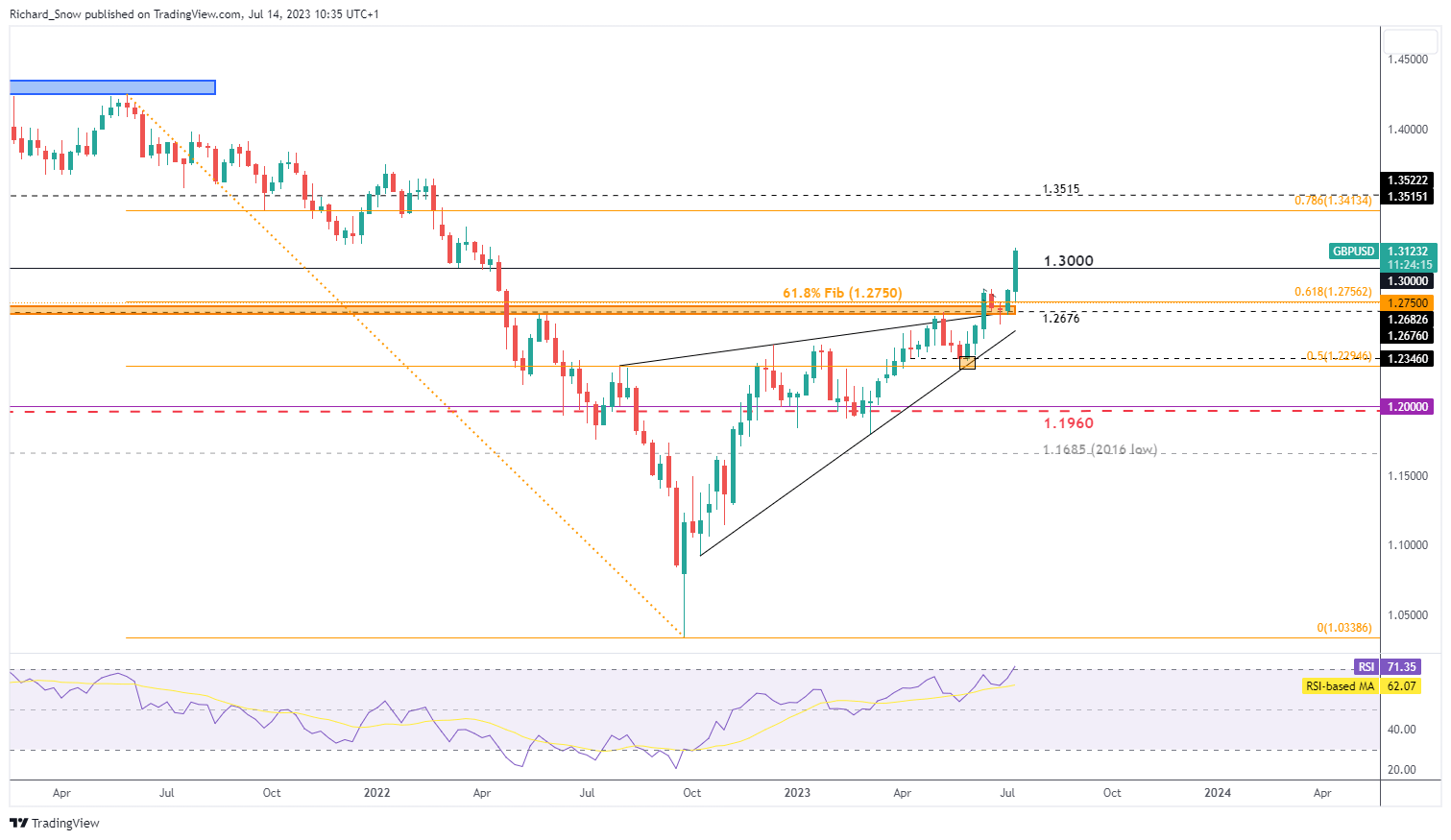

The GBP/USD weekly chart shows the recent bullish progress and how important it is in a broader context. Prices were trading within a rising wedge formation, closing above the trend line resistance and now on its way to build on the move by closing above 1.3000. Consider the exponential rise and how the pair is overbought on the longer time frame.

GBP/USD weekly chart

Source: TradingView, prepared by Richard Snow

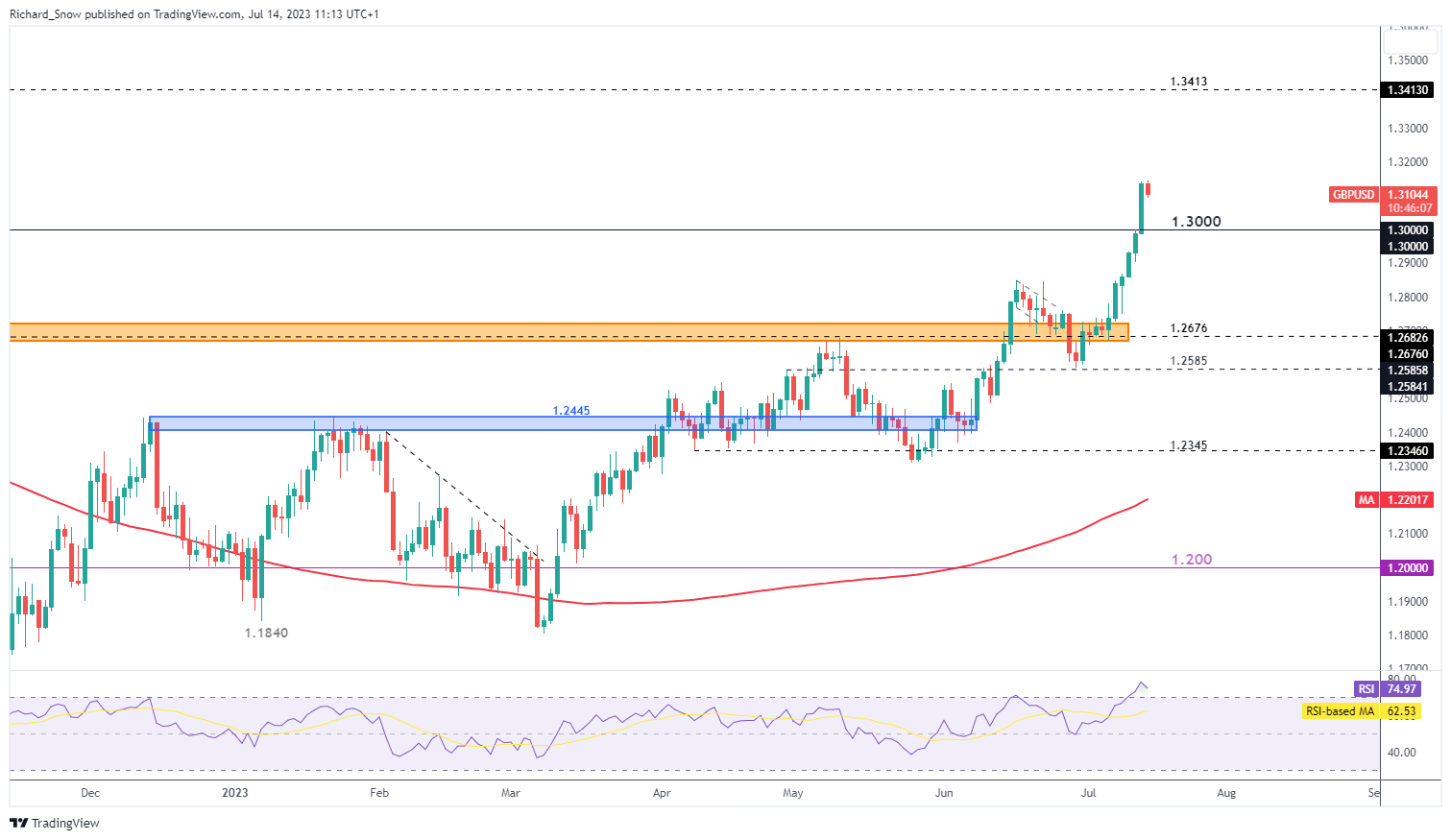

The daily chart reveals the intensity of the upward slope, which appears to have subsided in today’s London trading session, unsurprisingly, the pair is entering overbought territory on both the daily and weekly timeframes.

The bulls may look for signs of a decline towards 1.3000 before considering the continuation of the rise from these extended levels. 1.3000 is a major psychological support level with resistance all the way at the 78.6% Fibonacci retracement of the 2021-2022 decline (1.3413). Next week’s hot inflation report supports upside potential while an encouraging move lower in core CPI, if large enough, could see the pair give up a significant amount of its recent rally.

Daily chart of the British pound / US dollar

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to trade GBP/USD

Sentiment favors the current bullish trend

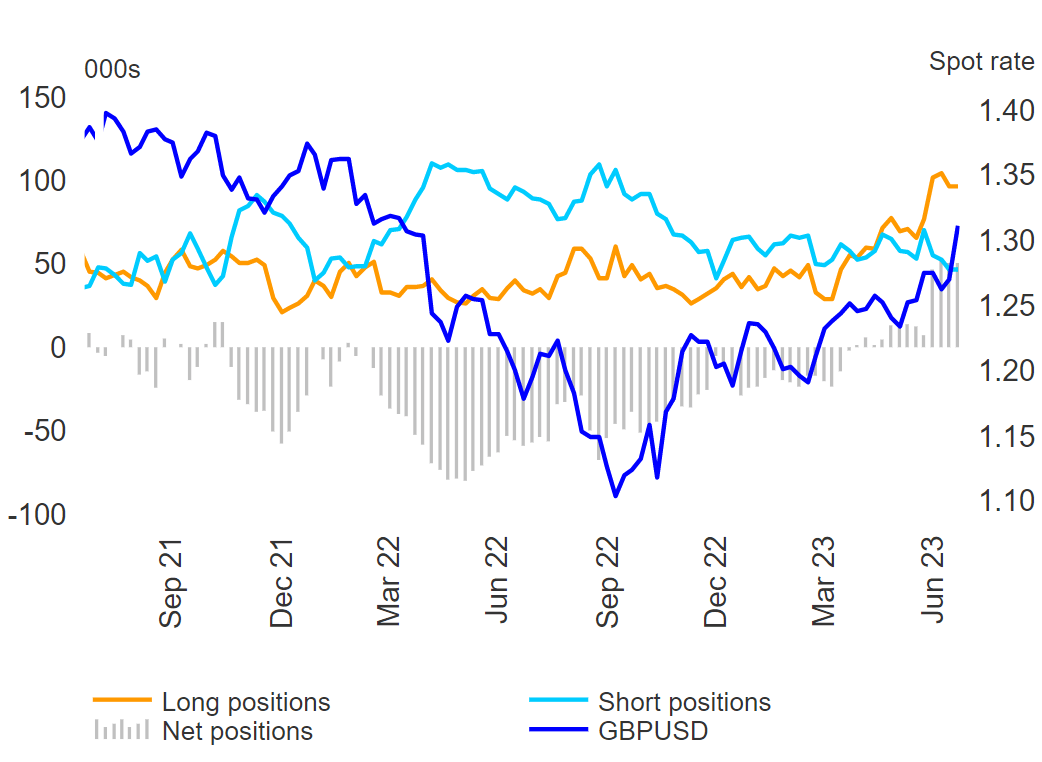

Large institutional speculators continue to position themselves in the direction of the trend while retail clients accumulate bets on a reversal. Sterling remains net long.

Speculative positioning in accordance with Commitment to Traders Report, CFTC

Source: CoT, CFTC, Refinitiv, Prepared by Richard Snow

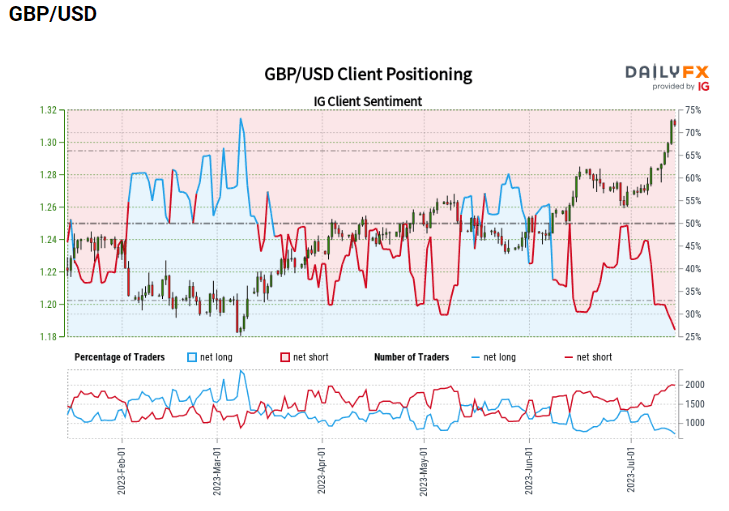

Contrasting indicator is IG customer sentimentsAnd See traders rallying on the short side of GBP, anticipating a reversal. This tends to be a difficult position to hold during extended rallies, much like what we are currently experiencing.

IG customer sentiment data stacked heavily in favor of a reversal

Source: TradingView, prepared by Richard Snow

What type of dealer are you?

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @employee