EUR/USD analysis

- US CPI under the spotlight.

- Central bank speakers follow inflation in the United States.

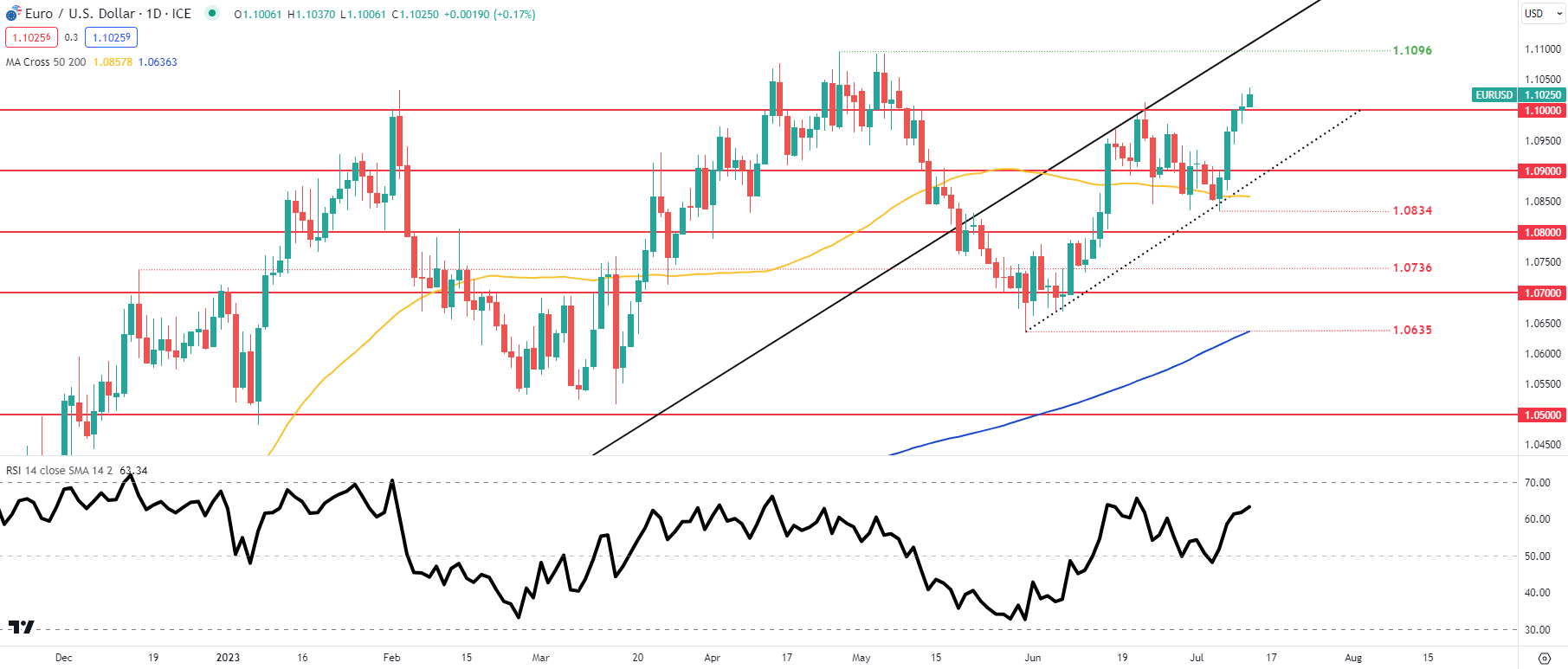

- EUR/USD is eyeing 1.1096 yearly swing high.

Recommended by Warren Vinkitas

Get your free EUR forecast

Euro background

The euro is looking to end its fifth consecutive positive day against the US dollar this Wednesday, after rising above 1.1000 Psychological dealing. Despite yesterday’s weaker ZEW Economic Sentiment data, higher German inflation reinforced the bullish bias.

Today’s focus will be firmly on the US CPI report (see economic calendar below) with much lower ratings in both major and core metrics. If the actual numbers come out in line with expectations, the Fed hike cycle could be close to climaxing after one more possibility 25 bits per second to rise. After the inflation release, there will be a group of Fed speakers who will react to the data and perhaps revise their current hawkish bias to be less aggressive.

From the EUR perspective, there are no economic data scheduled but Lin and Vujic are expected to speak from the ECB. I don’t expect any change in their stance on continued monetary tightening which could further support the euro.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Economic calendar for EUR/USD (GMT +02:00)

source: DailyFX Economic Calendar

Technical Analysis

EUR/USD daily chart

Chart created by Warren VenkitasI.G

EUR/USD daily price action remains within the uptrend channel but firmly within bullish territory as prices hold steady above both the short-term 50-day moving average (yellow) and the longer-term 200-day moving average (blue). The Relative Strength Index (RSI) although it is slightly below overbought levels, there is room for further upside. 1,1096 swing high.

resistance levels:

Support levels:

- 1.1000

- Channel support (black dashed line)

IG’s customer sentiment data: mixed

The IGCS shows that retailers are currently on board short On EUR/USD, with 69% of traders who hold short positions (as of this writing). At DailyFX, we usually take a view contrarian to crowd sentiment, but due to the recent changes in long and short positions, we come to a cautious short-term bias.

Contact and follow up@employee