We’re gonna get the first U.S. business activity numbers for the month of August!

Will the numbers justify a September rate hike for the Fed?

More importantly, how could the USD react to the news ahead of Powell’s Jackson Hole speech?

Here are points you need to know if you’re planning on trading the event:

Event in Focus:

U.S. Flash Manufacturing PMIs for August 2023

The purchasing managers index (PMI) comes from a survey conducted among a few hundred purchasing managers in major business sectors, such as the manufacturing and services industries.

An index reading of 50.0 and above hints at optimism and industry expansion, while a reading of 49.9 and below denotes pessimism and possible industry contraction.

This is most often viewed as a leading signal to top-tier economic indicators, most notably inflation and employment metrics, and thus tends to draw in noticeable market reactions.

When Will it Be Released:

August 23, 2023, Wednesday (1:45 pm GMT)

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

(as of Aug. 22 at 5:10 pm GMT)

S&P Global flash manufacturing PMI: 49.5 forecast vs. 49.0 previous

S&P Global flash services PMI: 52.0 forecast vs. 52.3 previous

Previous Releases and Risk Environment Influence on the U.S. Dollar

Jul 24, 2023

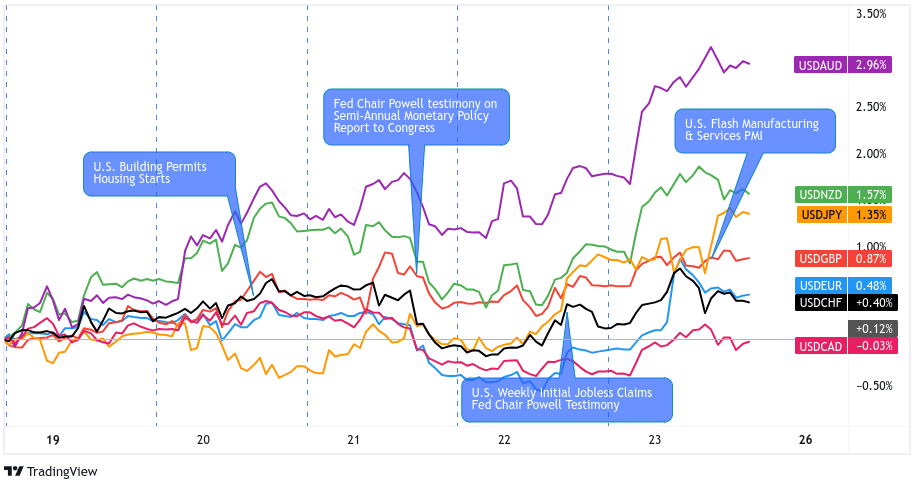

Overlay of USD vs. Major Currencies Chart by TV

Event results / Price Action: July’s PMI reports were mixed, with the manufacturing PMI jumping to a three-month high in July while the services PMI missed its estimates and dropped to a five-month low. A closer look showed that service providers registered a softer upturn in output and manufacturers reported broadly unchanged levels of production.

The U.S. dollar, which was still looking for direction ahead of the FOMC statement, reacted with mixed results. USD gained against JPY, CHF, EUR, and GBP but lost pips to the comdolls by the end of the U.S. session.

Risk environment and intermarket behaviors: Weak PMI readings from the U.K. and the Eurozone released earlier in the day made it easier to take on a risk-averse trading environment on a Monday.

It also didn’t help risk-taking that traders were expecting rate hikes from the Fed and ECB as well as a hawkish turn for the BOJ for later that week.

Jun 23, 2023

Overlay of USD vs. Major Currencies Chart by TV

Event results / Price Action: Both the manufacturing and services PMIs printed lower index figures in June compared to May. Manufacturers saw “a sharp fall in new export orders” while the services sector outlook remains iffy despite a pause in the Fed’s rate hikes.

The U.S. dollar, which found support from Powell’s hawkish testimony the day before the PMI releases, dipped from its intraweek highs and capped Friday slightly lower than its daily highs.

Risk environment and intermarket behaviors: Higher-than-expected U.K. CPI data, interest rate hikes by the BOE, SNB, and Norway’s central banks, and a hawkish testimony from Powell helped drag “risky” assets lower and pushed safe havens like USD higher in the second half of the week.

Price action probabilities:

Risk sentiment probabilities: While we wait for Powell’s Jackson Hole speech, some traders appear to be pricing in a soft landing in the U.S. and maybe even a less hawkish speech from Powell later this week.

This is probably why the U.S. dollar and U.S. and Asian equities are saw gains, but we’re seeing a pull back in risk-on vibes, likely due to U.S. Treasury yields hitting their 16-year highs, raising the costs to do business as well as potentially pulling capital from other asset classes.

Of course, PMI reports from major economies like Australia, Japan, Eurozone, and the U.K. are scheduled to release just before the U.S. release, and may affect overall risk sentiment during the U.S. PMI event.

That is, clear weaknesses could shift the markets’ focus back to global growth concerns and the risks of a high-interest rate environment. Meanwhile, upside PMI surprises could broaden the risk-taking beyond equities and major currencies.

U.S. Dollar scenarios:

Potential Base Scenario: We know from last month’s report that “growth is being entirely driven by the service sector” while the manufacturing sector is seeing subdued demand amidst “slower economic growth, weaker job creation, gloomier business confidence, and sticky inflation.”

We could see the same trends again this month as markets expect slightly lower readings from both the manufacturing and services PMIs.

The dollar’s reaction may take its cues from more than the U.S. PMIs, however. While we expect USD’s price reaction to directly correlate with the PMI results, the degree of the dollar’s upswing or downswing may depend on the PMI reports printed earlier that day, as well as the difference between the U.S.’s actual numbers vs. forecast/previous reads.

Weaker U.S. PMI reports that followed weaker PMI readings from other major economies may encourage a risk-averse trading environment and push USD higher against “riskier” bets like AUD, NZD, CAD, or EUR.

Potential Alternative Scenario: Weaker U.S. PMIs in August may translate to USD-selling if the Asian and European sessions adopt a risk-friendly trading vibe.

Look out for a scenario mix of upside surprises in earlier PMI releases, rising speculation of a “soft landing,” and/or a less hawkish Jackson Hole speech from Powell as potential catalysts that traders may focus on for more on risk-taking.

In a risk-friendly scenario, USD may lose some of its gains from the previous week. Look for short opportunities against AUD, NZD, CHF, and GBP.