Key points of the US Consumer Price Index:

Recommended by Zain Fouda

Get your third-quarter forecast on the US dollar now

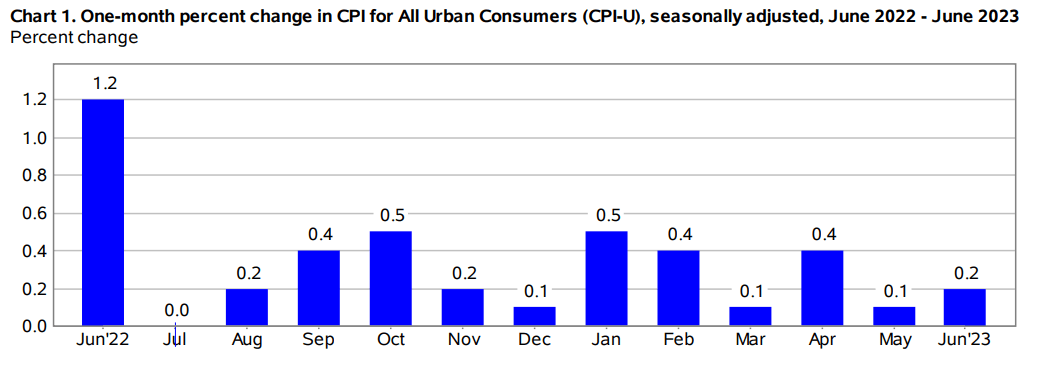

US headline inflation fell yoy in June to 3% beating expectations of 3.1% while core yoy CPI which was a problem for the Fed also beat expectations at 5%. The headline inflation reading on an annual basis is the lowest since March 2021 and caps 12 consecutive months of declines. The recently proven core CPI fell to 4.8%, the lowest level since October 2021.

Customize and filter live economic data via DailyFX Economic calendar

The biggest contributor to the decline in the headline number was a 16.7% drop in energy costs versus -11.7% in May, with prices falling 36.6% for fuel oil, 26.5% for petrol, and 18.6% for gas services. Food prices were another pain point for the Fed but provided another surprise today as prices rose 5.7%, down from 6.7% in May.

Source: US Bureau of Labor Statistics

FOMC meeting in July and way forward

With the July FOMC meeting approaching, markets were pricing in an 88% chance of a 25 basis point rally, and the Fed is unlikely to be affected by today’s CPI number. US labor markets continue to show resilience even with a slight decline in the NFP print last week, along with the upside of part-time workers over permanent workers.

Federal Reserve policymakers reiterated their hawkish stance this week with many feeling it would be appropriate to continue on the hiking trail. We saw signs of disagreement among Fed members in the June FOMC minutes on the optimal path forward, but I still expect the Fed to raise rates in July. If we were to see any surprise, I think it could come in the size of the rally with 10-15 pips per second potential.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

market reaction

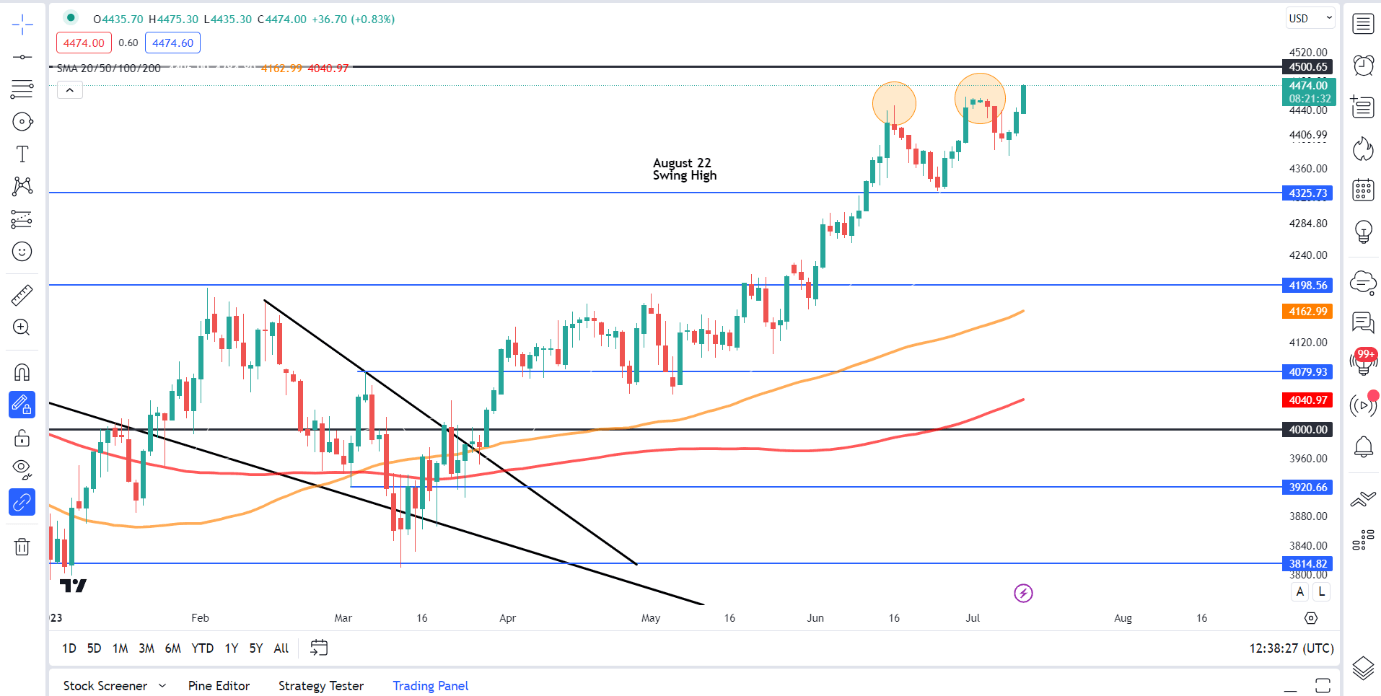

S and p 500 daily chart

Source: TradingView, prepared by Zain Fouda

The initial reaction saw the dollar index drop as risky assets enjoyed a rebound. The SP500 gained about 25 pips in the immediate aftermath. Looking at the bigger picture, the SP500 is giving signs that we may be in for a downward correction with a possible double top pattern in early June. However, no such move materialized and the pattern now appears to have become irrelevant with the bullish breakout of the previous highs. There is a major resistance ahead though at the psychological level of 4500 which might be difficult to break.

— Written by Zain Fouda L DailyFX.com

Connect with Zain and follow her on Twitter: @employee