German CPI/HICP superiority estimates

- German inflation rose across all measures in June

- The ECB is likely to continue its hawkish tone due to stubborn inflation. The euro will remain supported

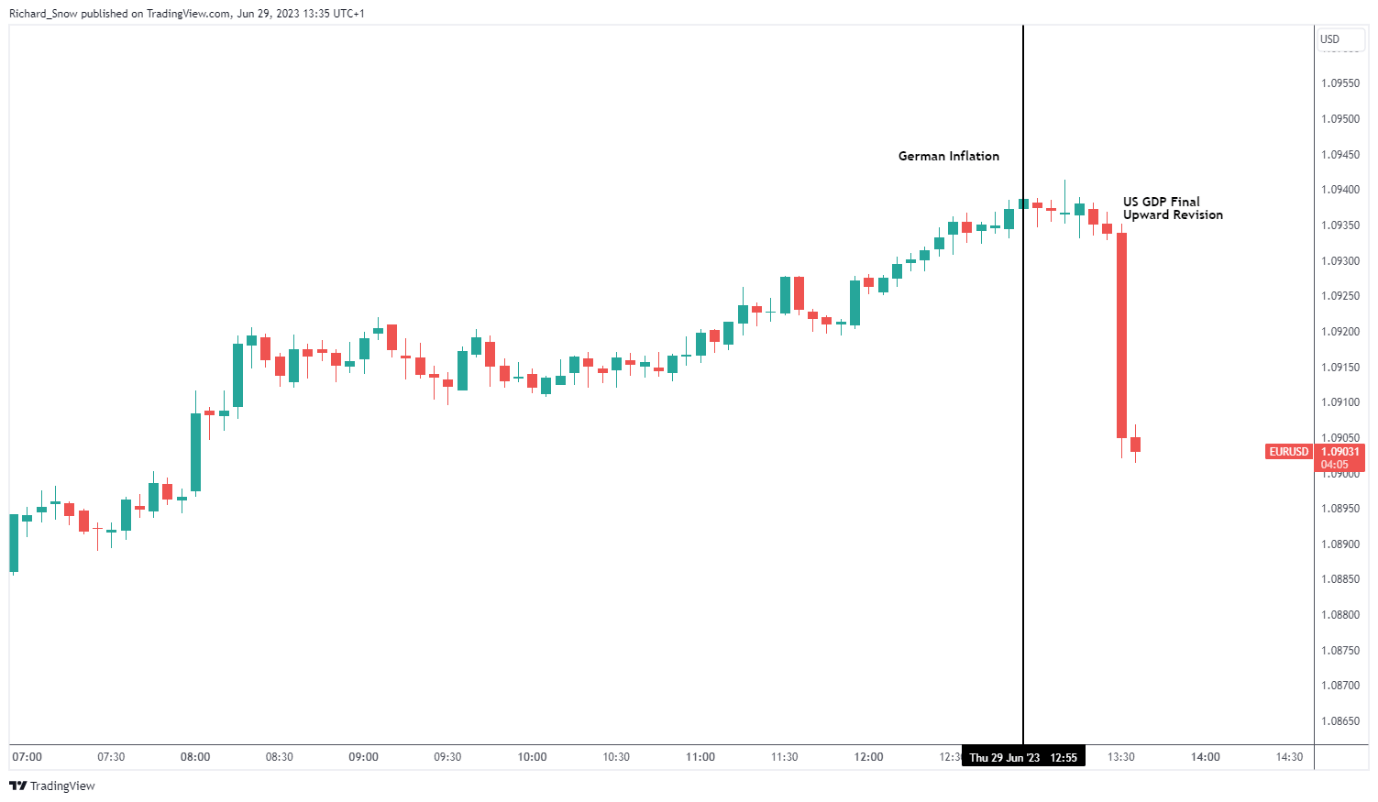

- Surprising US GDP data lifted the dollar, sending EUR/USD sharply lower after the moment of release

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Introduction to forex news trading

German inflation rose by all measures in June

Germany’s CPI rose above 6.2% in the past months and the consensus estimate at 6.3% prints at 6.4% – ending the downward trend in headline inflation that has developed over the year. The most widely comparable metric within the Eurozone, HICP also revealed a hotter month-on-month reading and came in at 6.8% which was within or slightly above expectations depending on the source of the surveyed data used. Either way, the higher reading will encourage Christine Lagarde and the rest of the board as they continue to talk about future rate hikes.

Customize and filter live economic data via DailyFX Economic calendar

German data today tends to weigh on broader EU inflation data due tomorrow, which could push for a higher-than-expected reading there. Since inflation is still being discussed this week, after tomorrow’s EU inflation data, we will have US PCE data – the preferred measure by the Fed.

immediate market reaction

The immediate reaction to the EUR was somewhat muted, given that rates were hiked ahead of schedule. However, 30 minutes later, a massive upward revision of the final US GDP number for Q1 saw the dollar rally, sending EUR/USD sharply lower.

5-minute chart of EUR/USD

Source: TradingView, prepared by Richard Snow

The US data affected the intraday trading observed on the daily chart, as it turned from positive to negative as prices are trading below 1.0910 at the time of writing.

EUR/USD daily chart

Source: TradingView, prepared by Richard Snow

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @tweet