EUR/USD ANALYSIS

- )Softer German inflation maintains downward pressure on EUR upside.

- Euro area retail sales and ECB/Fed speak to come.

- EUR/USD bear flag still under consideration.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro has paired back its recent gains post-NFP with certain US central bank speakers ‘out-hawking’ their European Central Bank (ECB) counterparts. The Fed’s Logan and Bowman in particular highlighted the resilience of the US economy and the possible need for additional interest rate hikes. In summary, Fed officials will likely adopt a ‘wait and see’ approach as more data is needed after the recent NFP miss.

Today’s early session moves were stoked by a sharp decline in German inflation (see economic calendar below) on both MoM and YoY metrics. Being the largest economy within the euro area, this statistic serves as a gauge for the wider inflationary backdrop. With ECB speakers scheduled to speak later today, this could bring in some dovish undertones to their messaging and weigh negatively on the euro. Euro area retail sales are anticipated lower and could add to euro woes.

Later today, the focus will shift to the Federal Reserve once more with Fed Chair Jerome Powell under the spotlight. The speech will be dissected for any clues or potential changes to the prior narrative. Other Fed speakers will follow Mr. Powell but markets will likely keep their reactions aimed at the Fed Chair.

Implied Fed funds futures have been ‘dovishly’ re-priced to levels pre-NFP showing the fickle nature of financial market expectations. With the ECB expected to cut by +/-30bps more by year end 2024, the US dollar could remain supported ceteris paribus. The ongoing war in the Middle East may supplement the safe haven attribute of the USD against the EUR.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

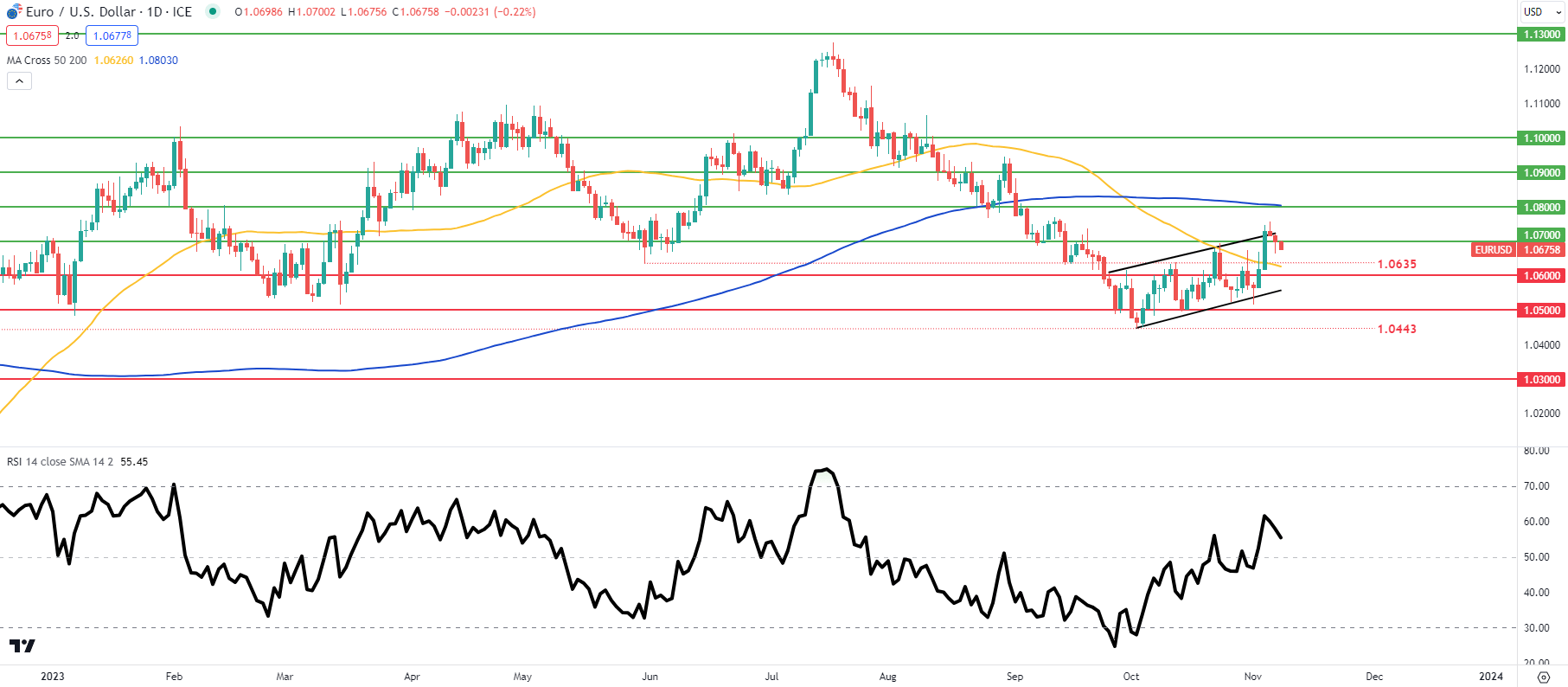

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD daily chart above now trades below the 1.0700 psychological handle. The pullback higher within the larger and longer-term downtrend remains within a bear flag formation (black) that could still unfold in its traditional sense.

Resistance levels:

- 1.0800/200-day MA

- Flag resistance

- 1.0700

Support levels:

- 1.0635

- 50-day MA

- 1.0600

- Flag support

- 1.0500

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 56% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas