Euro Analysis (EUR/USD, EUR/GBP)

Recommended by Richard Snow

Get Your Free EUR Forecast

German inflation rose to 3.7% in December, up from the prior 3.2% in November. The HICP measure rose to 3.8%, up from 2.3% in November. The rise in the data was preceded by numerous warnings by prominent ECB officials that it is way too early to be talking about rate cuts and that interest rates are required to remain restrictive for as long as is necessary.

Customize and filter live economic data via our DailyFX economic calendar

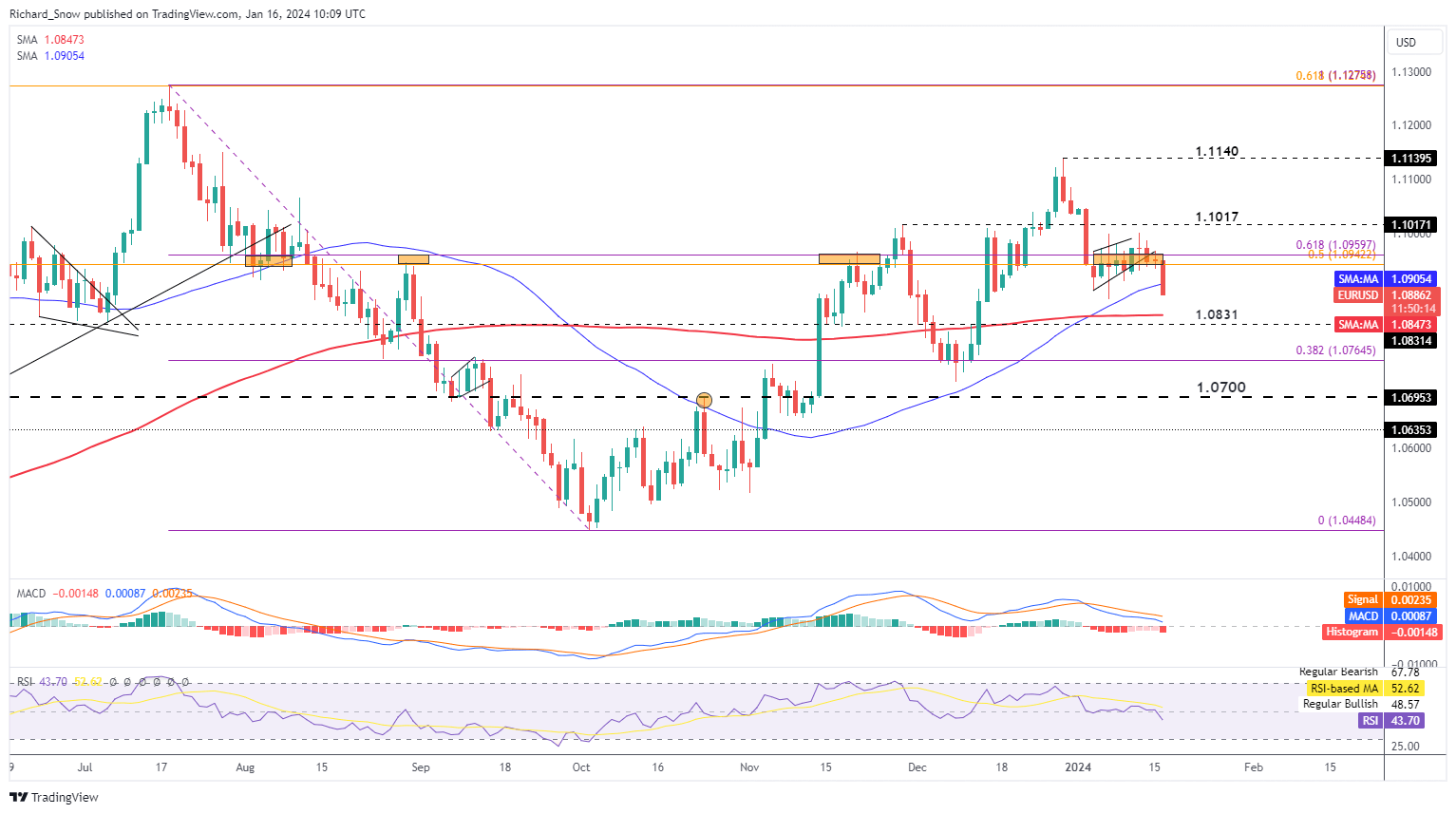

EUR/USD Hints at a Directional Move after Period of Consolidation

EUR/USD trades sharply lower this morning on what appears to be a response to a lift in US yields attempting to arrest the recent decline. US yields have been dropping day after day, providing EUR/USD bulls with support. However, momentum had waned and now that yields have turned positive (on the day this far), the pair trades sharply lower. US retail sales data for the Christmas period is due on Wednesday and could point further to strong US consumption led by a robust labour market.

1.0831 and the 200-day simple moving average are the next levels of potential support

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Recommended by Richard Snow

FX Trading Starter Pack

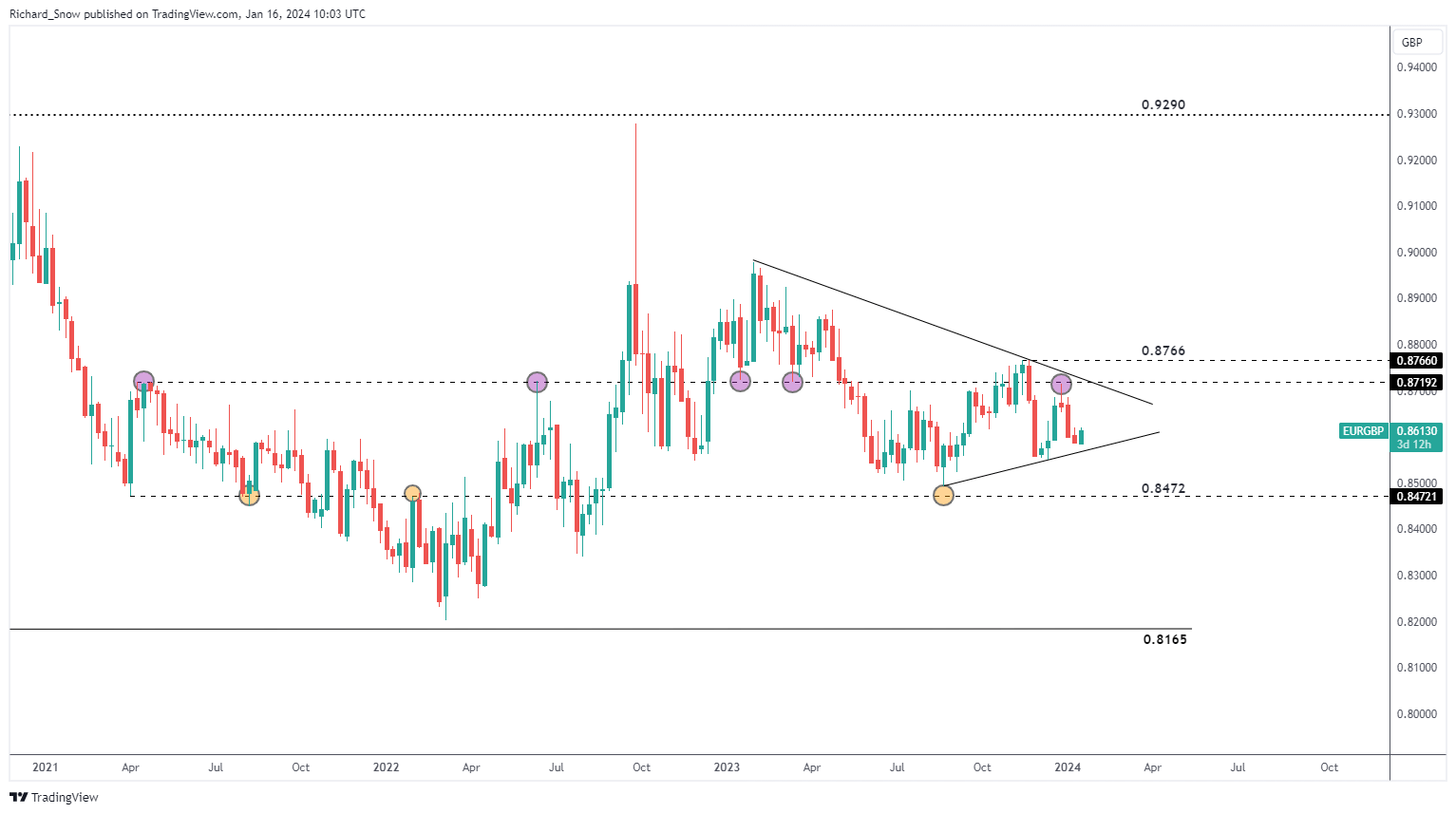

EUR/GBP Lifts off Support but Bullish Momentum Yet to be Tested

EUR/GBP reveals a tendency to trade within what appears to be an asymmetrical triangle over the longer, weekly time frame. This week has seen a bounce off of trendline support but momentum remains a concern.

Earlier this morning the UK revealed a drop in average earnings while the unemployment rate remained steady at 4.2%. The Bank of England has focused less on average earnings in recent months and more on services inflation as a whole. Markets still expect fewer rate cuts in the UK than in the US or EU due to lingering inflation concerns.

Upside momentum will face its first test at the 0.8635 level, followed by the grouping of the 50 and 200 day simple moving average (viewable on the daily chart). Support remains at the trendline acting as support. Tomorrow UK inflation data will provide greater insight into the fight against inflation in the UK and remains a major piece of data for the week.

EUR/GBP Weekly Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX