Gold, XAU/USD – price action and forecast:

- XAU/American dollar It has broken above the main resistance.

- The breakout formed a slight inverse head and shoulders pattern, which indicates further gains.

- What are the key levels to watch in XAU/USD?

Recommended by Manish Grady

Get your free predictions for the best trading opportunities

Gold rebounded after US inflation slowed more than expected in June, reinforcing market expectations that the Federal Reserve is nearing the end of its tightening cycle.

The US Consumer Price Index rose 0.2% on a monthly basis in June, the smallest rise since August 2021, compared to the expected 0.3%. Core CPI eased to 4.8% yoy versus 5% expected and 5.3% in May. However, interest rate futures show a 92% chance of a 25 basis point hike at the July 25-26 meeting, and a small chance of another hike before the end of the year, according to CME FedWatch.

However, markets are pricing in rate cuts starting in the first half of 2023, with approximately 5 rate cuts by the end of next year. Market expectations contrast with two rate hikes by the Federal Reserve before the end of the year and no rate cuts until 2025. Wednesday’s data boosted pessimistic prices in the market. Having said that, with inflation still well above the Fed’s target and the labor market still resilient, the rate hike may continue at the July meeting. Beyond that, it remains highly uncertain, both in terms of whether And price hikes happen with you.

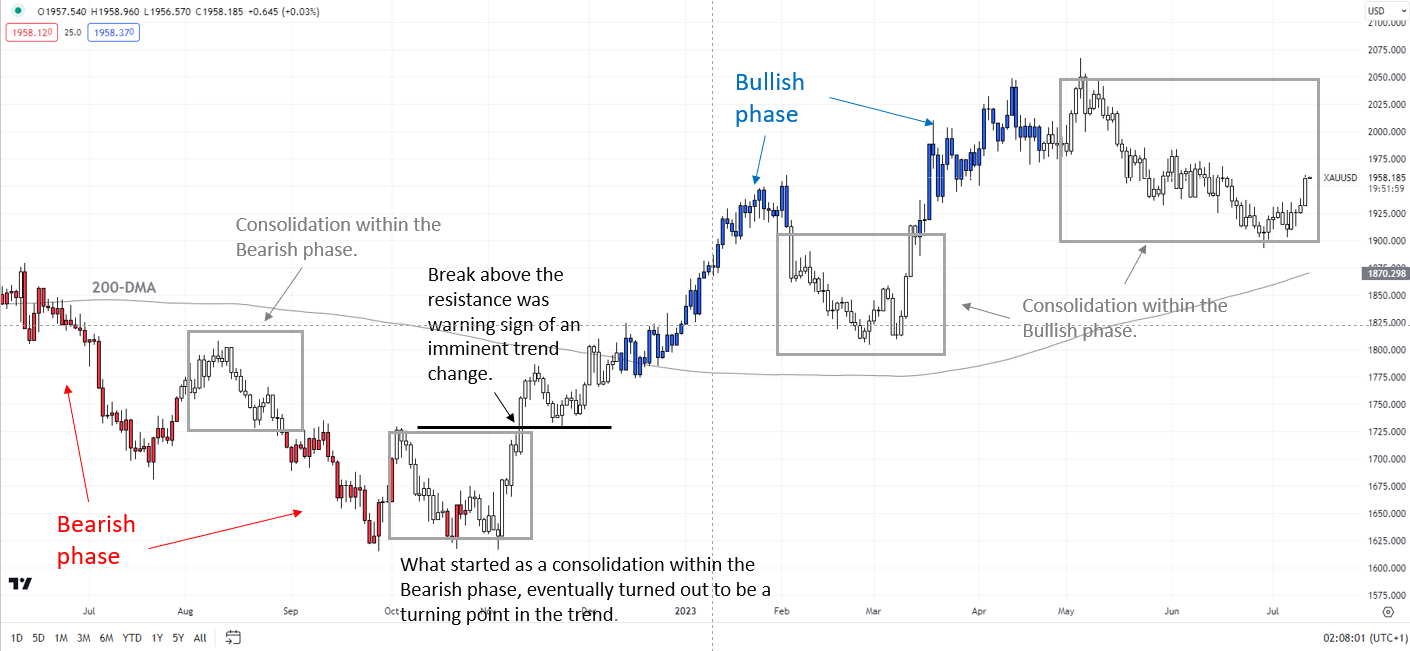

XAU/USD 240 minute chart

Chart by Manish Gradi using TradingView

On the technical charts, the bearish pressure eased after XAU/USD surged above the key 1935-1945 resistance area (including the end-June high, the 89-period moving average, and the 200-period moving average on the 240-minute charts. ). The breakout resulted in a slight inverse head and shoulders pattern (left shoulder low in late June, head low in late June, right shoulder low in early July), with a potential price target around 1980, near the high level in early June 1983.

XAU/USD daily chart

Chart by Manish Gradi using TradingView; Notes at the bottom of the page.

Intraday technical charts showed a loss of bearish momentum ahead of Friday’s US jobs data. Moreover, XAU/USD has achieved the price target of the descending triangle that started in late June. For further discussion, see “Gold Slips After FOMC Minutes; XAU/USD Scenario Ahead of US Jobs Data,” posted on July 6.

Zooming out, gold is still in a consolidation phase within the broader uptrend, as shown by the color-coded daily candlestick charts. However, beyond the daily charts, the higher time frame charts showed gold bullish stress. See “Gold Could Find Difficulty Breaking $2000,” posted on March 28, and “Weekly Gold Outlook: Time to Be Cautious on XAU/USD?” Posted April 16th.

Note: The above color-coded chart(s) are (are) based on trend/momentum indicators to reduce subjective biases in trend identification. It is an attempt to separate the bullish and bearish phases, and consolidate within a trend-versus-trend reversal. The blue candles represent a bullish stage. Red candles represent a bearish phase. Gray candlesticks act as consolidation phases (during a bullish or bearish phase), but they sometimes tend to form at the end of a trend. Candle colors are not predictive – they only indicate the current trend. In fact, the color of the candle can change in the next bar. False patterns can occur around the 200-period moving average, around support/resistance and/or in a sideways/volatile market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Recommended by Manish Grady

Get free forecasts in US dollars

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish