Gold prices, charts and analysis:

- gold prices remain near its one-month high.

- The weaker United States economic inflation It saw the most extreme stakes raised.

- However, the market appears to be overbought and further gains may be hard to come by.

Recommended by David Cottle

Get your free gold forecast

Read more: The Fed is making progress as inflation slows in the US, and the S&P 500 rises

Gold prices extended gains into European trading on Thursday and remain close to one-month highs as markets surprisingly digested benign official inflation numbers from the US in the previous session.

Consumer prices rose just 0.2% in June, well below expectations, for an annual gain of 4.8% – the weakest in more than two years. While it is too early to declare victory in the battle of inflation, a weak trend is now evident. As a result, investors are rethinking a bit about how high US interest rates are and see no more than two more modest increases this year.

Rate futures now forecast a quarter-percentage-point rise in the Fed funds target rate in July and a 25% chance of another similar move before the end of the year. This is down from about 35% prior to the data. The odds of any further half-point increase appear to have diminished significantly.

The opportunity for lower-than-expected bond yields ahead has given gold a rally, with its strong gains on weaker inflation belying the notion that the metal acts as an inflation hedge.

Weakness in the US dollar on the back of the data also gave golden wings. The dollar’s decline brings the magic of dollar-denominated gold and its derivatives to those who hold other currencies.

Spot gold rose more than $30 an ounce on Wednesday and remained above $1,960 by Sharpe in Europe. These are the levels last seen in mid-June.

The focus of the market on Thursday will remain on US inflation, likely the passing effects on Fed policy. There is an official producer price snapshot on the list along with the latest weekly jobless claims numbers.

Find out what kind of forex trader you are

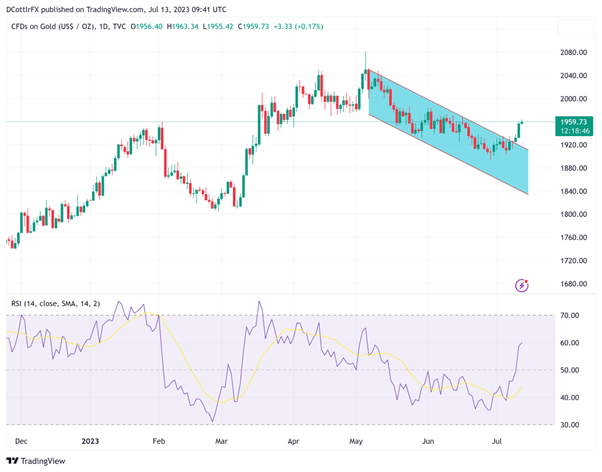

Technical analysis of gold prices

daily gold chart

Chart compiled using TradingView

Prices have broken sharply above the previous well-respected downtrend channel. They did so on Monday when they cleared the $1928.23 level, which is now left well below the market.

The obvious question mark after such a sharp rally is how sustainable it will be and there is news for the gold bulls that is probably less good. The RSI for the metal is heading upwards to the 60 region indicating an overbought market.

These bulls will need to rally at least as much as $1989.46, the June 1st high, if they are to hold this week’s highs and bring the focus back to $2000 again. This seems to be a big ask since there are no major potential trading signals before the end of the global Friday session. With that in mind, the non-committal may want to see where prices are approaching for the week before returning to this market.

Prices are currently well above the 100-day moving average, which comes in at $1,952, which now offers support, ahead of late-June lows around $1,892.

It is worth noting that IG’s sentiment data found that the market is still very bullish, with 62% of traders still going long-side. This may also indicate that enthusiasm has gone too far.

– By David Cottle for DailyFX