Market summary

The conclusion of the June meeting saw the Federal Reserve (Fed) keep interest rates unchanged at 5.00%-5.25% in a widely expected move, but there is less market conviction that today’s move will mark the end of the tightening campaign.

The hawkish takeaway came from the FOMC point chart, where the peak rate for 2023 was revised to 5.6% from 5.1% previously, indicating another 50 basis points of tightening by the end of this year. Price forecasts for 2024 and 2025 have also been revised upwards, which appears to put expectations of higher interest rates on the horizon. The justification may come on the back of some persistence in inflationary pressures, as the Fed’s core personal consumption expenditures forecast rose to 3.9% for 2023 compared to the 3.6% projected in March.

Comments from Federal Reserve Chairman Jerome Powell seemed to add to the hardening equation, as he said the Fed’s rate cuts were “two years out,” at a time when broad market expectations were pricing in a rate cut by the end of the year. With the July meeting seen as a “live” meeting from the Fed chair, he will leave any interest rate decision to a handful of future inflation and employment data. Existing Fed funds futures continue to lean toward a 25bp move in July, but their pricing of the final interest rate at 5.25%-5.5% remains less hawkish than the Fed directed, leaving any further recalibration in check.

Treasury yields were mixed, reflecting some hesitation in the aftermath of the FOMC meeting. On the other hand, the outlook for higher interest rates was not well received by gold prices, which saw initial gains reversed sharply overnight. Intermittent bounces over the past month have failed to find much follow-through, with prices hovering near a two-month low around $1940. Any collapse to a new lower low could be on the horizon, which could reinforce its bearish bias in the near term. The Relative Strength Index (RSI) continues heading below the key level of 50, while the support of the main trend line valid since November 2022 has been invalidated, reflecting the sellers’ control for the time being.

Source: IG Charts

Asian Open Championship

Asian stocks appear set for a slight positive open, with the Nikkei +0.17%, ASX +0.31% and KOSPI +0.30% at the time of writing as market participants continue to digest the recent FOMC meeting. This morning’s economic calendar saw New Zealand’s Q1 GDP reading push the country into a technical recession. A decline of 0.1% qoq in Q1, following a 0.7% drop in Q4, is likely to provide further justification that the RBNZ is done tightening, which translates into some downward pressure on the New Zealand dollar. . .

The next day will focus on Australian employment data, followed by a series of economic data from China (industrial production, retail sales, investment in fixed assets). Recent cuts in China’s short-term borrowing costs may spur hopes for a similar revision to the one-year MLF rate later today, and upcoming economic data is likely to add to the recent series of negative surprises and boost subdued growth for longer. expectations in China. All three data above are expected to show some moderation in year-on-year growth from April.

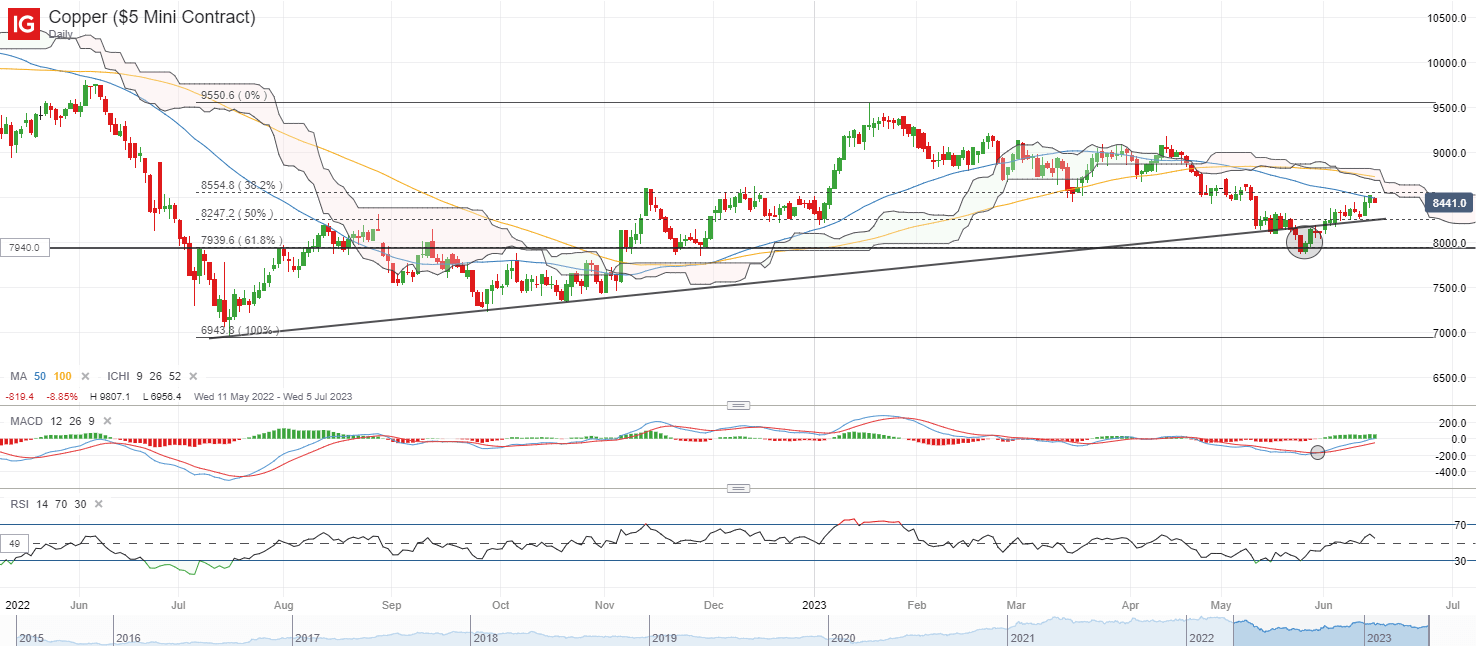

Copper prices managed to recover more than 8% since finding support at $7,940 a ton. The recovery of the RSI above the 50 level, along with a bullish cross at the MACD could indicate some bullish momentum in the near term. However, the immediate resistance still stands at $8,600/ton for now. It may be necessary for the greater conviction of a more stable uptrend to come from a move above the Ichimoku Cloud to indicate that an uptrend is in place. On any downside, $8,250/ton could bring some support from the ascending trend line in confluence with the Fibonacci retracement level.

Source: IG Charts

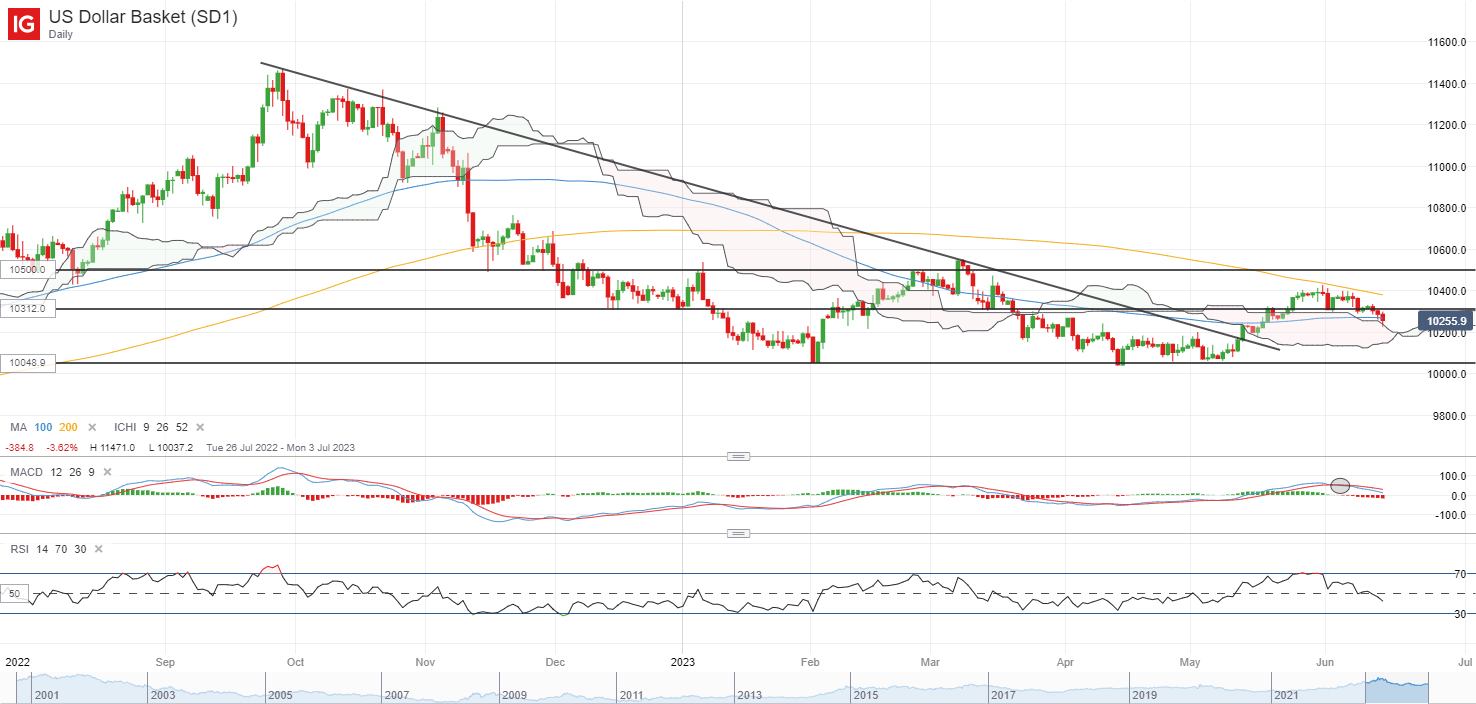

On watch list: choppy reaction in the US dollar but more signals needed

The FOMC meeting caused some volatility in the US dollar overnight, as the dot chart release triggered an unexpected 0.5% reaction mid-day before paring some gains during the Fed’s press conference. The biggest conviction for the bulls may come from the reversal of forming lower highs and lower lows on the four-hour chart since the beginning of the month, with immediate resistance to be overcome at 103.12.

Currently, its RSI is heading below the key level of 50, along with a declining MACD, warranting the need for a significant increase in bullish momentum to provide some conviction to the bulls as well. Any failure to capitalize on the hawkish tone from the FOMC meeting for any move higher over the subsequent days could indicate continued exhaustion, which could put the May low in sight for the next retest.

Source: IG Charts

Wednesday: DJIA -0.68%; S&P 500 +0.08%; Nasdaq +0.39%, DAX +0.49%, FTSE +0.10%