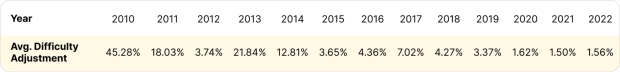

Since the inception of Bitcoin, the network difficulty It grew from 1 to the 48.71 trillion hashes a miner would theoretically need to generate to find the winning element. This means that mining a bitcoin block today is 48.71 trillion times more difficult than when mining first started in 2009 – a compound increase of 20.64% per month.

At the time of writing, Bitcoin difficulty is at an all-time high, which means miners – on a BTC basis – are earning fewer rewards per unit of hash rate than ever before. Besides the price of bitcoin, the difficulty of bitcoin is the primary factor influencing retail price (Mining revenue per unit of hash rate), so miners are interested in highlighting bitcoins hash rate Growth trends and difficulty for business planning.

To this end, miners and bitcoin clients devised the block time constant method for estimating upcoming modifications, but this method usually over or under estimates difficulty changes at the start of each difficulty period.

To improve on this, the team at Luxor Technologies developed a new method called the “rolling blocks method,” which we describe in more detail in A recent report on Bitcoin mining difficulty prediction.

We hope that the rolling blocks method for predicting Bitcoin difficulty will provide miners, investors, and hash rate traders a better tool for planning for difficulty changes.

The rolling shortest method for predicting difficulty adjustments

For this report, we developed a new time-series prediction method for upcoming difficulty adjustments, which improves accuracy on epoch onset compared to the fixed time-block method. We briefly call this the “rolling block time method 2.015 blocks, square root weighted, or modified juicing block time method” (or just “rolling blocks method”, “modified block method”, or “double-squeezing method”).

This new method improves on the early-epoch constant-time method by including block times from 2015 previous blocks, rather than just blocks from the current epoch, which can skew predictions early in the epoch due to a lack of data points. To account for the change in network difficulty between eras, the blocking times of the previous era are adjusted through previous adjustment. Finally, we weight the average block times for the current epoch with the square of the ratio across the epoch. This last step is to reduce the impact of block times from the previous era as the current era progresses since these values do not actually determine the next mod.

In the graph below, we can see from confidence intervals that the new method performed better than the old model at the beginning of the epoch up to block 650, but performed slightly worse after that:

This prediction, of course, is only to drop the next difficulty adjustment. What if we wanted to predict, say, a year in the future?

Predicting Bitcoin’s long-term mining difficulty

Luxor developed long-run models to predict difficultytoo, but these models are obviously more complex, as they span a longer time frame.

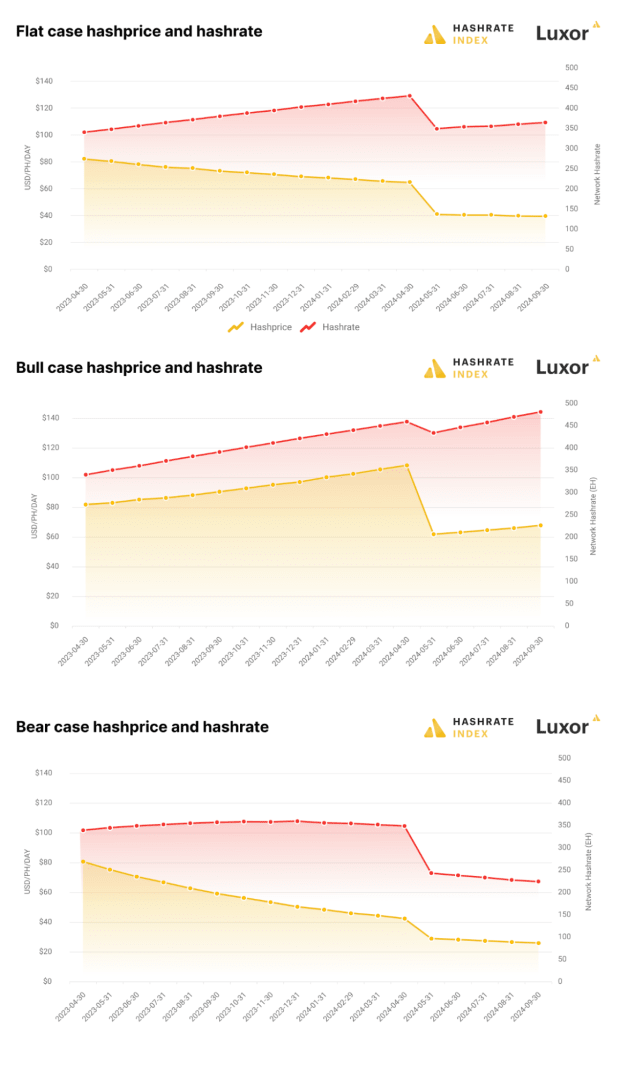

Our model takes the bitcoin price, transaction fees, and block support as inputs on the demand side, and internal data on ASIC production estimates and operating cost distributions across the industry on the supply side. Using these inputs, the model produces an equilibrium hash rate, difficulty, and hash rate for the 18-month periods.

The structure of the model reflects reality. Hash rate, difficulty, and hash rate are internal to the system, not external determinants of each other. We can perform sensitivity analyzes using the model across all inputs as well. For example, we can predict the balance hash rate, difficulty, and hash rate across a range of bitcoin prices.

The charts below display projections from our updated supply and demand model for hash rate. Provides estimates for flat, bull, and bear bitcoin price scenarios.

Retail price, difficulty and retail price drop updates

Hash Rate is an emerging asset class and digital goods market. Hash rate market participants such as bitcoin miners, hosts, lenders, investors and traders need access to the rigorous economic analysis and data available in other commodity markets.

Luxor will be committed to providing this analysis and forecast on a quarterly basis. If you would like to know more, please Visit this post.

This is a guest post by Colin Harper. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.