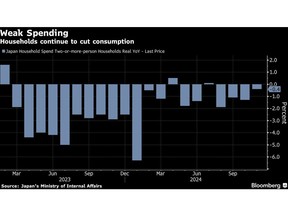

Japanese households cut consumption for a fourth month as inflation continues to weigh on their purchasing power, showing economic fragility that is likely to make the Bank of Japan cautious about raising interest rates further.

Article content

(Bloomberg) — Japanese households cut consumption for a fourth month as inflation continues to weigh on their purchasing power, showing economic fragility that is likely to keep the Bank of Japan cautious about raising interest rates further.

Article content

Article content

The Interior Department reported Friday that inflation-adjusted expenditures fell 0.4% in November from a year earlier, led by household durable goods and clothing. The result was better than expectations for a 0.9% decline, but the index rose only twice in the past 12 months. Nominal spending increased by 3% compared to the previous year.

Advertisement 2

Article content

Consumer spending has been on a downward trend for several months as shoppers deal with inflation that has been at or above the Bank of Japan’s target rate for more than 30 months. The biggest wage growth in years has yet to change direction, as inflation continues to outpace salary increases.

In November, basic salaries for Japanese workers rose by the most in more than three decades, but real wages fell for the fourth month in a row.

“Prices have risen more than expected and real wages have continued to fall, which continues to hamper consumption,” said Takeshi Minami, an economist at Norinchukin Research Institute. “People can’t loosen their wallets because they’re not confident that wage increases will continue.”

The central bank has signaled caution about the timing of the next rate hike, as Governor Kazuo Ueda seeks confirmation that strong wage momentum will continue until spring negotiations between businesses and labor unions. The Bank of Japan is scheduled to conclude its next policy decision meeting on January 24.

Even if wage growth remains strong, fragile consumption may give the Bank of Japan another reason to pause, as it signals the limit of the virtuous economic cycle the central bank is seeking to achieve.

Advertisement 3

Article content

In its branch managers’ report on Thursday, the Bank of Japan also indicated that it sees progress on wage hikes, although the comments were not strong enough to make January or March more likely as the next timing for a rate hike.

“It is possible that the Bank of Japan will raise interest rates in January,” Minami said. “But they may wait until March or April if they choose to confirm data including the outcome of spring pay talks.”

Private consumption accounts for more than half of the economy and was one of the main drivers of growth in the three months to September, partly due to a one-off tax cut implemented in the summer.

In late 2024, Prime Minister Shigeru Ishiba added new aid for low-income households to deal with inflation, through an economic stimulus package. The weak yen also affects the purchasing power of Japanese households because it makes food and energy imports more expensive.

(Updates with economists’ comments, and additional background.)

Article content

Comments are closed, but trackbacks and pingbacks are open.