Nvidia (Nasdaq: NVDA) It has been in scintillating form in the stock market in 2024, reaching gains of nearly 180% as of this writing. This is due to the strong growth recorded by the company in recent quarters due to strong demand for graphics cards deployed in artificial intelligence (AI) servers.

The stock’s average 12-month price target of $150 — according to 64 analysts covering Nvidia — suggests there’s not much upside in the offer as it indicates gains of only 9% from current levels. but, Bank of America It recently raised its price target on Nvidia from $165 to $190, which would translate to a 38% upside from current levels.

Let’s see why this was the case and check if this was high flying Semiconductor stocks It could rise above consensus estimates and post stronger gains in the future.

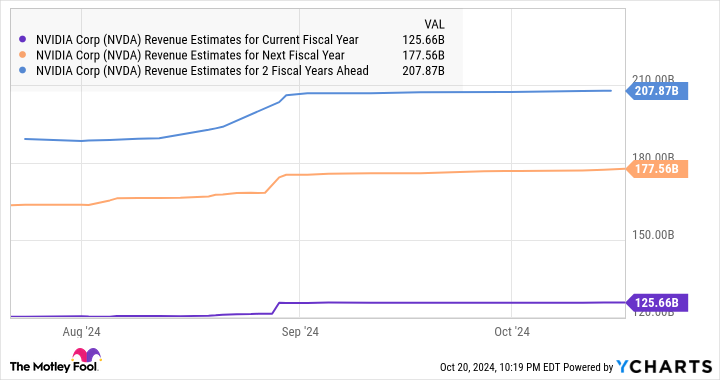

Bank of America analysts raised their price target for Nvidia due to the company’s dominant position in the artificial intelligence chip market. They believe the chipmaker could continue to capture an estimated 80% to 85% share of this space, putting the company in a great position to capitalize on a $400 billion market opportunity.

Bank of America’s upside also stems from the arrival of Nvidia’s new generation of Blackwell processors, as well as an impressive earnings report from the major supplier TSMC And Nvidia CEO Jensen Huang’s claim that demand for upcoming Blackwell cards is “insane.” It is worth noting that Nvidia’s management indicated the company’s decision in August Earnings conference call It is on track to sell Blackwell processors worth several billion dollars in the fourth quarter of the current fiscal year.

More importantly, demand for Blackwell chips is expected to be higher than supply in 2025. This would not be surprising given that several cloud computing giants are preparing to deploy Nvidia’s Blackwell processors. In March of this year, Nvidia management indicated this Amazon web services, Dell Technologies,google, dead, Microsoft,Open Eye, oracle, TeslaxAI is among many companies expected to adopt Blackwell’s platform.

This is not surprising given the huge jump in performance that Nvidia’s Blackwell platform is expected to deliver compared to the previous generation Hopper chips. More specifically, Nvidia promises a 4x increase in AI training performance and a 30x jump in AI inference compared to Hopper. Better yet, Nvidia claims that Blackwell can train large language models (LLMs) “at up to 25 times lower cost and power consumption than its predecessor.”

Comments are closed, but trackbacks and pingbacks are open.