POUND STERLING ANALYSIS & TALKING POINTS

- An increase in central bank divergence between BoE and Fed could support pound.

- Fed speakers to dominate headlines today.

- Ascending triangle (GBP/USD) & long wicks (EUR/GBP) in focus.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD & EURGBP FUNDAMENTAL BACKDROP

The British pound’s resilience this year (+5.4%) against the US dollar remains fervent as sticky inflationary pressures within the UK persist. The euro has followed a similar trend as the Bank of England’s (BoE) interest rate cycle continues in an aggressive manner. Money markets (refer to table below) favor a 25bps rate hike in September but the probability has shifted from almost 92% to just 80% with a greater chance of a larger half basis point increment gaining traction. This will theoretically give GBP additional support as the Fed is expected to keep rates on hold.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

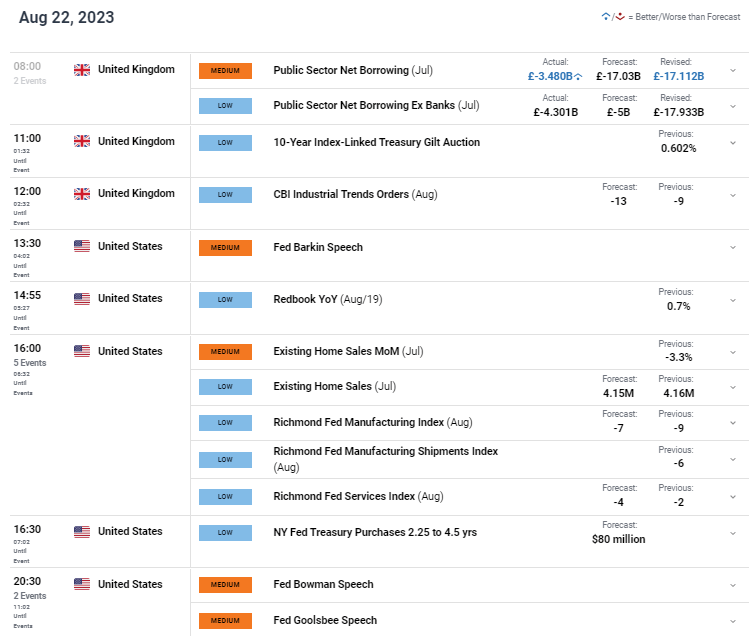

Earlier this morning, UK public sector net borrowing for July (see economic calendar below) beat forecasts while public sector net borrowing excluding public sector banks (PSNB ex) in July 2023 was £4.3 billion, £3.4 billion more than in July 2022 and the fifth-highest July borrowing since monthly records began in 1993 (Source: ONS). The rest of the day will be dominated by Fed speakers that could provide some insight into what Fed Chair Jerome Powell could have in store for markets at the Jackson Hole Economic Symposium later this week.

With no euro area announcements/releases scheduled today, EUR/GBP is likely to trade in a rangebound manner.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD & EUR/GBP ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

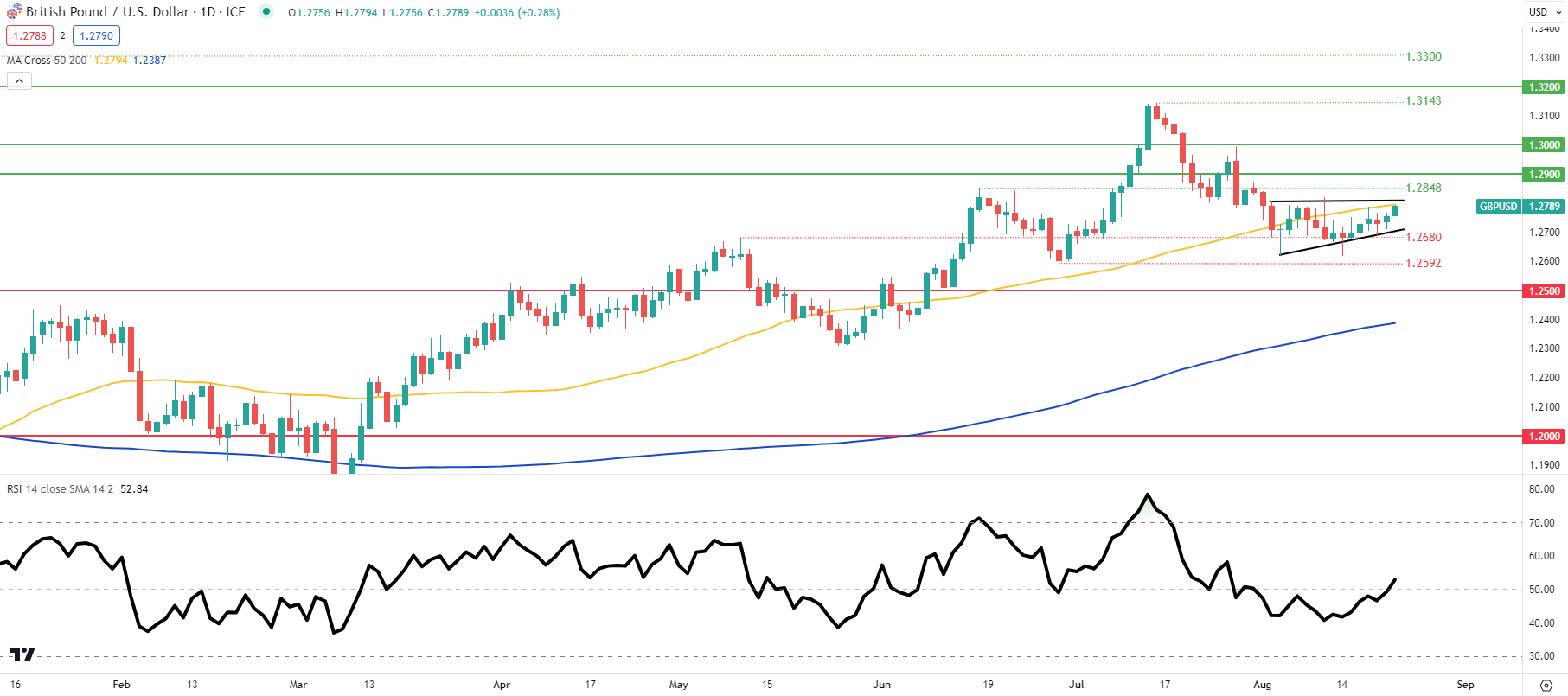

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above resembles an ascending triangle chart pattern (black) that traditionally points to a bullish breakout should prices close above triangle resistance. In this case, a dovish implication at Jackson Hole could prompt such a move as the BoE maintains its aggressive monetary policy stance. A ‘higher for longer’ message could bring bears into the equation and negate the chart pattern by breaking below triangle support and exposing subsequent support zones.

Key resistance levels:

- 1.2900

- 1.2848

- Triangle resistance

- 50-day moving average (yellow)

Key support levels:

- Triangle support

- 1.2680

- 1.2592

- 1.2500

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 51% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

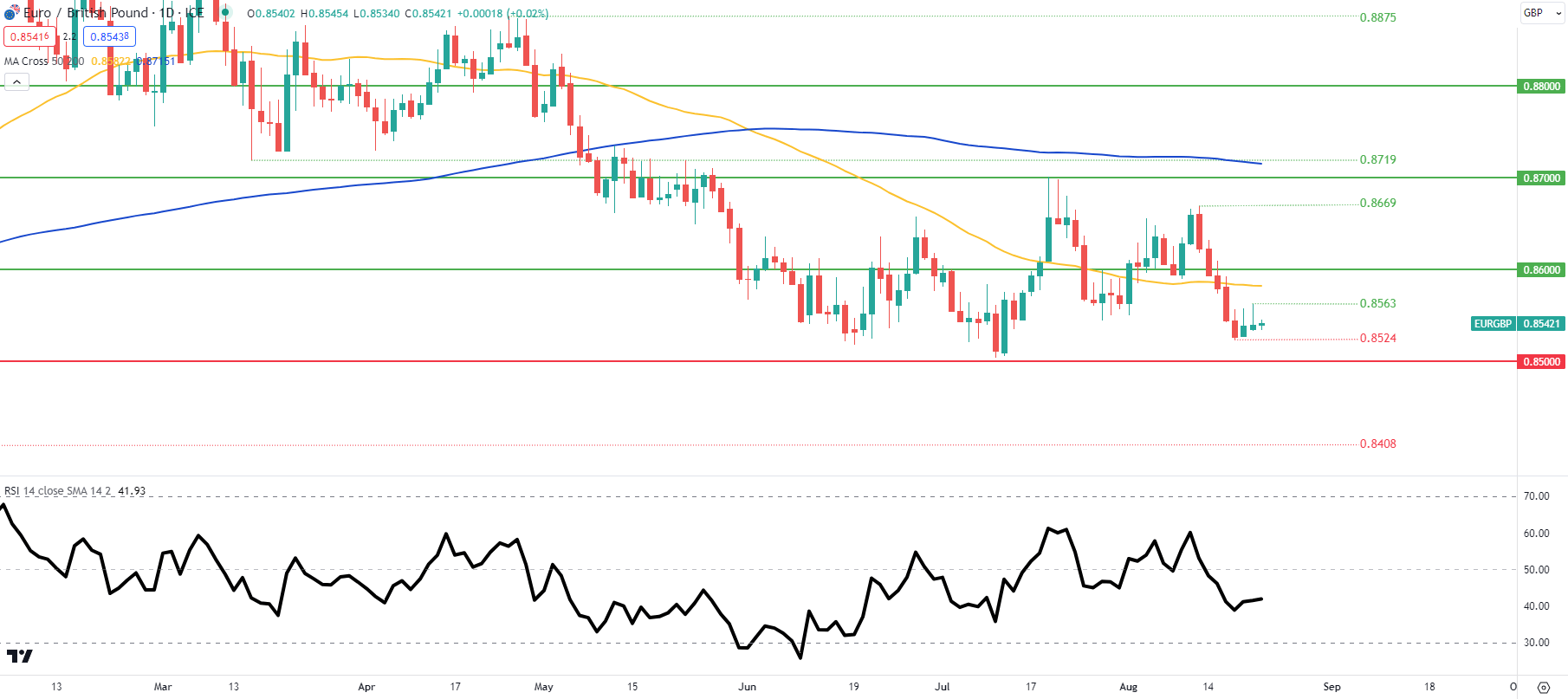

EUR/GBP DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/GBP look to be eyeing further downside as several long upper wick candles have been produced. These tend to suggest a bearish move and with prices below the moving averages (50 and 200-day) as well beneath the midpoint on the Relative Strength Index (RSI), more pound strength is possible.

Key resistance levels:

- 0.8600

- 50-day moving average (yellow)

- 0.8563

Key support levels:

CAUTIOUS IG CLIENT SENTIMENT (EUR/GBP)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on EUR/GBP with 73% of traders holding long positions (as of this writing).

Contact and followWarrenon Twitter:@WVenketas