Sterling analysis and talking points

- UK Employment Change and Unemployment Estimates shatter.

- US CPI under the microscope.

- A rise of 0.5% gains traction for the Bank of England.

- Initial reaction = GBP/USD up 0.35%.

Recommended by Warren Vinkitas

Get your free GBP forecast

There is no waiting for the UK labor market, the pound offer!

The British Pound rose on the back of the excellent jobs data (see economic calendar below. All metrics showed improvement which is not a good sign for the BoE). Concerns about sticky core inflation from the BoE and strong monetary policy comments from Haskel yesterday are sure to add to today’s data with the fact that many of the other BoE speakers today (Green, Governor Bailey and Dongra) could add to the hawkish bias.

Economic calendar

source: DailyFX Economic Calendar

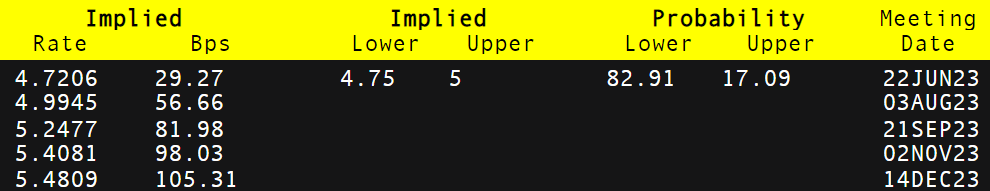

The measure of average earnings is of particular concern as it hit new annual highs (6.5%) and should contribute to rising inflation pressures. Money markets now expect approx 105 bps A rate hike by December 2023 (see table below) with a probability of 82% of A 25 bits per second (down from 93% a few days ago) an increase for the June meeting. Should the impending UK economic data be announced in the same way, expectations could shift more in favor of A 50 bits per second to rise.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

While Pound buying is shown this morning, the market may not lag behind the data as strongly as usual due to market hesitation about the upcoming US CPI report which could form a short term cable bias.

Bank of England interest rate odds

Source: Refinitiv

Technical Analysis

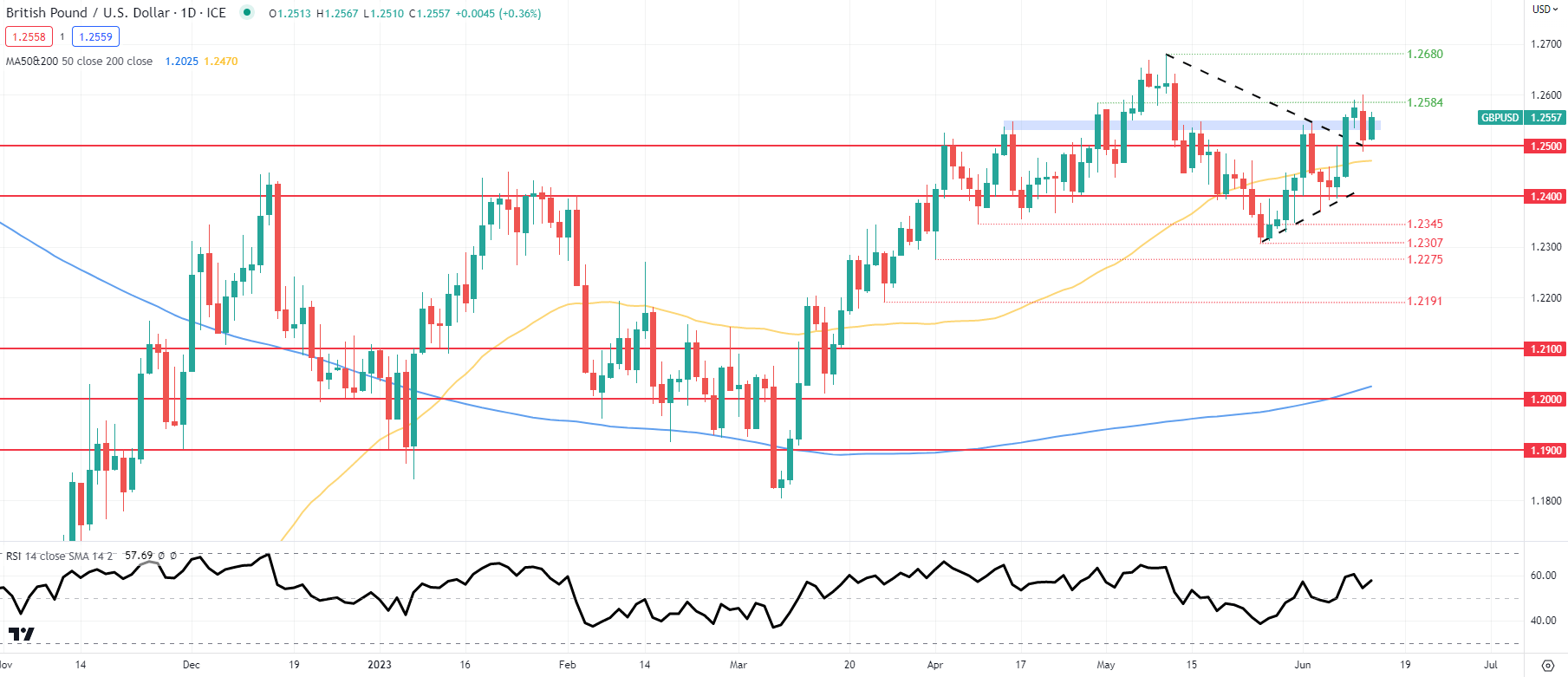

GBP/USD daily chart

Chart created by Warren VenkitasI.G

The price action on the cable daily chart is strongly higher than 1.2500 The psychological handle after breaking out of the symmetrical triangle chart pattern (black). A full break-up may be triggered by fading US inflation later today, exposing subsequent areas of resistance.

Key resistance levels:

Key support levels:

- 1.2545 (blue zone)

- 1.2500

- 50 day moving average (yellow)

- 1.2400

IG client mixed sense

IG’s client sentiment data (IGCS) shows that retail traders are currently net-trading short on GBP/USD with 54% of traders who hold short positions (as of this writing). At DailyFX, we usually take a view contrarian to crowd sentiment but due to the recent changes in long and short positions, we arrive at a cautious short-term disposition.

Contact and follow up@tweet