British Pound – GBP/USD and EUR/GBP Analysis and Charts

- ECB may slash rates by 150 basis points next year.

- US Jobs Report the next GBP/USD driver.

For all market-moving economic data and events, see the DailyFX Calendar

Most Read: Euro (EUR) Latest: Dovish ECB Commentary Weighs on EUR/USD, Yields Slump

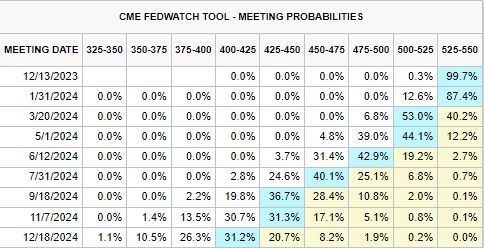

Interest rates are set to be slashed in the Euro Area and the US next year as inflation in the two economies looks set to fall further. Current market expectations show the ECB cutting rates by nearly one-and-a-half percentage points from their current 4% level, while the US is seen cutting 125 basis points from the current 525-550 Fed Fund range. Both central banks may announce their first rate cuts at the end of Q1 2024.

ECB Rate Probabilities

CME FedFund Expectations

Download our Complimentary Guide on How to Trade GBP/USD

Recommended by Nick Cawley

How to Trade GBP/USD

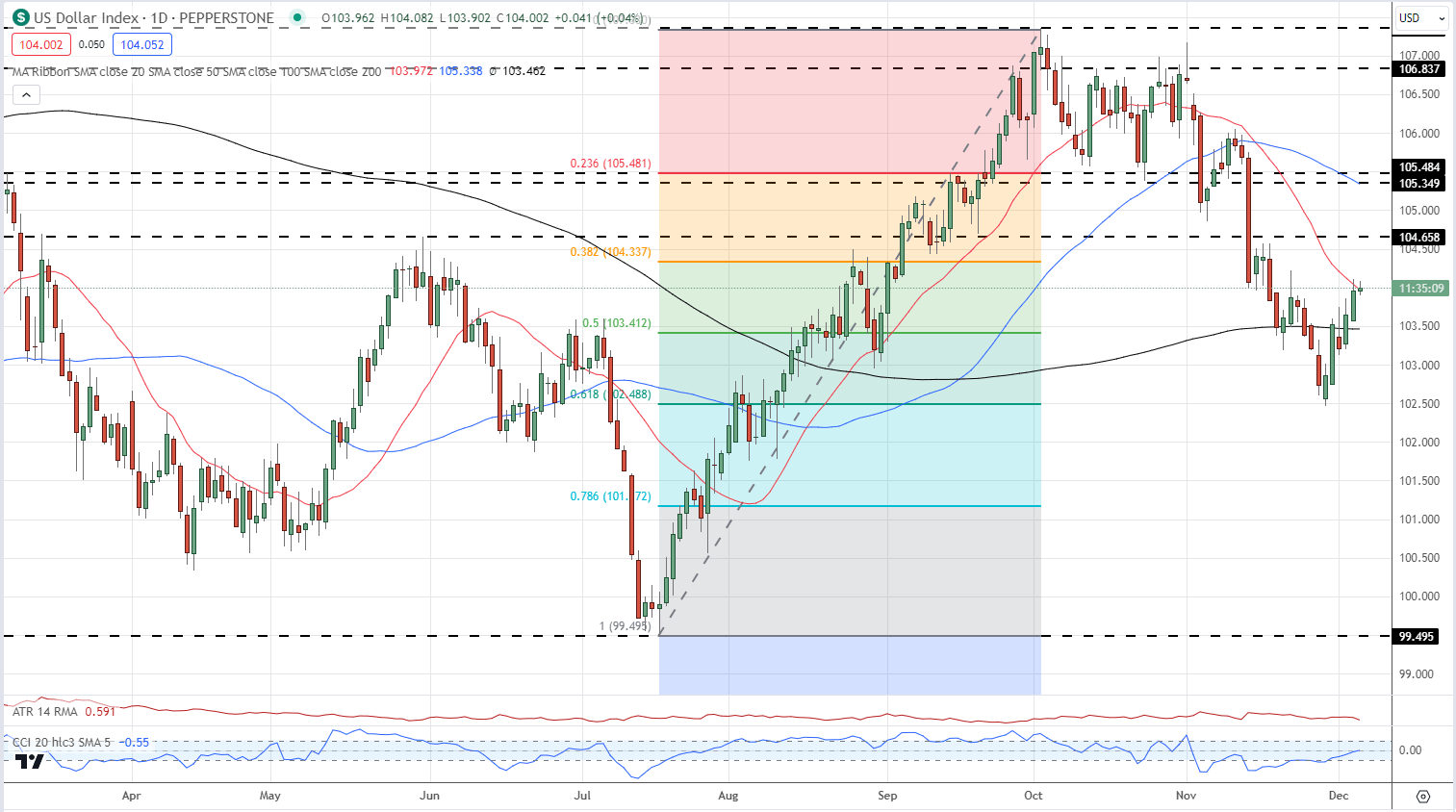

As rate cut expectations are increased and brought forward, the underlying strength of both the Euro and US dollar reduces. The major move over the last two weeks has been in the Euro and this is noticeable against a range of other currencies. As the Euro weakens, the US dollar index (DXY) gains – the Euro makes up around 60% on the index – and this can be seen clearly on the daily DXY chart over the last week.

US Dollar Index (DXY) Daily Chart

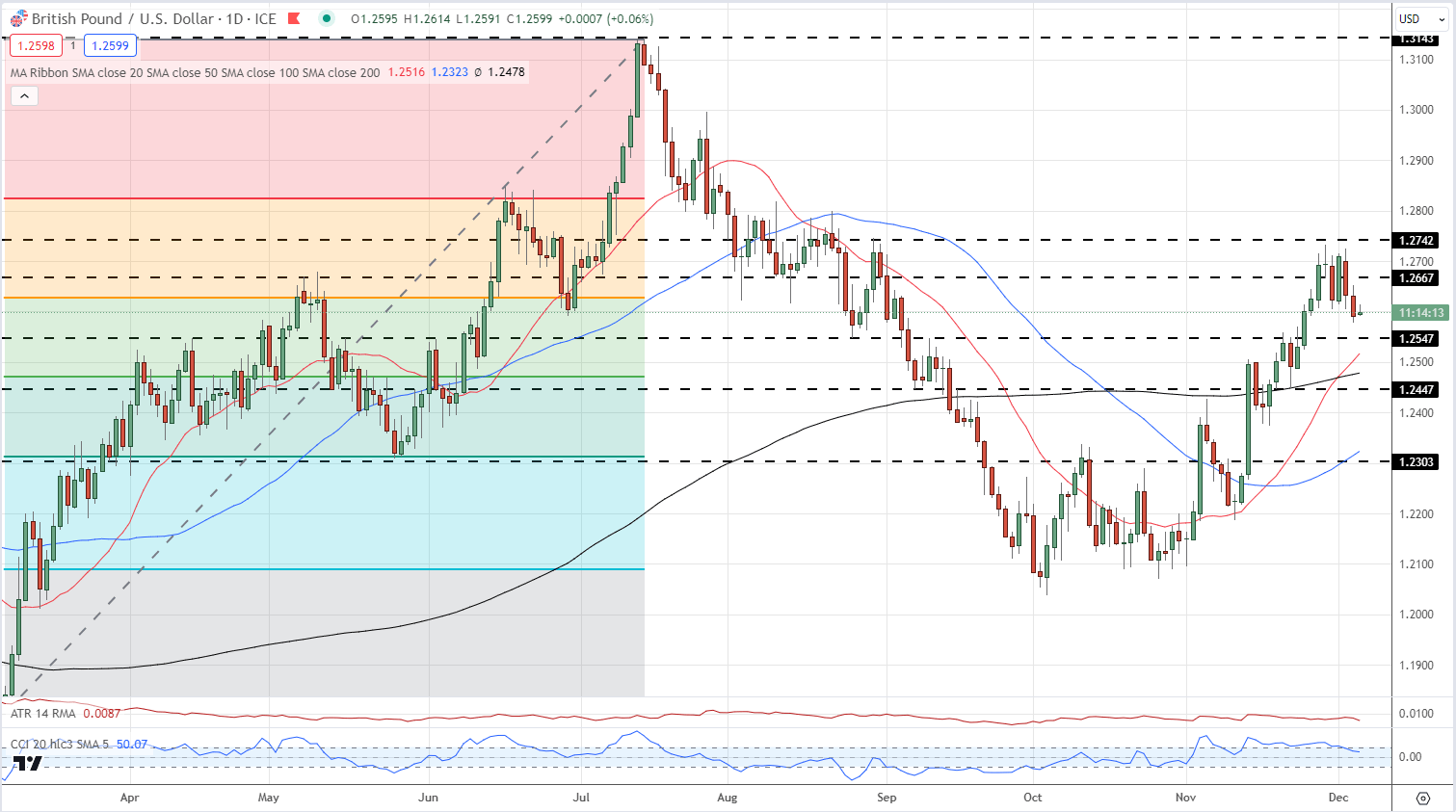

The Bank of England in contrast is expected to trim rates by 75 basis points next year, underpinning the British Pound against the US dollar and the Euro.

Cable is currently trading on either side of 1.2600, propped up by Sterling and weighed on by the US dollar. The daily chart setup remains positive but the current strength of the US dollar is likely to make further upside in the pair limited over the coming days. Support is seen at 1.2547 and resistance at 1.2742.

GBP/USD Daily Price Chart

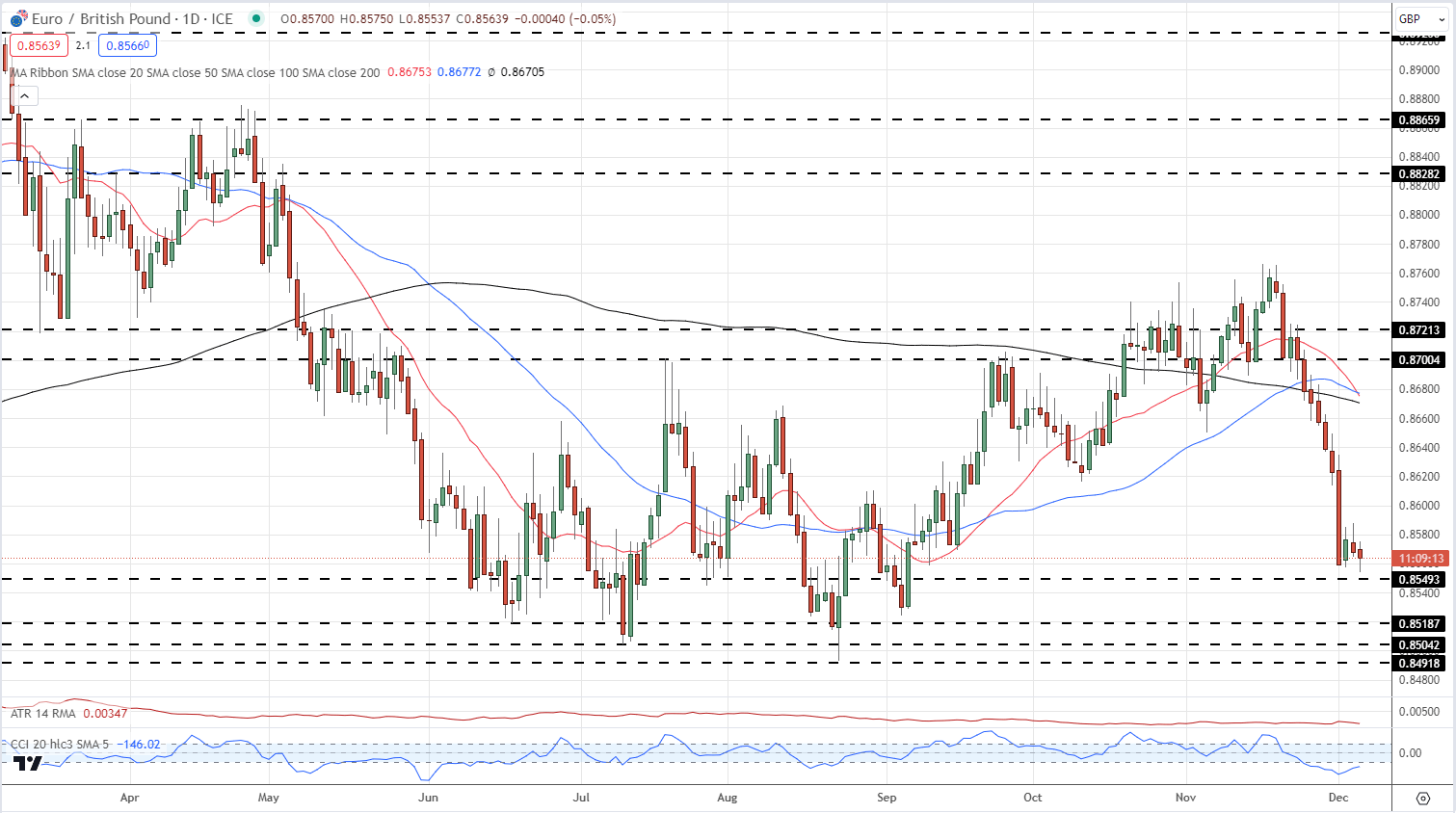

A clearer picture of the Euro weakness/Sterling strength can be seen in EUR/GBP. This pair has fallen by over two big figures over the last two weeks and is heading towards a prior zone of support all the way down to 0.8492. This looks set to hold in the short term.

EUR/GBP Daily Price Chart

Charts using TradingView

Retail trader EUR/GBP data show 74.50% of traders are net-long with the ratio of traders long to short at 2.92 to 1.The number of traders net-long is 3.34% higher than yesterday and 24.64% higher than last week, while the number of traders net-short is 2.27% higher than yesterday and 19.64% lower than last week.

What Does Changing Retail Sentiment Mean for Price Action?

| Change in | Longs | Shorts | OI |

| Daily | 3% | 3% | 3% |

| Weekly | 24% | -26% | 6% |

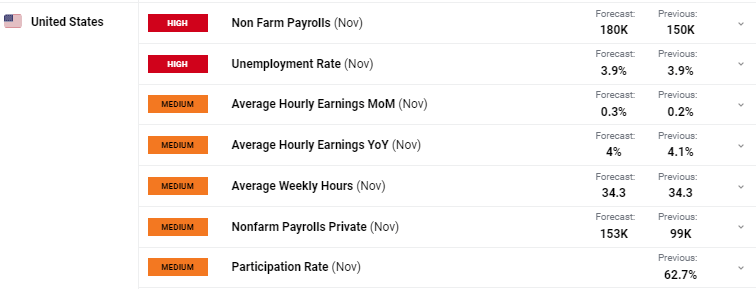

At the end of the week, we have the latest US Jobs Report that is expected to show 180k new jobs created in November. The labor market remains near the top of the Fed’s priorities in its fight against inflation and any major deviation from this market forecast will steer the US dollar, and US Dollar pairs, going into the weekend.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.