buying alphabet (NASDAQ: GOG) (NASDAQ: GOOGLE) Stocks are rarely a bad idea.

Imagine you bought $1,000 worth of Alphabet stock on Feb. 25, 2014. It turned out to be the worst day of the year to buy shares in the tech giant. The day’s peak, at a record $30.50 per split-adjusted share, was followed by an 18% decline over the next 10 months. The downside factors piled on as European regulators considered breaking up the company, Android phone sales struggled, key executives left, and new product ideas like Google Glass and Waymo’s self-driving cars failed to pan out.

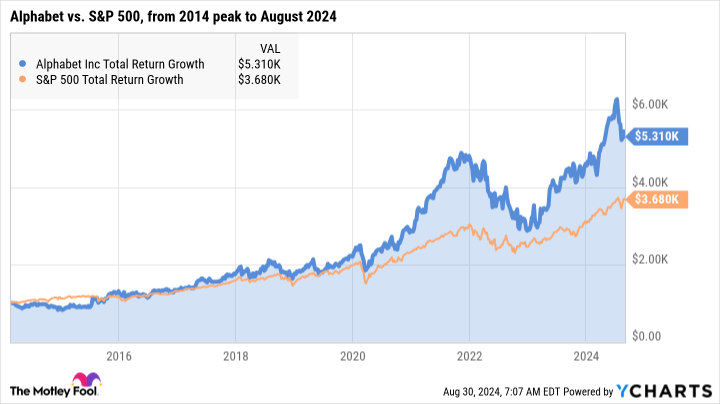

That’s okay, though. If you had held onto that $1,000 investment through thick and thin, after about ten years you would have $5,310 in your pocket, more than the market was worth.

Alphabet shares have stumbled before — and then bounced back

Of course, you would have done better if you had invested in Alphabet any other day that year, but the company overcame its problems and crushed the broader market even from its worst possible starting point in 2014. I expect future generations to say similar things about buying Alphabet stock in 2024 — this investment should outperform the market for years or even decades to come, no matter how poorly you timed it.

Time in the market trumps market timing.as you know. And This company is built to last a very long time..

I can’t think of any company more likely to deliver strong returns in 2040, 2050 and beyond than Alphabet. The terrible price decline of 2014 is barely a squiggly graph now. And Alphabet’s results have continued to grow:

Alphabet stock is a good deal right now.

Hold on — it keeps getting better. In addition to Alphabet’s resilience, the stock is unusually affordable right now.

After hitting another record high of $191.40 in July, Alphabet shares have fallen 15% to about $162. As I write this, the company is trading at 23.4 times trailing earnings with a price-to-earnings-to-growth ratio of 1.1. These are the most reasonable earnings-based valuations among the “Magnificent Seven” of tech giants.

Moreover, Alphabet has played a leading role in the AI boom. Google Cloud is a popular cloud computing platform where other companies can train and run their own AI platforms. Google’s Gemini chatbot competes directly with OpenAI’s ChatGPT in language understanding and generation. The company is poised to make the most of generative AI as a catalyst for long-term growth.

I could go on, but you get my point. Alphabet stock was a good investment before the recent sell-off, and it’s an even better choice today. The market sell-off can be your friend when you’re looking to invest in a great company like Alphabet.

Should you invest $1,000 in Alphabet now?

Before you buy shares in Alphabet, keep the following in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are plenty of companies investors want to buy right now… and Alphabet wasn’t one of them. The 10 stocks that made the list could deliver massive returns in the years to come.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $731,449.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of August 26, 2024

Susan Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund The Motley Fool has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Disclosure Policy.

The recent sell-off in the tech sector has made this AI stock a better buy. Originally posted by The Motley Fool

Comments are closed, but trackbacks and pingbacks are open.