US Dollar (DXY) Analysis

Recommended by Richard Snow

Get Your Free USD Forecast

Longer Dated Yields Soar to Impressive Levels

US Treasury yields, particularly those with longer investment horizons, continue to press on. The chart below highlights the recent consolidation in the shorter-term 2-year yield (Green) and rise of longer-dated yields as indicated with by the arrows.

The US dollar has enjoyed a month of steady appreciation (measured by the US dollar basket, (DXY)) as central banks for developed markets look to reach their respective interest rate peaks. Therefore, interest rate differentials become less likely to contribute towards FX direction. US yields however, are supporting the recent DXY appreciation.

US Treasury Yields Rise

Source: TradingView, prepared by Richard Snow

The 10-year treasury bond yield has now reached levels last seen in 2008, around 4.28%. The rise, noticed particularly in yields focused on the longer end of the curve, have been raising concern over the possible impact on US stocks.

The 10-year is often cited as the benchmark for a ‘risk free’ rate which investors refer to when calculating the payoff of safer investments compared to those associated with riskier assets like stocks. With risk free investments now offering attractive yields, attention may shift from highflying equities towards safer bonds.

Rising yields have also been bolstered by the relative outperformance of the US economy, particularly when compared to Europe and China. A particularly hot economy reignites concerns that inflation may stick around longer than anticipated – potentially necessitation higher interest rates yet.

US 10-Year Treasury Yields (Monthly chart)

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

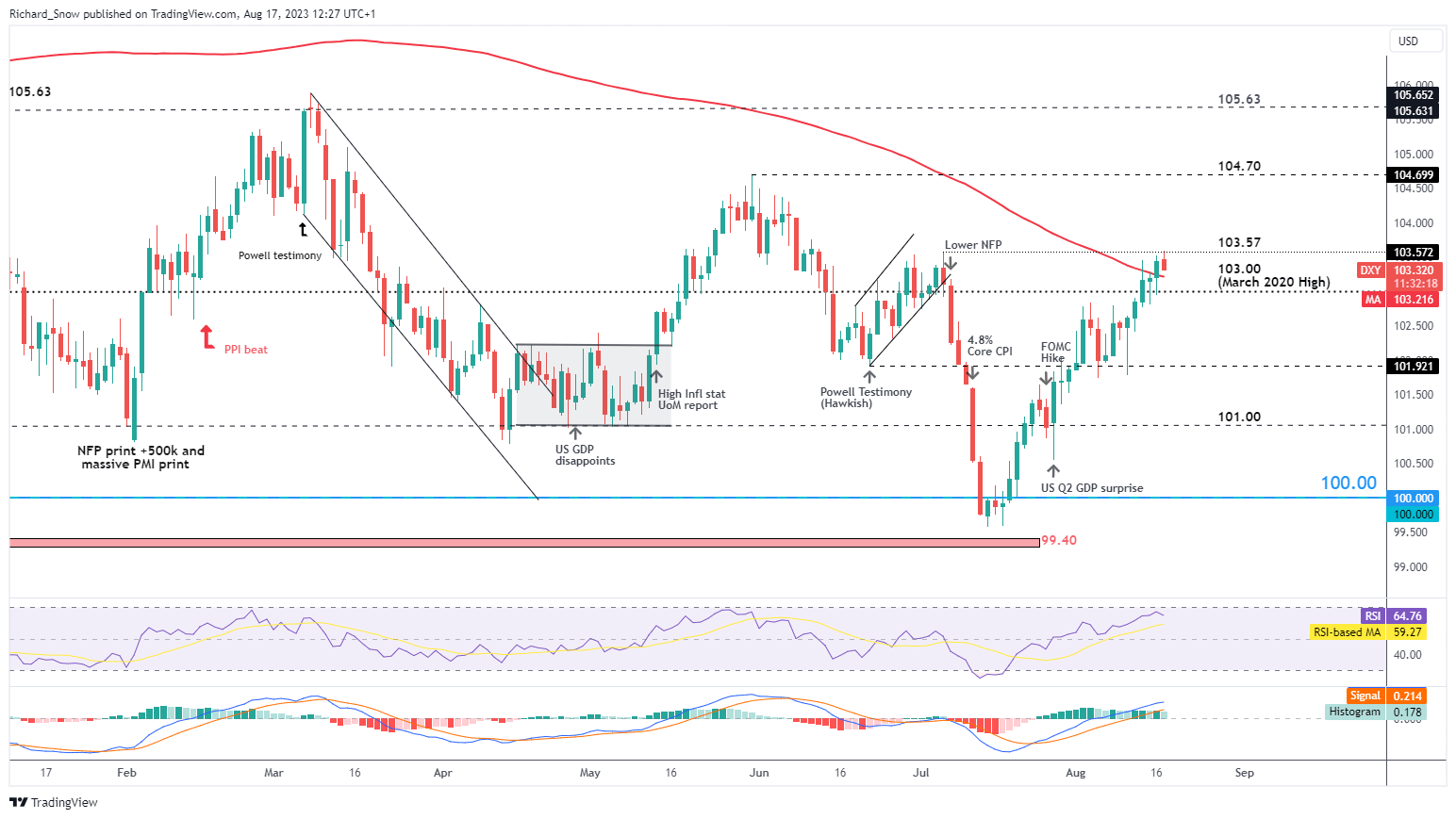

US Dollar Basket Eases after Testing Prior Resistance

The US dollar basket has put in quite the performance, fully retracing the early July selloff when economic data appeared to point to easing jobs and inflation conditions. Bullish momentum has powered through previous challenges including the 22nd of June swing low, the significant 103 level and recently the 200 day simple moving average (SMA).

Immediately after tagging the prior swing high at 103.57, the greenback heads slightly lower, testing 103. The recent bullish move has neared overbought territory before turning slightly lower, with the uptrend remaining constructive despite the minor pullback.

Yields continue to support the dollar meaning that moves to the downside could prove short-lived. Upside levels of interest include the 103.57 and 104.7 levels. FOMC minutes yesterday also revealed that the call for a light recession towards the end of the year has been removed in light of unfolding data.

US Dollar Index (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX