Canadian Dollar Rate, Charts and Analysis:

- Loonie looks to be on track for more gains for the dollar as Bank of Canada (BoC) like DXY The slide continues.

- BoC Governor Macklem revealed concerns about the pace that were being raised economic inflation It is expected to decrease going forward.

- Technical indicators are hinting at more downside, however, a short-term bounce is still possible.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Read more: Bank of Canada: Trader’s Guide

Canadian dollar backdrop

The Canadian dollar has had an interesting two weeks heading into yesterday’s BoC meeting. The central bank opted for a 25 basis point hike while warning that downward pressure on inflation may start to ease. This was followed by a warning that more increases could come if the recent advance in inflation shows significant signs of slowing.

Read more: BoC rises 25 basis points, warns of slowing downward momentum for inflation

More comments from Governor McClim yesterday revealed that the Bank of Canada expects CPI to hover around 3% for the next 12 months with the recent slowdown largely attributed to lower energy prices. In terms of the labor force, Governor Macklem said the rise in immigrant numbers is having a negative impact on inflation as consumer demand rises. After the interest rate decision and Governor McClim’s comments, the money market is still priced at a peak rate above 5% for the month of December 2023.

Given the pivot we see from market participants regarding the Fed and the possibility of a pause after this month’s meeting as well as dollar weakness which could be a long term trend, USDCAD could be poised for further declines in Q3.

Recommended by Zain Fouda

Get your free predictions for the best trading opportunities

Economic calendar and risks of upcoming events

Not much left this week in terms of high risk events on the calendar as tomorrow brings the preliminary numbers of Consumer Confidence out of Michigan. Earnings season also starts in the US tomorrow and this could lead to increased volatility in the markets in the coming days as it could provide another indication of the overall health of the US and the global economy.

All the attention from the Canadian dollar perspective is likely to come next week with the release of inflation data for the month of June. Given the comments made by Governor McClim, any signs of inflation picking up could see aggressive rate hike bets repriced adding another layer of support for the CAD and potentially sending USDCAD down further.

For all the economic data and events that move the market, see DailyFX calendar

Price actions and possible setups

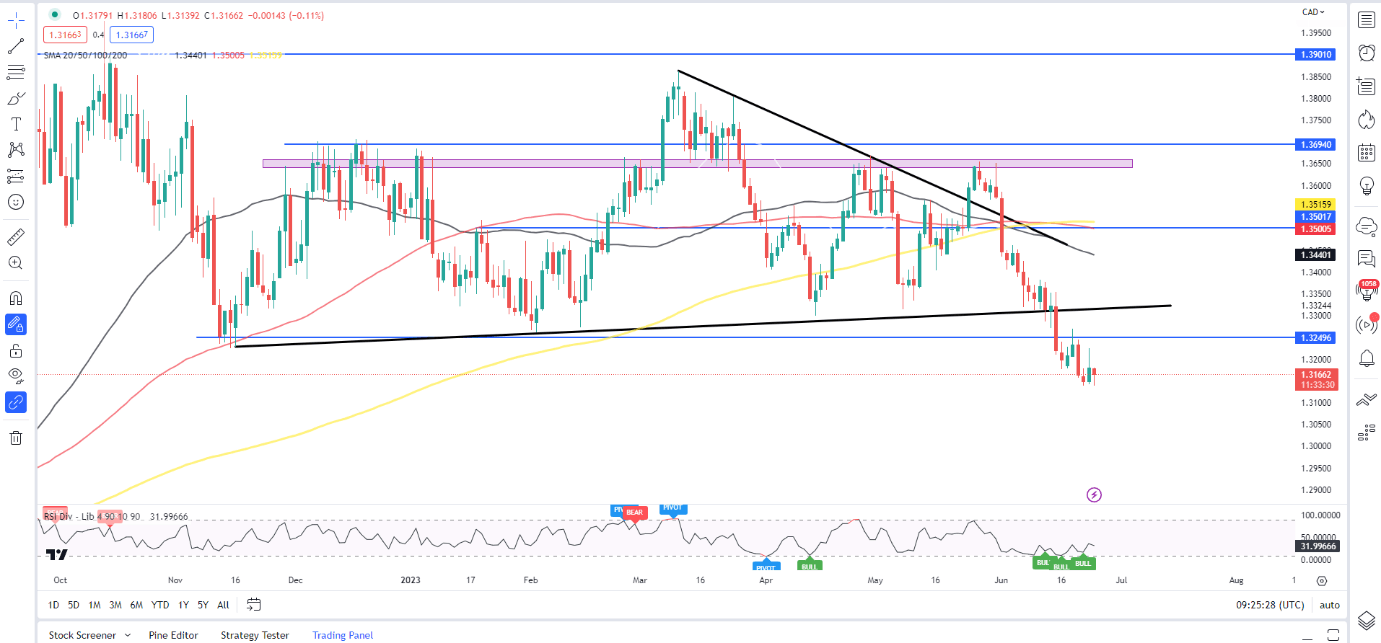

USDCAD continued to fall today as US CPI and a rate hike by the Bank of Canada inspired a renewed push to the downside. 1.3000 remained the key level for USDCAD historically with a long overdue retest as the pair traded below the mentioned level in August 2022.

American dollar/ bastard daily chart

Source: TradingView, prepared by Zain Fouda

The pair is approaching the overbought area and there is a possibility that rice will reach 1.3000 and it may be in the process of bouncing before finally falling and breaching the 1.3000 level.

We take a look at IG’s customer sentiment data and we can see that retailers are currently net positive long on USDCAD with 68% of traders who hold long positions (as of this writing). At DailyFX, we usually take a contrarian view to crowd sentiment which means we may see USDCAD prices continue to fall after a short rally.

Key levels to watch out for:

Support levels:

- 1.3000

- 1.2900

- 1.2750 (Aug 2022 swing low)

resistance levels:

Find out what kind of forex trader you are

— Written by Zain Fouda L DailyFX.com

Connect with Zain and follow her on Twitter: @employee