Bitcoin’s price performance in 2024 is one for the history books, as the leading cryptocurrency crossed the $100,000 mark for the first time ever. However, reaching this milestone has opened the door to another conversation – when will the market reach the top?

As a result, several Bitcoin top price predictions have emerged from the cryptocurrency crowd over the past few weeks. The latest on-chain observations suggest that the market may not have peaked or may not be close to peaking yet.

The percentage of profit achieved is relatively low compared to previous sessions

In a recent Quicktake post on the CryptoQuant platform, an analyst with the pseudonym CryptoOnChain He explained How whale behavior and movements could help determine the top of the Bitcoin market. The relevant metric here is the realized profit ratio, which measures the percentage of investor group exits from the market.

The “Realized Profit Percentage” metric calculates the proportion of coins sold at a profit relative to the total transaction volume. A high value of this metric indicates that the market is approaching its peak, as participants begin to unload their assets to make a profit.

On the other hand, a lower realized profit ratio shows that fewer market participants are selling their bags for profit. This often indicates investors’ continued confidence and belief in further growth of cryptocurrency prices.

According to CryptoOnChain, the profit percentage of different groups of Bitcoin whales (holding between 10 to 100, 100 to 1,000, and 1,000 to 10,000 BTC) is significantly lower compared to recent sessions. As shown in the chart below, it appears that the whales have not yet started making profits.

Source: CryptoQuant

This indicates that Bitcoin whales, which are influential market entities, believe that the major cryptocurrency has not yet reached its peak in the cycle. As of this writing, Bitcoin’s price is just below $102,000, reflecting no significant change over the past 24 hours.

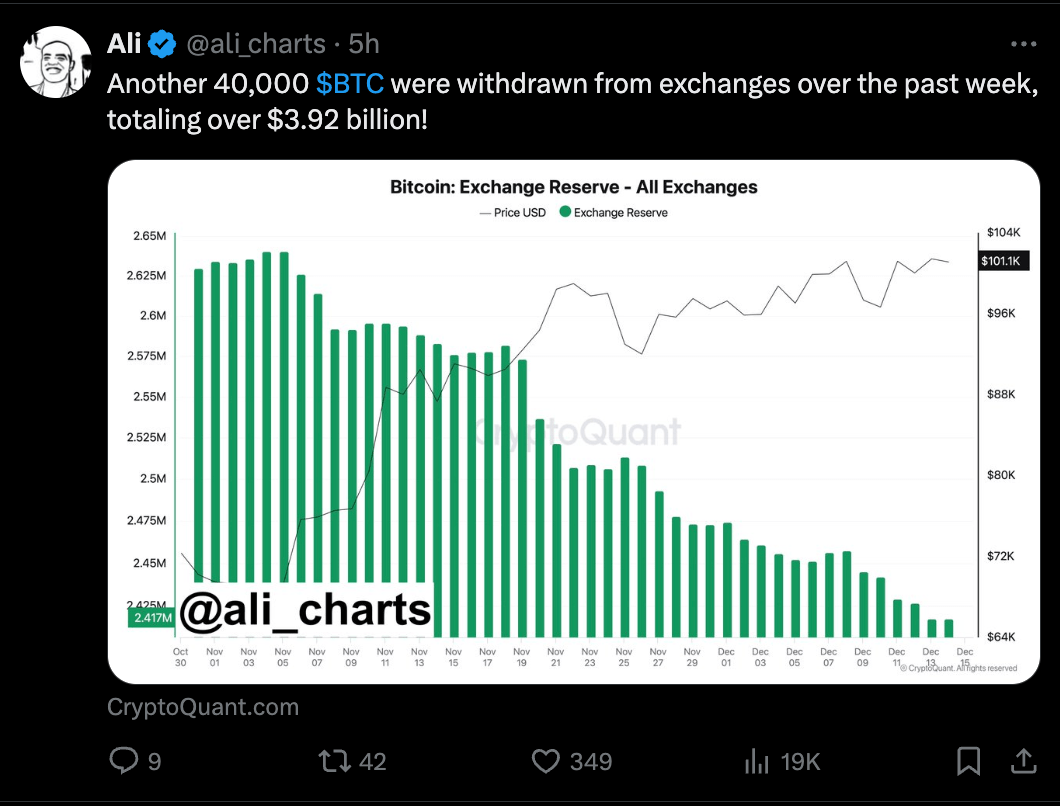

40,000 Bitcoins were transferred from the central exchange: CryptoQuant

There appears to be another data point to support the idea that market participants are currently looking for higher gains. Prominent cryptocurrency expert Ali Martinez took to the X platform to do just that Share Large amounts of Bitcoin have flowed from central exchanges in the past few days.

Source: Ali_charts/X

More than 40,000 bitcoins (worth about $3.92 billion) were sent from exchanges over the past week. This movement of assets into non-custody portfolios indicates rising confidence among investors, with a focus on long-term promise rather than quick, short-term gains.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.