Ethereum is struggling to restore a brand of $ 2800 as support, making investors not sure of the short -term direction of its price. The second largest encrypted currency was unable to start the recovery gathering, as analysts are increasingly calling for a declining continuation. Negative spirits have been nourished by the scary ETHEREUM performance compared to the market expectations, making the price range binding without the main supply levels.

Despite pessimism, some investors still hope that Ethereum will enter the recovery stage soon. A potential recovery can appear as the market begins to find stability. In addition to optimism, the supreme analyst Ali Martinez has participated in the main standards that reveal a significant development: more than 900,000 ETHEREUM has been withdrawn from the stock exchanges in the past ten days. This direction signals of the accumulation by the larger players increased and reduce the pressure pressure, indicating that investors may prepare for a possible gathering.

The great withdrawal of ETH from the stock exchanges can indicate the increasing confidence between long -term holders, even amid short -term price conflicts. As the ETH uniformity continues less than 2800 dollars, the next few days will be very important to determine whether it can reflect its declining direction or confront the negative side. Investors closely monitor to see if the ETH can manage the tide and restore higher levels.

Ethereum standards indicate a strong accumulation

Ethereum wrestles with great fluctuations because it merges without a mark of $ 2800, which is the decisive level that bulls need to restore to start recovery collection. Feelings on the market are still divided, with retail investors' fear of a negative aspect, while some analysts expect an aggressive volume in the coming months. Ethereum seems to be a pivotal stage in this course, as it struggles to get momentum like Bitcoin, which showed relative strength.

Martinez has Common keys data Shed light on the current Ethereum dynamics. Over the past ten days, more than 900,000 ETHEREUM has been withdrawn from the stock exchanges, indicating that accumulation is increased by senior players and reduced sale pressure. This trend indicates that institutional and long -term institutional investors may prepare for a potential upward movement, even as retail participants grow.

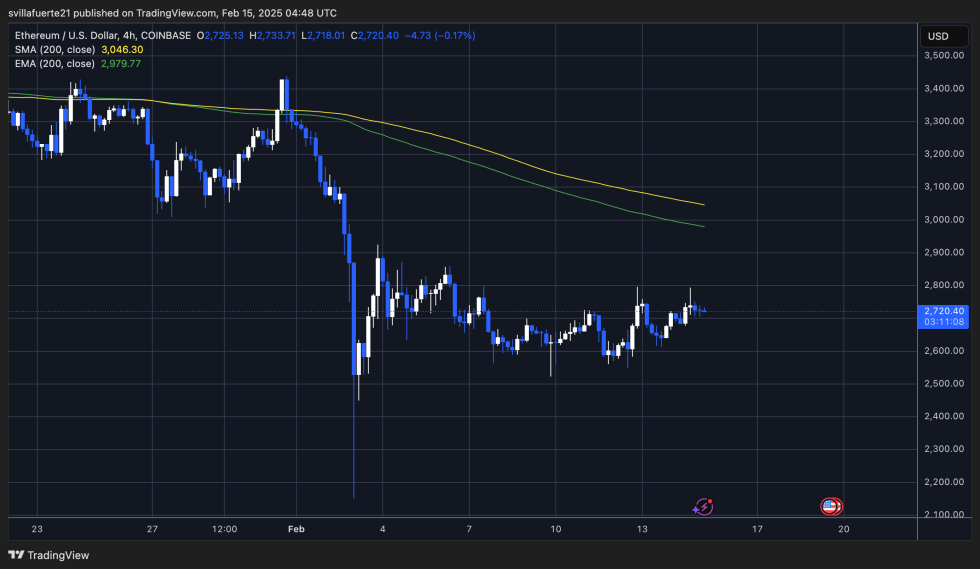

The past few weeks have been difficult for Ethereum holders. The dramatic sale witnessed last week that the ETH decreased from $ 3,150 to 2150 dollars in less than two days. While the price has been recovered since then to a range of $ 2600-2700 dollars, ETH has struggled to hack from the main supply levels and restore its foot above $ 2800.

With ETHEREUM incorporate at the current levels, the next few days will be very important. If Bulls managed to restore the brand of $ 2800 and push it up, it may indicate the start of a new upward stage. On the contrary, failure to break these levels can lead to long unification or even another negative aspect, which adds to uncertainty. Investors and analysts are closely monitoring the market, waiting to know whether Ethereum can be freed from his homosexual fist and draw a way to recovery.

Prices test supply level

ETHEREUM is trading at $ 2720 after days of side trading and frequency. The market appears to be stuck in a stage of speculation, with feelings of feelings sharply in terms of directing the short -term price. Investors are waiting for a clear signal as it enhances ETH without critical resistance levels.

In order for Ethereum to confirm the decline in recovery, Bulls needs to restore a brand of $ 2800 as support and pay the price above the level of psychological dollars. The penetration of these levels would refer to the bullish momentum and pave the way to turn towards the higher supply areas. The level of $ 3000 is also in line with the moving average for 200 days, which is a major indicator of long -term direction. The ongoing step above this level would bring renewed optimism to the market.

However, the risk of negative additions remains. If Ethereum fails to recover 2800 dollars, the price may be recovered to reduce the demand areas by about $ 2,500. This scenario is likely to exaggerate the emotional feelings and prolong the current period of uncertainty. With the division of feelings and the broader Crypto market, it is possible that the next step for Ethereum tone to perform in the coming weeks. Bulls and bears are looking for a brand of $ 2800 as a critical turning point for the second largest encrypted currency.

Distinctive image from Dall-E, the tradingView graph

Comments are closed, but trackbacks and pingbacks are open.