EUR/USD analysis

Recommended by Richard Snow

How to trade EUR/USD

Powell’s persistence leads to a decline in the dollar and an increase in the euro

Jerome Powell’s testimony before the US House of Representatives Committee on Finance stressed that the Fed expects a more gradual rate hike in the future. Markets are now considering an additional 25bp hike before they see the Fed pause, while the ECB is on track for two more 25bp hikes – which is very much priced into market expectations.

The market’s implied probabilities for future price hikes

Source: Refinitiv

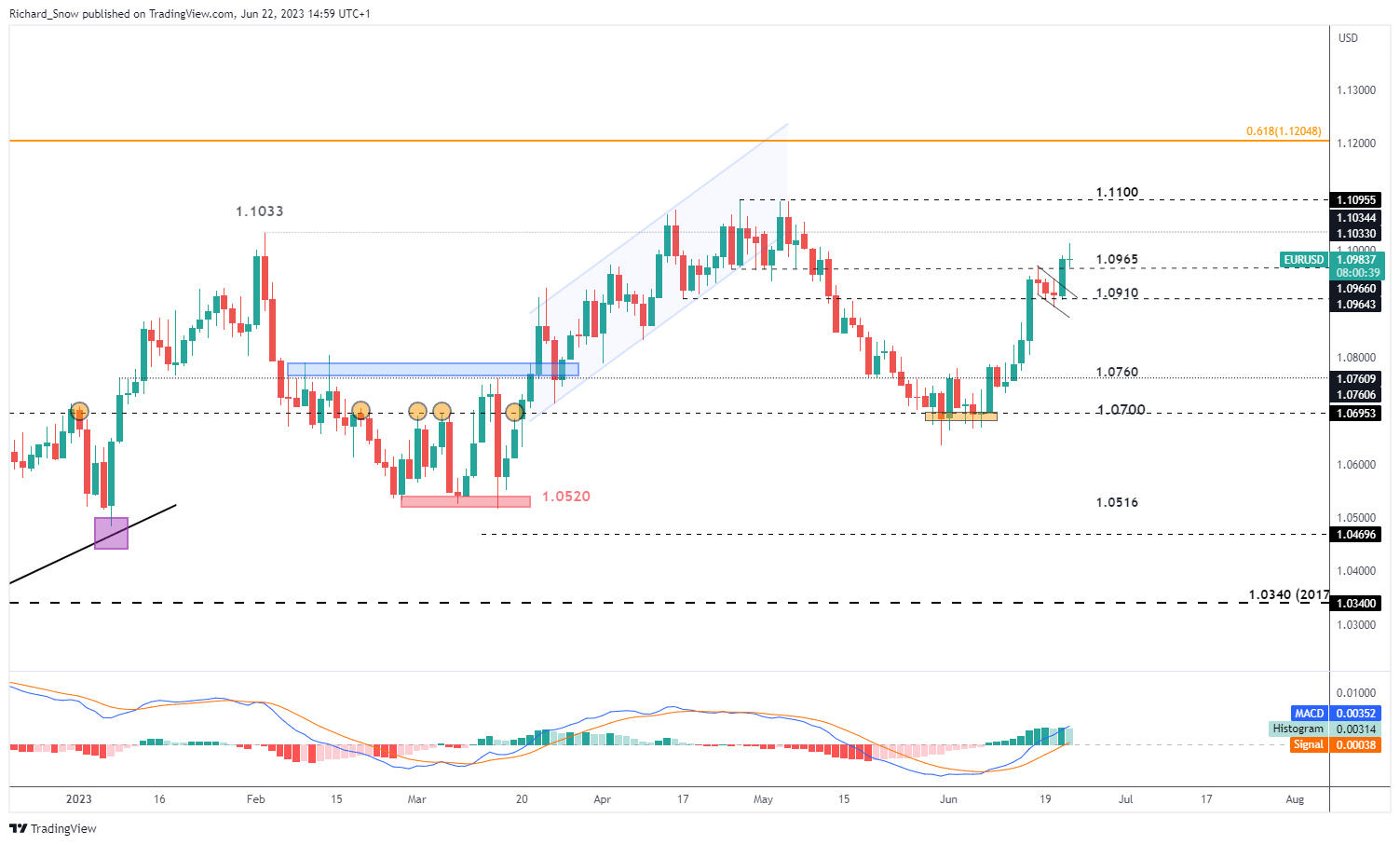

Key technical levels for EUR/USD to watch

A bullish continuation is in play in EUR/USD which started the initial climb after reversing off the support area around 1.0700. The initial rally was boosted by the European Central Bank’s interest rate decision on June 15th which saw the emergence of a sharper bullish wave. After that, prices retreated lower as some of their strength was shed – creating a bullish flag.

The slight pullback was tested and it even traded below 1.0910 during the day but failed to close below the support level, indicating that bullish momentum may return soon. Yesterday’s price action highlights a return to bullish potential even as EUR/USD struggles to build on yesterday’s gains.

More upside remains constructive at daily stability above 1.0965, with ascending resistance levels at 1.1033 and 2023 high at 1.1100. Although the MACD is a lagging indicator, it does indicate an extended bullish momentum. The bullish continuation should be re-evaluated if the pair traded and closed below 1.0910.

EUR/USD daily chart

Source: TradingView, prepared by Richard Snow

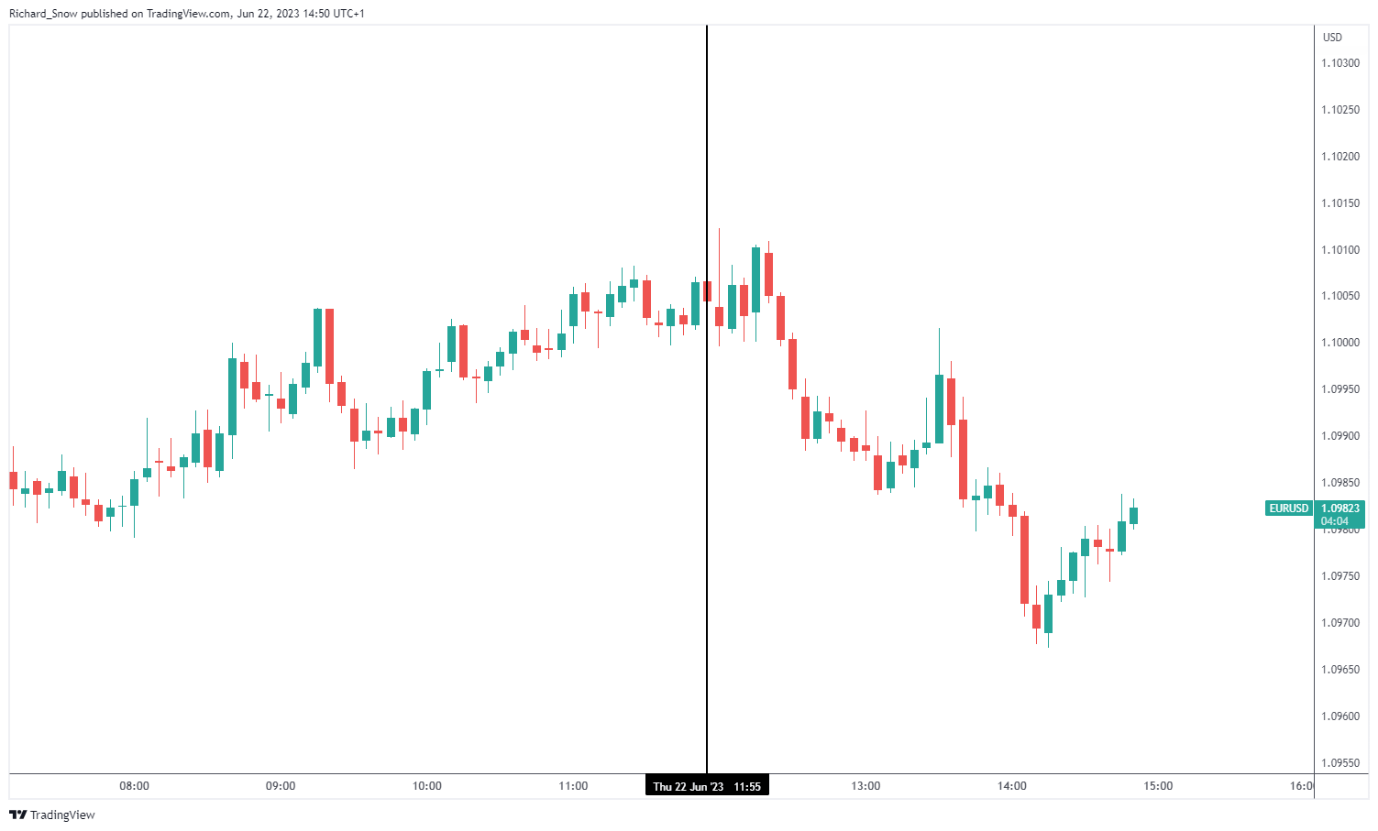

The intraday move lower in the EUR/USD pair immediately gained traction after a surprise 50 basis point jump from the Bank of England (BoE). EUR/USD headed lower in the moments following the announcement.

5-minute chart of EUR/USD

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @tweet