Dow, DAX Index Analysis

Recommended by Richard Snow

Get Your Free Equities Forecast

DAX Pushes Past Significant Resistance as Earnings Season Continues

The DAX received a boost ahead of the ECB rate announcement today as earnings season grips the German index. A broad list of stocks that have reported positive earnings updates this week are trading higher along with stocks due to report early next week as a seemingly dovish ECB statement (alongside a very strong US growth print) helped spur on a complete turnaround in EUR/USD while supporting the recent DAX advance too. Big winners on the day include Mercedes-Benz which reported today as well as Deutsche Post and Daimler Truck Holding AG which report earnings next week Tuesday.

The DAX has surpassed the prior level of resistance and 2022 major high of 16,285 en route to retest the all-time high of 16,427. The MACD indicator suggests that bullish momentum remains in place and the RSI is yet to dip into overbought territory.

DAX Daily Chart

Source: TradingView, prepared by Richard Snow

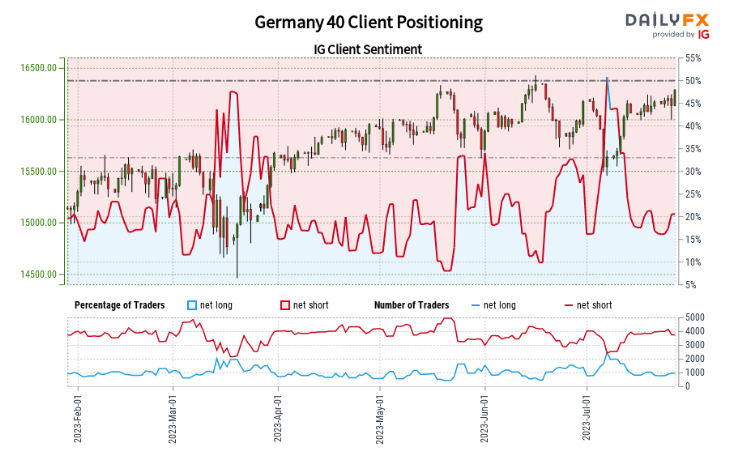

Retail Sentiment Enters Extremes as Long-Term Uptrend Extends

Retail traders briefly closed the gap between longs and shorts as the index plummeted but have extended the gap to extreme levels once again.

IG Client Sentiment Chart (DAX)

Source: TradingView, prepared by Richard Snow

Germany 40:Retail trader data shows 19.55% of traders are net-long with the ratio of traders short to long at 4.12 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Germany 40 prices may continue to rise.

The number of traders net-long is 19.40% lower than yesterday and 16.77% lower from last week, while the number of traders net-short is 10.49% higher than yesterday and 6.52% higher from last week.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Germany 40-bullish contrarian trading outlook.

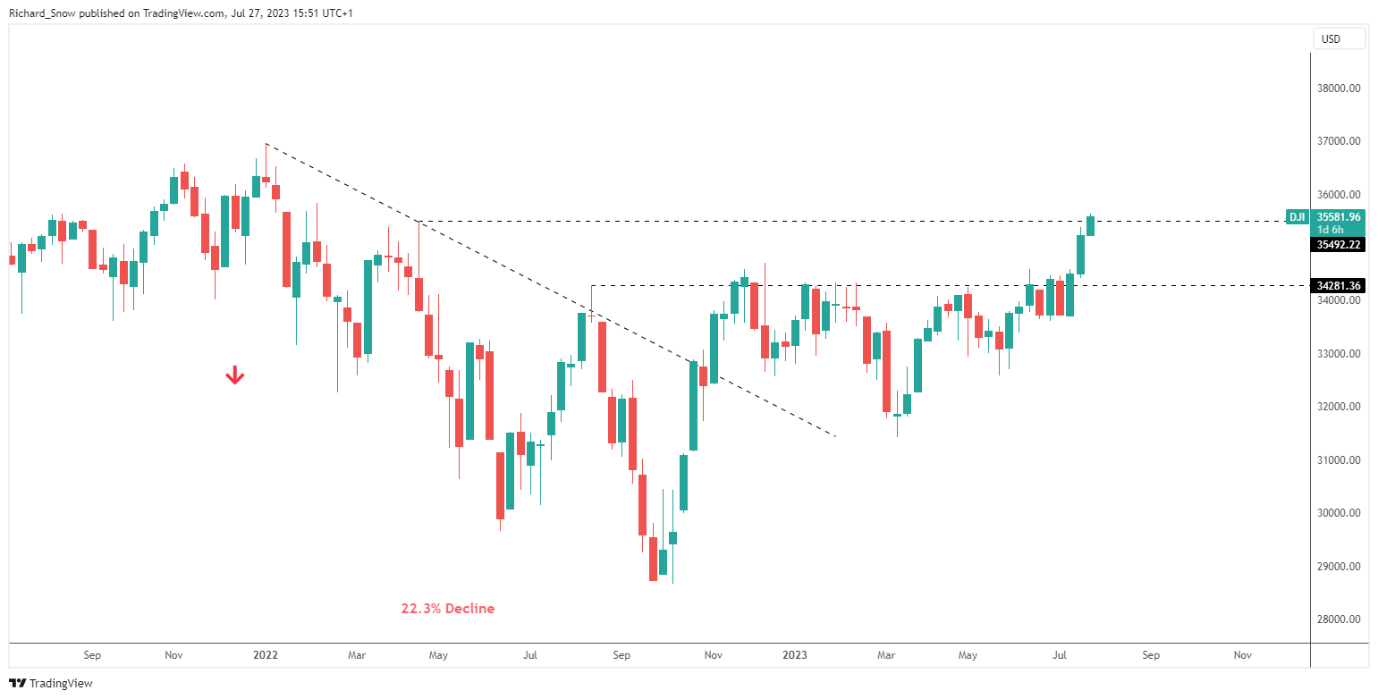

Dow Jones Industrial Average Hints at a Shift into Value Stocks

The Dow is on track to achieve three weeks of a notable advance. What has been the laggard of the three main US indices – with the other two being the S&P 500 and Nasdaq 100 – is now rising the fastest on a relative basis.

Traders and investors that view the red hot tech run as overdone may be signaling such a view by pivoting away from big tech and into the more value driven Dow Jones.

Dow (DJI E-Mini Futures) Weekly Chart

Source: TradingView, prepared by Richard Snow

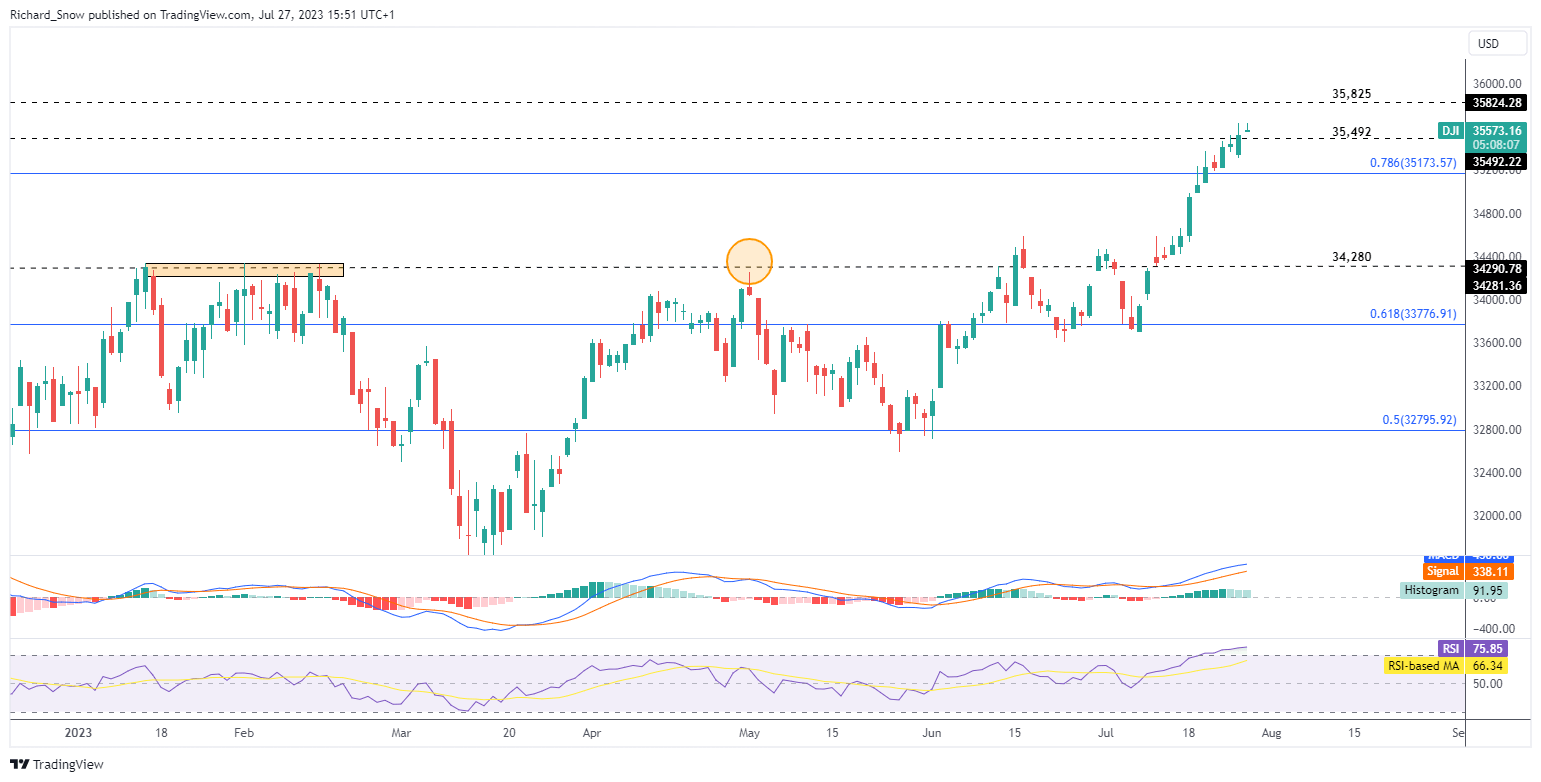

The daily chart helps put the recent move into perspective at a time when the S&P 500 and Nasdaq appear to be rising less quickly or even showing sighs of potential bullish fatigue. It is interesting to note however, that due to the Dows consistent advance, it now trades at extended (overbought) levels. 35,825 is the next level of resistance ahead of the all-time-high of 39,592. Support rests at the 76.8% Fibonacci retracement of the 2022 major decline.

Wall Street (Dow) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

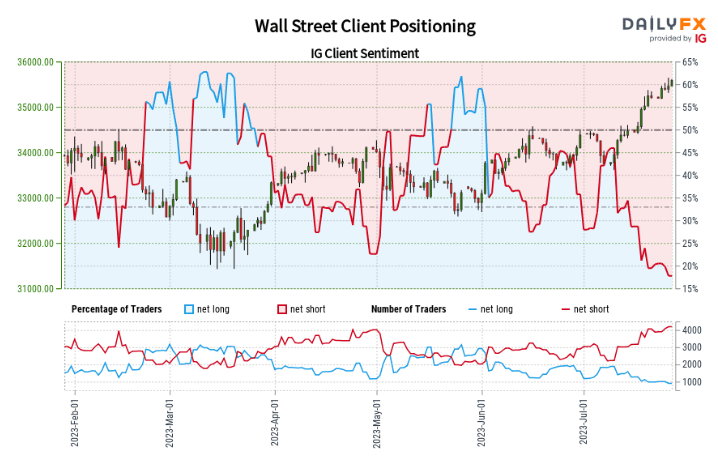

Divergence between shorts and longs in the Dow reach extreme levels.

IG Retail Client Sentiment (Dow)

Source: IG, prepared by Richard Snow

Wall Street:Retail trader data shows 20.26% of traders are net-long with the ratio of traders short to long at 3.94 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Wall Street prices may continue to rise.

The number of traders net-long is 0.66% lower than yesterday and 13.60% lower from last week, while the number of traders net-short is 0.61% higher than yesterday and 13.64% higher from last week.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bullish contrarian trading outlook.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX