With years of historical data, we can observe patterns from past bull cycles and are increasingly able to make predictions about our current cycle. In this analysis, we take a deep dive into when Bitcoin’s next peak might occur and at what price level.

Pi cycle

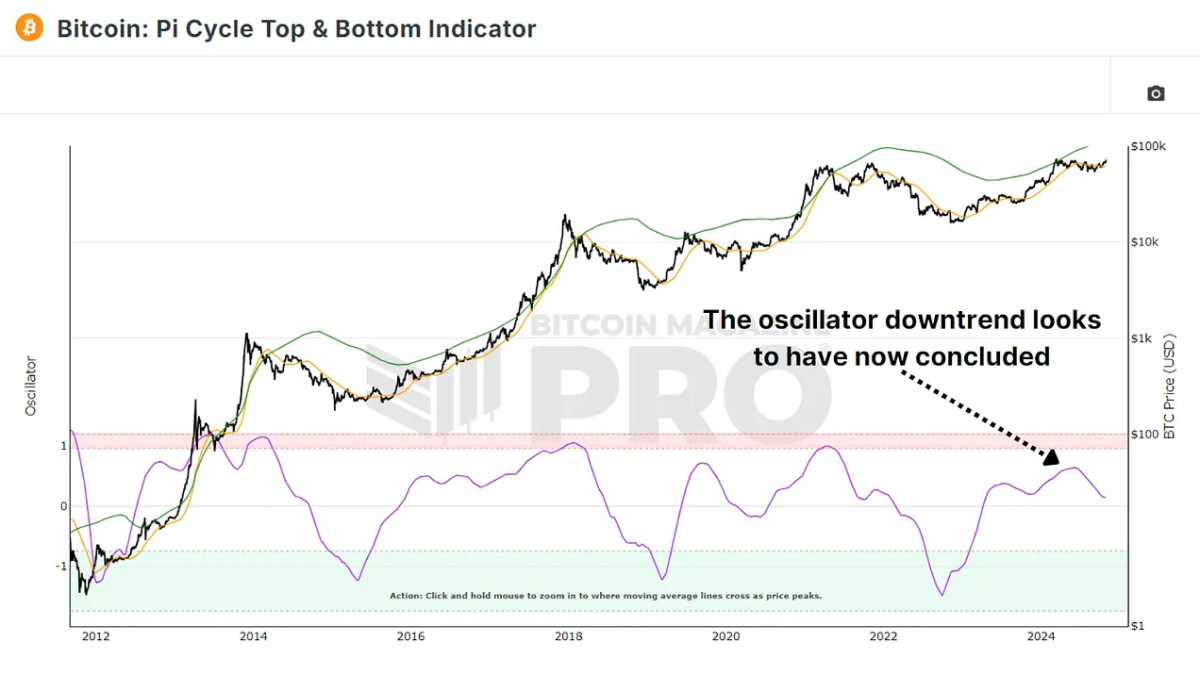

Pi cycle top indicator It is one of our most popular tools for analyzing Bitcoin cycles. This indicator monitors the 111-day and 350-day moving averages (multiplied by 2), and when these two lines intersect, it has historically been a reliable sign that Bitcoin has reached the peak of the cycle, usually in just a few days. After several months of these two levels diverging due to sideways price action, we are just starting to see the 111 day trend moving back up to start closing the gap.

We can measure the difference between the two averages to better determine Bitcoin’s position during up and down cycles using Pi Cycle upper and lower indicator. This upward oscillator once again indicates that the next uptrend for Bitcoin could be just around the corner, with similarities to previous cycles seen in 2016 and 2020.

Previous Bitcoin Courses

Historically, Bitcoin bull cycles show similar phases: initial rapid growth, a cooling off period, a second peak, and finally, a major bounce followed by a new high.

2016 cycle: This cycle saw a first peak, then a decline, then a second peak, then a full-blown bull market. It’s very similar to the trend we’re currently seeing. Bitcoin price reached new highs after these two declines.

2020-2021 cycle: The pattern was slightly less clear, but a similar trajectory was observed. Bitcoin price peaked twice, once during the initial rally and again at the peak of the uptrend where BTC was hitting all-time highs.

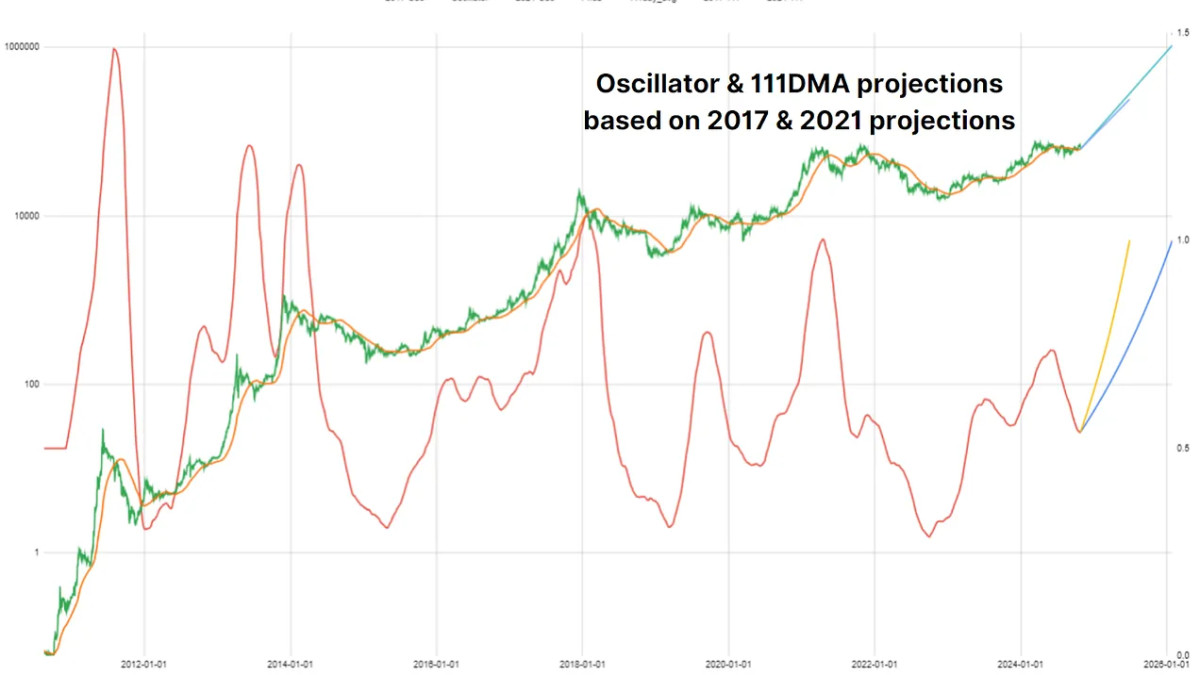

Using Bitcoin Magazine Pro API, we can simulate different growth scenarios based on past cycles. Since the upper and lower oscillators of the Pi cycle have recently turned upward, we can overlay the rate of change in the oscillator from previous cycles to see the likely path of this cycle.

If the 2021 cycle repeats, the 111-day and 350-day moving averages may intersect around June 29, 2025, indicating a potential peak for Bitcoin. If the 2017 cycle reverses, the moving averages may not cross until January 28, 2026, indicating a later peak.

Price forecasts

Using these dates, we can also try to estimate potential price levels. Historically, Bitcoin price has significantly surpassed the moving averages at its peak. During the 2017 bull run, Bitcoin’s price was three times the value of these moving averages at the peak. However, as the market has matured, we have seen diminishing returns with each cycle, which means that Bitcoin’s price may not rise as dramatically relative to its moving averages as it has historically.

If Bitcoin follows a similar pattern to the 2021 cycle, with an increase of about 40% above its moving averages, this would put Bitcoin’s peak at around $339,000. Assuming diminishing returns, Bitcoin’s price may rise only about 20% above the moving averages. In this case, the peak price will be closer to $200,000 by mid-2025.

Likewise, if the 2017 extended cycle is repeated with diminishing returns, Bitcoin could peak at $466,000 in early 2026, while a more moderate increase could lead to a peak price of around $388,000. Although Bitcoin is unlikely to reach $1 million this cycle, these more moderate forecasts could still represent significant gains.

conclusion

While these forecasts use established data, they are not guarantees. Each cycle has its own unique dynamics that are influenced by economic conditions, investor sentiment, and regulatory changes. Returns are likely to decrease and cycles may lengthen, reflecting the maturity of the Bitcoin market.

As Bitcoin’s bull cycle continues to evolve, these predictive tools can provide increasingly accurate insights, especially as data evolves. However, an analysis like this provides potential outcomes to help manage your risks and prepare for each outcome.

For a more in-depth look at this topic, watch a recent YouTube video here: Mathematically predicting Bitcoin’s all-time high

Comments are closed, but trackbacks and pingbacks are open.