AUD/USD trading points analysis

- The previous RBA decision was a coin toss that likely signaled a pause in the July meeting.

- US data and the Fed speak in the spotlight later today.

- A potential golden cross on the horizon?

Recommended by Warren Vinkitas

Get your free AUD forecast

Australian dollar basic background

The Australian dollar is offered this morning against the US dollar although the greenback is still relatively flat according to the DXY indicator. The sell-off initially stemmed from concerns over the Chinese economy as the People’s Bank of China (PBoC) cut key interest rates for the 1-year and 5-year loan only. 10 bits per second respectively (see economic calendar below). In an effort to stimulate economic growth, we may see more interest rate cuts in the future and with lower inflation in China compared to other major global economies, there is not much constraint to continue easing monetary policy. Being a major trading partner with China, the bleak outlook will hamper commodity exports from Australia, negatively impacting the Australian dollar.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Economic calendar for AUD/USD (GMT +02:00)

source: DailyFX Economic Calendar

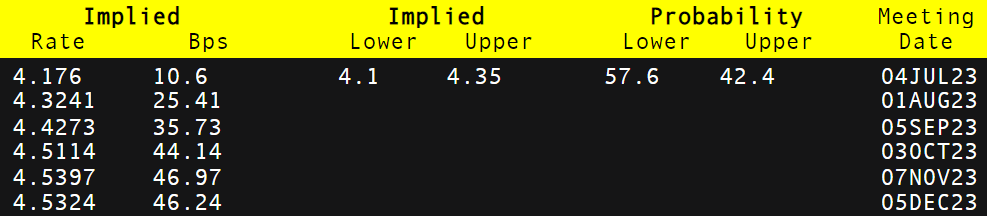

This was followed by the RBA’s meeting minutes highlighting the reluctance in the recent meeting to raise interest rates but with the sudden hike, the July outlook leans slightly towards a rate halt as shown in the table below – following the Fed’s direction. Inputs of economic data will be of paramount importance in the lead-up to the meeting as reliance on data becomes more important for the RBA.

Later in the day, the focus shifted to the Federal Reserve’s speech as well as the US Building Permits data. Recent releases have been lower, but estimates point to a marginal rally that could be a net positive for the dollar.

Probabilities of the RBA overlap rate

Source: Refinitiv

Technical Analysis

Introduction to technical analysis

Moving averages

Recommended by Warren Vinkitas

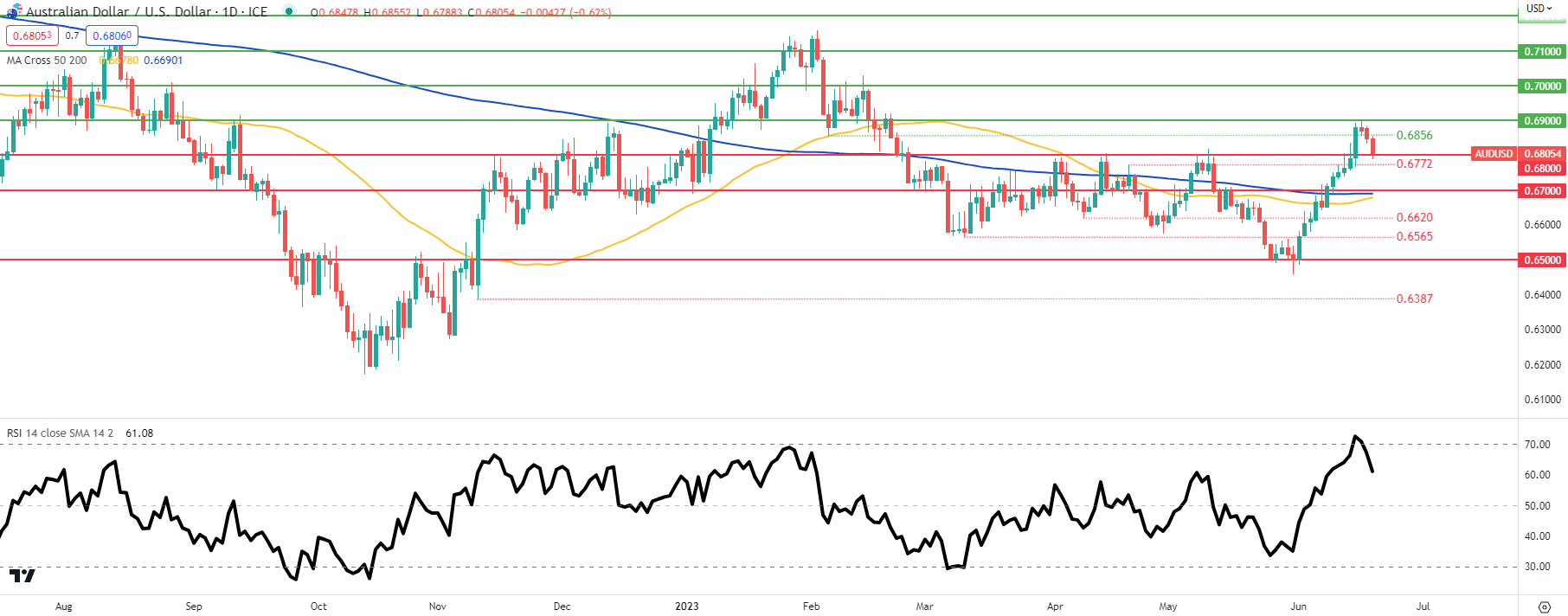

AUD/USD daily chart

Infographic by Warren Venketas, IG

AUD/USD daily price action is now marginally higher 0.6800 The psychological level after sliding lower briefly during the Asian trading session. Breaking out of overbought levels as measured by the Relative Strength Index (RSI) makes the move unsurprising from a technical analysis point of view and has the romance to move further. However, there could be potential for a bullish crossover known as the golden cross where the 50-day moving average (yellow) crosses above the 200-day moving average (blue). This could mean that the current bias to the downside may be short-lived in the medium term.

Key resistance levels:

Key support levels:

IG’s customer sentiment data: mixed

IGCS shows that retail traders are currently net traders Hort On AUD/USD, with 51% of traders who are currently holding short positions. At DailyFX, we usually take a contrarian view to the resulting crowd sentiment but due to the recent changes in long and short positions, we are reaching for a cautious short-term disposition.

Contact and follow Warrenon Twitter: @WVenketas