AUDUSD, Australia Monthly CPI – Talking Points:

- Australian dollars It fell sharply after Australia monthly CPI It came in well below expectations.

- RBA rate Upside expectations for July eased slightly after the data.

- What then Australian dollar / US dollar?

Recommended by Manish Grady

How to trade AUD/USD

The Australian dollar fell after the Australian monthly CPI showed that price pressures moderated more than expected last month which could reduce the need for aggressive rate hikes by the Reserve Bank of Australia (RBA).

Australia’s May CPI came in at 5.6% yoy, compared to expectations of 6.1%, down sharply from 6.8% in April. The odds of an RBA hike in July eased slightly after the data was released. The Reserve Bank of Australia unexpectedly raised interest rates by 25 basis points earlier this month and said further tightening may be required in its determination to return inflation to its target. Granted, the monthly CPI numbers have been quite volatile and often not a good indicator of the quarterly CPI, which holds more significance from an RBA perspective.

5-minute chart of the AUD/USD currency pair

Chart by Manish Gradi using TradingView

The main focus now is on Australian retail sales due on Thursday and US PCE data due on Friday. Retail sales in May are expected to have risen to 0.1% in the month. The higher-than-expected figure should boost resilience in global consumer spending even after a significant tightening in financial conditions. Data released on Tuesday showed US consumer confidence rose in June to the highest level in nearly a year and a half.

Core PCE price index in the US is expected to hold steady in May at 4.7% over the year, but is likely to decline slightly on a monthly basis to 0.3% from 0.4%. The headline personal consumption expenditures price index is expected to come in at 3.8% y/y compared to 4.4% in April. If the monthly data is in line with or below expectations, this could affect the US dollar, which rose slightly last week.

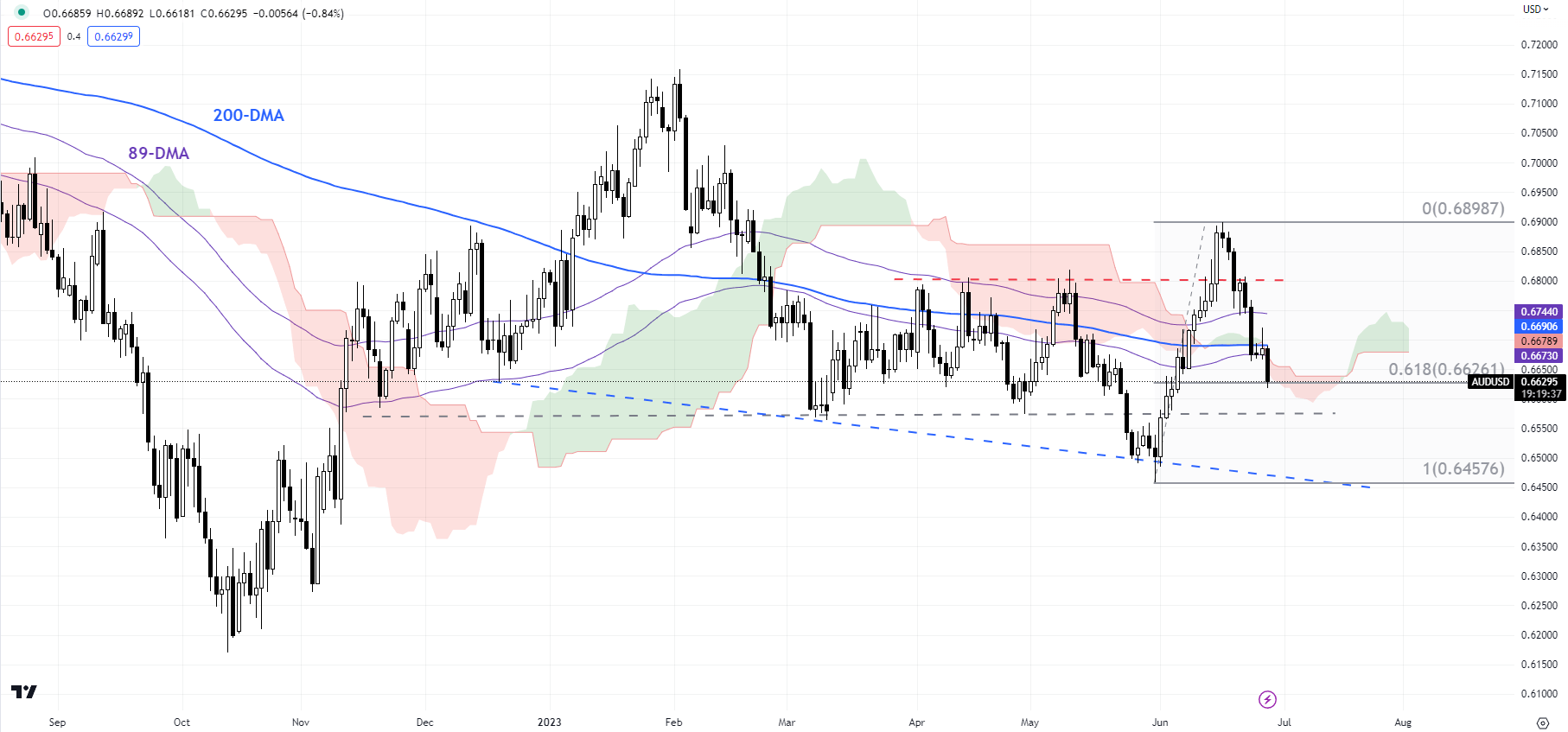

Daily chart of the Australian dollar / US dollar

Chart by Manish Gradi using TradingView

Meanwhile, US Federal Reserve Chairman Jerome Powell is scheduled to speak later Wednesday at the European Central Bank Forum, which may not differ much from his testimony last week. He will be joined by Bank of England Governor Andrew Bailey, European Central Bank President Christine Lagarde and Bank of Japan Governor Kazuo Ueda. Powell is likely to continue the hawkish rhetoric given stubbornly high inflation. At the same time, he can repeat his message from last week that prices may rise at a precise pace.

On the technical charts, AUD/USD is looking oversold as it tests a vital convergence cushion at the 89-day moving average and 0.6625 (61.8% retracement of the early-June rally), suggesting that Further downside may be limited. However, the pair would need to rise above the initial ceiling at 0.6720 Tuesday’s high for the immediate bearish pressure to fade. Next support is at 0.6550 March low.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish