Focus on the event:

Bank of Canada monetary policy statement

When will it be released:

April 12, Wednesday: 2:00 PM GMT, 3:00 PM London, 10:00 AM New York, 11:00 PM Tokyo

Consensus predictions:

The policy interest rate is likely to be kept at 4.50%.

Business and consumer surveys from the BoC point to an imminent economic slowdown, which will likely lead to a more dovish view from the BoC at the upcoming April meeting.

While recent inflation updates have eased, in general, expectations remain well above the target inflation range, making the possibility of near-term easing highly unlikely.

Canadian data since the last monetary policy statement:

| Bullish arguments for monetary tightening | Bearish arguments for more loose monetary policy |

|

Canadian GDP January 2023: +0.5% m/m to C$2.078 trillion vs. -0.1% m/m in December

Canadian CPI for February: 5.2% yoy vs. 5.9% yoy in January; +0.4% mom versus -0.5% mom expected/previous The BoC’s deliberations summary showed that members were concerned that inflation would remain above the 2% target and see another potential need to tighten monetary policy. Canadian retail sales for January rose 1.4% month-over-month to $66.4 billion; Core retail sales – excluding petrol stations, fuel suppliers and auto and parts dealers – rose 0.5% on a monthly basis Canada Employment Change in March: +34.7K (+10K forecast) vs. +21.8K prior; Unemployment rate at 5.0% |

S&P Global Canada Manufacturing PMI for March: 48.6 vs. 52.4 in February; The rate of inflation is declining

Canadian CPI for February: 5.2% yoy vs. 5.9% yoy in January; +0.4% mom versus -0.5% mom expected/previous Canada New Home Price Index for February: -0.2% m/m vs. -0.1% m/m expected (-0.2% m/m prior) Canadian Industrial Producer Price Index in February: -0.8%m/m vs +0.3%m/m in January; The raw material price index was -0.4% m/m versus -0.2% m/m in January |

Previous issues and the impact of the risk environment on the Canadian dollar

March 8, 2023

overlap bastard Pairs: 1 hour forex chart

Action / Results: the The Bank of Canada kept interest rates unchanged at 4.50% as widely expected but kept the door open for further hikes if needed. They stated that they expect their previous tightening moves to bring the CPI down to their 3% target by mid-2023. The Canadian dollar has headed lower all week, likely due to the BOC pause and due to the broad risk-off environment.

Risk Environment and Intermarket Behaviors: A broad environment to move away from risks due to negative global economic updates, Fed Chairman Powell’s hawkish remarks to fight inflation during congressional testimony. Weaker-than-expected US jobs numbers may also have played a role in the mood. The SVB collapse event accelerated the general trend for the week away from risky investments.

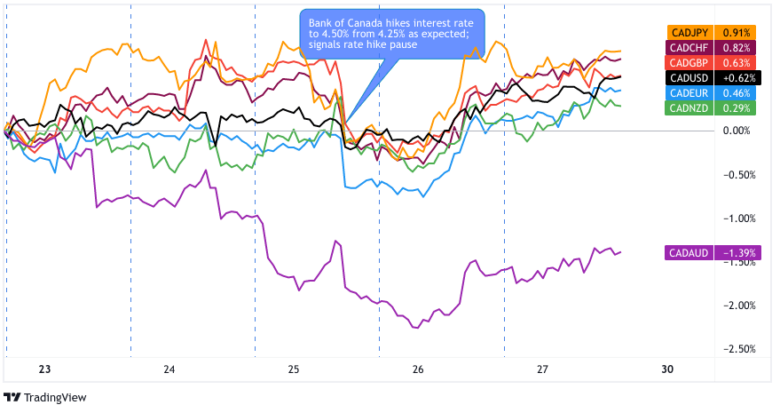

January 25, 2023:

overlap bastard Pairs: 1 hour forex chart

Action / Results: It was expected to raise the interest rate by 25 basis points to 4.50%. And with the BOC signaling a pause in raising interest rates to assess their effects on the economy, it was no surprise that the Loonie fell flat after the event. This decline was short-lived, as the Canadian dollar is likely to recover with the positive bias in global risk sentiment this week.

Risk Environment and Intermarket Behaviors: no Key risk sentiment drivers during this week in January. We saw choppy and mixed price action across the markets as traders faced the Fed’s interest rate and inflation expectations. On the net, risky assets are mostly trading in the green (excluding oil prices).

Oil was volatile but eventually fell during the week. It is likely to be affected by the latest round of PMI updates. Global PMIs were more optimistic than expected, but still contracted, indicating an economic slowdown ahead.

Possible price action this week:

Possibilities of feeling risky: Broad risk sentiment has recently turned positive with the odds increasing that we may be experiencing a peak inflation environment and aggressive force in terms of rate hikes.

But the US CPI could be a big X-factor for risk sentiment in general. It will be released 1 hour and 30 minutes before the BOC event, and could have a significant impact on the general risk sentiment during the rest of Wednesday’s session.

A lower reading in the pace of inflation could spark ‘risk sentiment’ as it supports the idea of the Fed aggressively delaying rate hikes, which could open the possibility of a fulcrum.

This may overshadow the BOC statement, especially if we get a significant divergence between the actual and forecast CPI numbers in the US.

Loonie scenarios:

Possible scenario 1:

BOC continues to hold back, but this time with a more pessimistic tone. And if market sentiment is broadly risk averse, it could attract CAD sellers in the short term if not priced in in advance.

In this scenario, we are likely to witness a mixed performance of the Canadian dollar against the major currencies, but a lower net decline in general is likely, especially if the risk environment is very negative and/or oil trends are down during the week.

The odds of this scenario rise if the release of the US CPI comes out higher than expected, which increases the odds of central banks keeping interest rates high, potentially shifting risk sentiment negatively.

Watch CAD/JPY, CAD/CHF and GBP/CAD for possible short-term CAD setups in this scenario, especially if oil prices are trending lower.

Possible scenario 2:

BOC continues to hold back, and on a more pessimistic note this time around. Broad risk sentiment is skewed positive, which could show if US CPI comes out cooler than expected, supporting a pause in the Fed’s tightening behavior, and possibly even pivoting policy if economic data worsens.

CAD/JPY, CAD/CHF and USD/CAD would be the pairs to watch for long-term CAD setups in this scenario, especially if oil is heading higher with the new bullish oil catalyst.

The Canadian dollar’s bullish gains may be limited, depending on how hawkish the Bank of Canada (BOC) was during its statement.

Comments are closed.