US Dollar, DXY Index – Forecast:

- The Fed kept interest rates unchanged, but predicted two more rate hikes in 2023 and no rate cuts until 2025.

- However, the market is pricing in another one high rate This year and cut interest rates as soon as next year.

- What does this mean for U.S. dollar?

Recommended by Manish Grady

Traits of successful traders

The US Dollar Index (DXY Index) has fallen below a key support level indicating that the market appears to be at odds with the US Federal Reserve’s hawkish stance.

The Fed held interest rates steady at its meeting last week, but delivered an unexpectedly hawkish surprise by projecting two more rate hikes in 2023 given the disappointingly slow decline in inflation. The economy’s resilience in the face of tightening financial conditions, a higher US debt ceiling, and reduced risks from banking sector stresses may also have contributed to the tightening guidance.

While the Fed’s point chart suggests two more rate hikes through the end of the year, the market is pricing in less than a 100% chance of one rate hike this year, with rate cuts starting as soon as next year. In contrast, Fed Chair Powell said he doesn’t see a rate cut until inflation drops significantly and meaningfully, which could take two years.

US Dollar Index (DXY) Daily Chart

Chart by Manish Gradi using TradingView; Notes at the bottom of the page

The market’s pessimistic pricing appears to be based on the perception that the Fed’s inflation expectations have lagged behind achieved inflation, and that producer and import price inflation are already pointing to weak activity. Federal Reserve officials have raised their economic growth forecasts for 2023 and see a slower decline in inflation. The core personal consumption expenditures price index is expected to ease from the current 4.7% to 3.9% by the end of 2023, compared to 3.6% year-on-year in March.

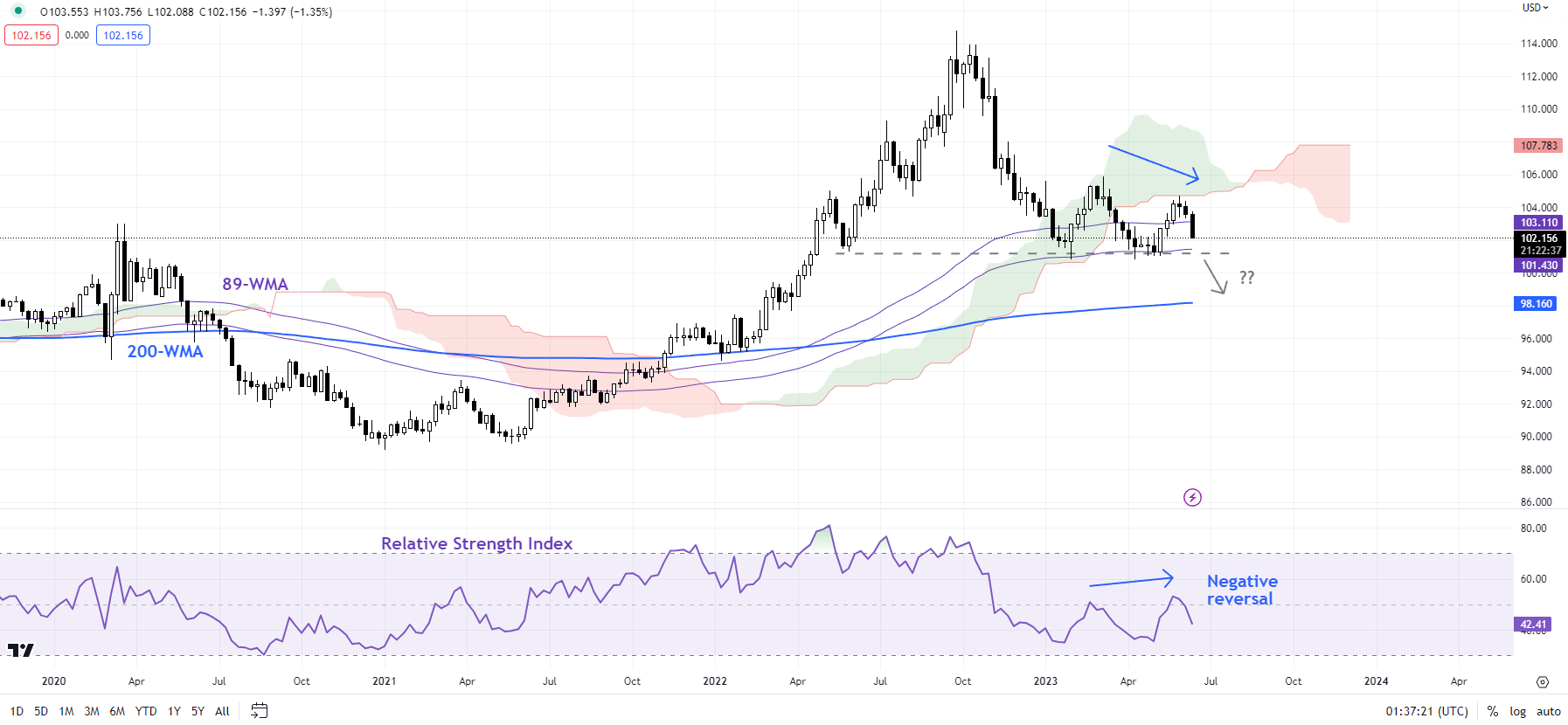

DXY Weekly Chart

Chart by Manish Gradi using TradingView

On the technical charts, the DXY fell below vital support at the early June low of 103.40 confirming that the upward pressure over the month has faded. The index appears to be heading towards the April low of 100.80.

From a trend perspective, the US dollar has been in a downtrend since the beginning of 2023, as the daily charts color-coded based on trend/momentum indicators show. This is further reinforced by a sequence of lower highs and lows from late 2022. Below 100.80 we see next support on the 200-week moving average (now at around 98.20). Unless the index can rise above a severe hurdle at the March high of 105.90, the path of least resistance remains sideways to the downside for the greenback.

Note: The above color-coded chart(s) are (are) based on trend/momentum indicators to reduce subjective biases in trend identification. It is an attempt to separate the bullish and bearish phases, and consolidate within a trend-versus-trend reversal. The blue candles represent a bullish stage. Red candles represent a bearish phase. Gray candlesticks act as consolidation phases (during a bullish or bearish phase), but they sometimes tend to form at the end of a trend. Candle colors are not predictive – they only indicate the current trend. In fact, the color of the candle can change in the next bar. False patterns can occur around the 200-period moving average, around support/resistance and/or in a sideways/volatile market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish