Bitcoin (BTC), Ethereum (ETH) Prices, Charts, and Analysis:

- Talk of an imminent BlackRock Bitcoin ETF turns markets higher.

- BTC and ETH remain in multi-week ranges.

The Bitcoin rumor mill was back in full flow yesterday after various tweets and stories suggested that the BlackRock spot Bitcoin ETF had already been agreed and would be announced shortly. Due to BlackRock’s market heft and reach, the announcement in mid-June that the fund manager had submitted a proposal for a BTC ETF caused the market to push sharply higher. Since then the price of Bitcoin has moved lower, erasing all BlackRock gains, as markets realized that it may be many months until the SEC gives a ruling, one way or another.

Also this week, ARK Invest and 21Shares put in a proposal for the first spot Ethereum ETF, causing interest in the second-largest cryptocurrency to grow. ARK’s proposal would allow a wider range of investors to participate in an exchange-traded fund that tracks the underlying cash Ethereum market.

As with all cryptocurrency tweets and stories, market rumors, especially in a quiet market, should be taken with a pinch of salt and not used as a reason to trade.

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

Despite yesterday’s move higher, Bitcoin remains trapped in a short-term range between $25.2k and $26.6k with the only move outside this range over the recent weeks caused by the BlackRock announcement. Bitcoin is neither overbought nor oversold, according to the CCI indicator, while volatility remains low, especially by historical standards. The 50- and 200-day simple moving averages continue to weigh on the price of Bitcoin, and unless there is some confirmed ETF news, one way or another, Bitcoin may remain trapped in the above range in the short term.

Bitcoin (BTC/USD) Daily Price Chart – September 8, 2023

Recommended by Nick Cawley

Traits of Successful Traders

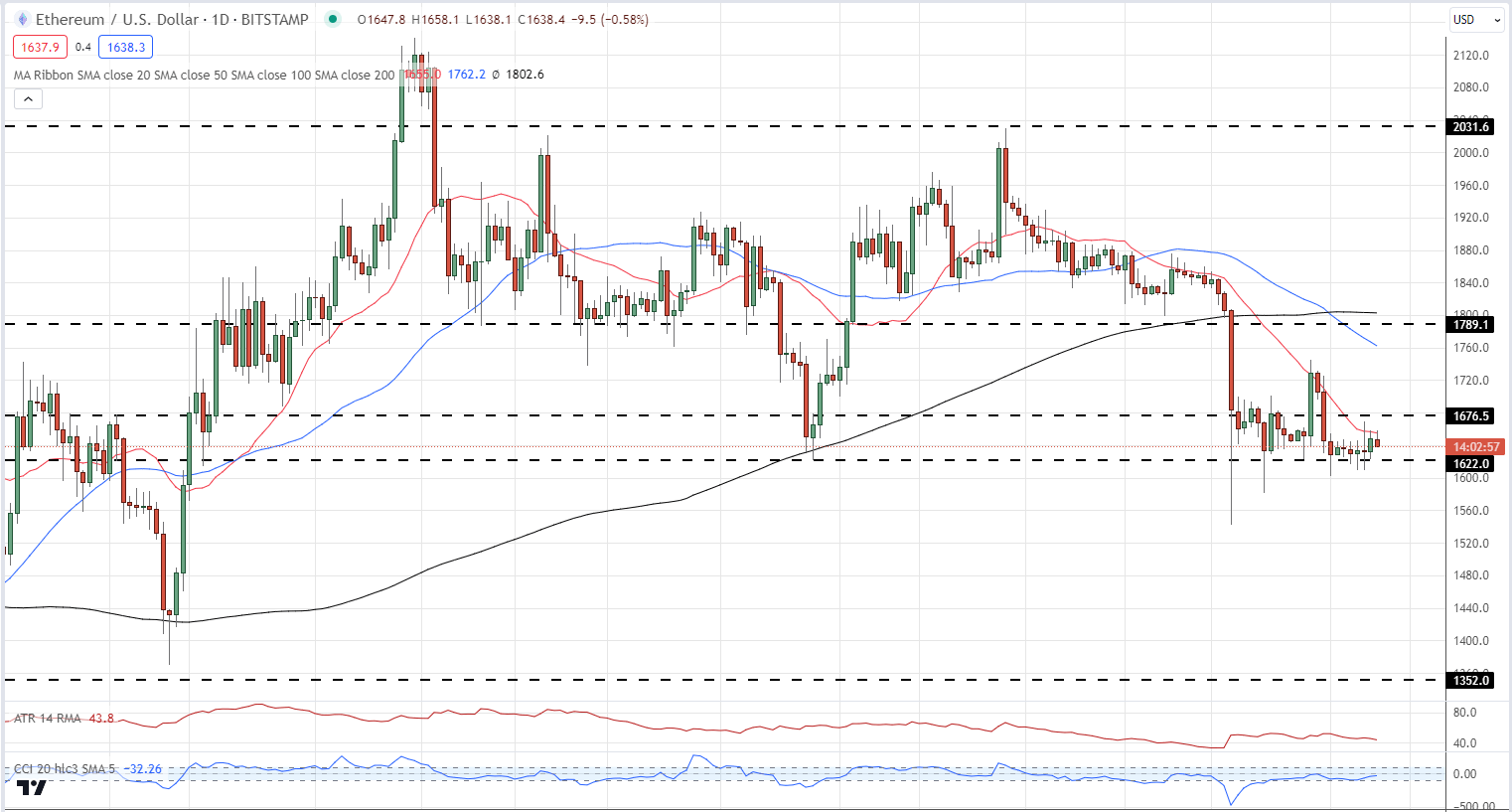

Ethereum is also stuck in a range, aside from a handful of spike lows, and is looking likely to test support again. Again, all three moving averages are weighing on ETH with the 20-day sma in particular curtailing any possibility of a further move higher. Sideways trade with a downside bias looks likely for Ethereum in the coming days.

Ethereum (ETH/USD) Daily Price Chart – September 8, 2023

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Charts by TradingView

What is your view on Bitcoin and Ethereum – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.