This article is also available in Spanish.

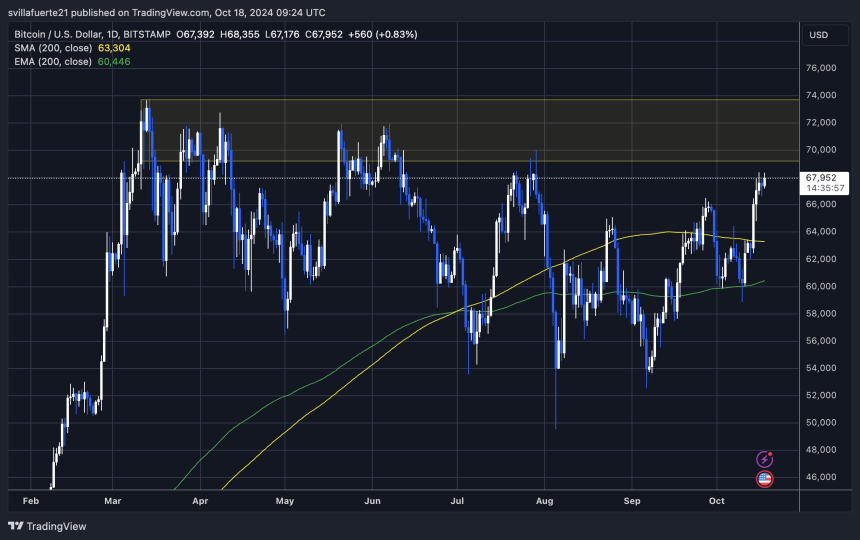

Bitcoin is at a pivotal moment after it crossed the $68,000 level and set a new local high, confirming its uptrend.

Analysts and investors are closely monitoring the next steps, looking for signs of a continued rally or a potential bounce from high supply levels. While excitement is palpable, there is caution as traders brace for potential resistance.

Related reading

Senior Analyst Dan shared a technical analysis highlighting that Bitcoin has exited the accumulation channel, suppressing the price. According to Dan, this break above the $68,000 resistance level indicates the potential for further upside as Bitcoin moves into uncharted territory.

The next few days will determine whether Bitcoin is able to maintain its momentum or will face a healthy pullback from these higher levels. As euphoria collides with fear of a correction, investors are keen to see if Bitcoin can continue its upward trajectory or if the market will see a pause in its rise.

Bitcoin Hack: The Next New ATH?

The cryptocurrency market is bullish, with Bitcoin and most altcoins rising from yearly lows to yearly highs in just a few weeks.

Analysts are now speculating that this could be the start of something big, a rally that could push prices to new highs and deliver huge gains for investors. Despite the excitement, there is also a lingering fear of an impending correction.

Historically, Bitcoin has struggled to maintain momentum above the supply near $70,000, often facing strong rejection that leads to sharp declines.

However, senior cryptocurrency analyst and investor Daan recently Share technical analysis on XExplaining why this latest breakthrough is different. According to Dan, Bitcoin has finally broken out of the seven-month accumulation pattern that kept prices low, indicating a major shift in market dynamics.

Furthermore, BTC managed to break above the 200 daily moving average (MA) and the exponential moving average (EMA), key technical indicators that had previously caused resistance since the summer.

Related reading

With the short to medium time frame trend rising strongly, Dan believes this bullish outlook may indicate that Bitcoin could avoid another rejection near $70,000. Alternatively, Bitcoin may be poised for a strong rally, as investors eye all-time highs in the coming weeks.

Bitcoin technical analysis

Since Monday, Bitcoin has tested an important supply zone after a strong 9% rally. The price is trading well above the 200 daily moving average (MA) and the exponential moving average (EMA), indicating strength and maintaining upward momentum with no immediate signs of a pullback.

This suggests that buyers are still in control for the time being, with a potential push to break the psychological level of $70,000.

However, there is still a risk that Bitcoin will fail to break and hold the $70,000 level, which is crucial for the bulls to maintain bullish momentum. Rejection at this level may indicate a shift in market sentiment, which could lead to profit taking and consolidation.

Historically, moments of euphoria in the market often end in a frustrating move that cools the excitement, and a healthy pullback is possible.

Related reading

If BTC experiences a pullback, it will likely find strong support at the daily 200 MA near $63,304. This level has served as a leading indicator of support in previous uptrends. It can provide a solid foundation for the next move higher if the price corrects before resuming its upward trajectory.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.