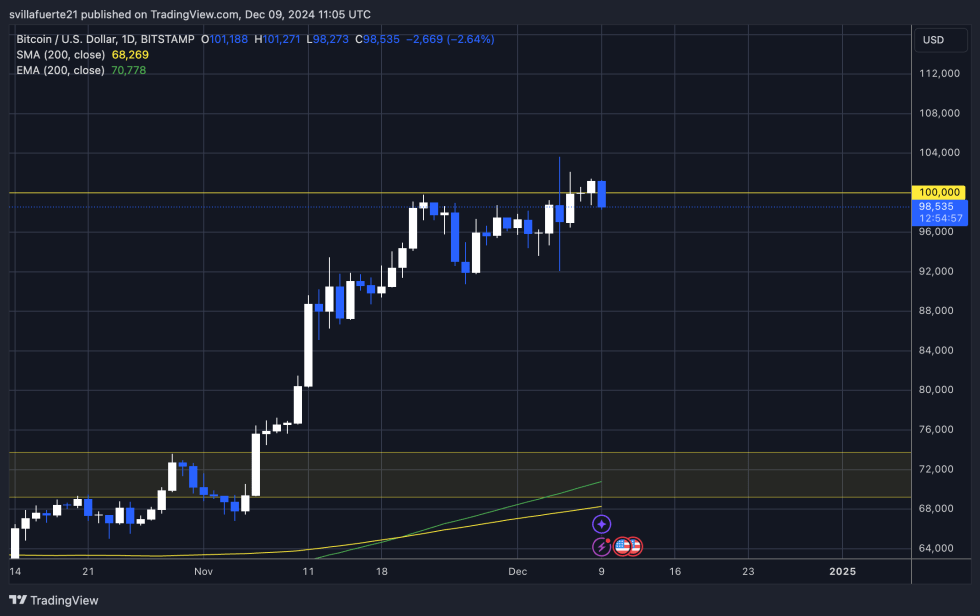

Bitcoin saw a whirlwind of volatility over the weekend, hitting the $100,000 mark and a new all-time high of $103,600. Despite this achievement, the price is still struggling to maintain levels above $100,000, raising questions about the strength of the current rally.

CryptoQuant metrics reveal an important trend among long-term holders (LTH), who are actively taking profits. The average purchase price for these owners is $23.4K, generating an impressive 326% gain on their investment. While this behavior reflects confidence in locking in profits at higher levels, it can also indicate caution, as such sell-offs have historically slowed momentum during an uptrend.

This sell-off may raise concerns among investors hoping for continued upward momentum. Some fear it could create resistance that hinders Bitcoin’s ability to sustain its rise beyond the $100,000 threshold. At the same time, it highlights the calculated strategies of experienced market participants, balancing optimism and wisdom.

The coming days will be pivotal as BTC navigates this critical juncture. Whether BTC regains its footing above $100k or succumbs to pressure, it will shape broader market sentiment and determine the next phase of the historic bull cycle.

Demand remains strong

Bitcoin is displaying impressive demand, with the price only seeing a 10% decline in the past month after breaking the important $100,000 level. This shows that the momentum driving Bitcoin’s rise remains strong, and it is only a matter of time before the cryptocurrency continues its push to new highs.

Analyst Axel Adler recently shared metrics Which supports the continued upward trend. One key observation is that long term holders (LTH) are actively selling the coins, making significant profits. The average purchase price for these owners is $23.4k, and with current prices, they are making a staggering 326% gain. As these LTHs sell their holdings, new investors step in to absorb the supply, keeping demand high.

This dynamic highlights a crucial point: the ongoing supply of LTHs is likely to increase as their profits grow. With such a large percentage of profits, more LTH devices will continue to be sold, which will fuel more market activity. However, this does not indicate a downtrend, as new investors are quickly absorbing the supply, and the overall demand for Bitcoin is unwavering.

Given these factors, it appears that Bitcoin’s bull run has only just begun. As LTHs continue to be sold off and more new capital enters the market, the stage is set for Bitcoin to surpass current levels and possibly set all-time highs. Continued demand, coupled with profit-taking behavior by long-term shareholders, indicates that the market is entering a period of sustained growth.

Bitcoin Struggles Above $100K

Bitcoin is currently trading at $98,500 after failing to break and hold above the $100,000 level three times in less than a week. The repeated struggle to keep the price above this key psychological level has raised concerns as BTC faces increasing volatility.

This can be attributed to whales taking profits after significant gains, given the massive rise from the $60,000 range. However, if demand continues to move forward and more buyers enter the market, Bitcoin could finally establish a strong foothold above $100,000.

The market reaction at this crucial level is a clear indication of the ongoing market dynamics. If buying pressure remains strong, Bitcoin could see a sustained rally above $100,000, with a possible consolidation phase above this mark. This may indicate that the Bitcoin uptrend is not over yet and that the market is still in an upward cycle.

Traders and investors will be watching price movements closely in the coming days to gauge whether the $100,000 resistance will turn into a support level, paving the way for further gains. Ultimately, continued demand from retail and institutional investors alike could fuel Bitcoin’s next phase, confirming its long-term bullish momentum.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.