On-chain data on May 7 shows that bitcoin (BTC) miners’ profitability is on the rise.

Bitcoin miner profitability has doubled

BitInfoCharts reveal That for every TH/s of hash rate, which is the computing power that is funneled into the Bitcoin network, a miner earns $0.0988 per day.

The sharp rise in miner profitability means that equipment operators are generating revenue at the fastest pace in three months. It should also be noted that the average miner’s profitability has doubled in the past three months at spot rates. As of March 12th, it is at $0.0589 but continues to rise.

A miner’s profitability is usually highly dependent on network activity, the spot BTC price, and the ease of block confirmation.

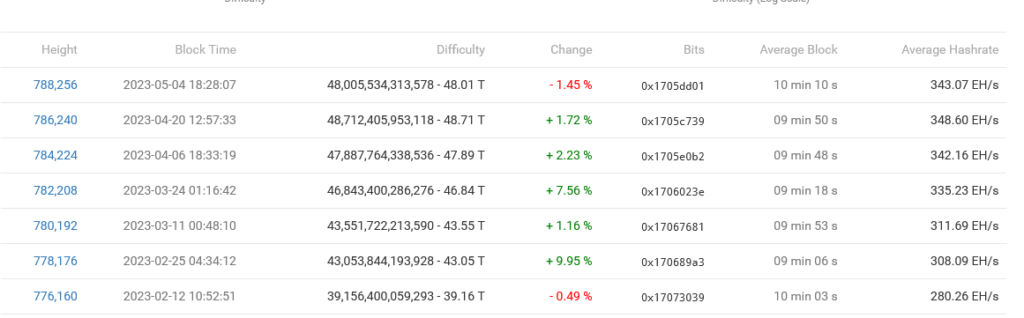

The ease of confirming a bitcoin block is measured by the prevailing difficulty levels. This metric shows how easy or difficult it is for miners to confirm and add a block of transactions to the longest chain for 6.25 BTC and block fee rewards.

On May 4, it Projection From record highs of 1.45% to 48.01T after five consecutive positive revisions from late February 2023.

Network congestion, bitcoin price soaring

So far, the Bitcoin network, based on the number of transactions posted on-chain, is at a multi-year high. As of writing on May 7, there are more than 400,000 transactions pending on the Bitcoin memory pool, otherwise known as the Mempool.

Mempool is where unconfirmed but valid transactions are “parked” before they are confirmed and added to the block.

However, how quickly the transaction is confirmed depends on whether the sender marks enough fees to incentivize the miner to confirm and add to the next block.

Thus, the staked fee is a factor that determines how quickly a BTC transaction can be mined and transmitted across the network. In general, the average block time is 10 minutes. This is encoded at the protocol level and directly affects the scalability of Bitcoin.

(embed) https://www.youtube.com/watch?v=UpZTdJDQF0I (/embed)

The mining company’s high profitability also coincides with relatively high prices. Since it fell to $0.0589 on March 12, the price has been steadily rising, peaking at $31,000 in April before easing back to spot levels. However, this is relatively higher than it was on March 12, when the price fell below $20,000. Since then, BTC has risen by 45%, reaching spot levels.

Comments are closed.