Bitcoin is currently in a period of consolidation and disbelief after weeks of violent volatility and uncertainty. This period is followed by a series of corrections and weak consolidations, which often precede significant market movements.

Historically, Bitcoin price action tends to build momentum during such phases, paving the way for potential explosive growth.

Prominent cryptocurrency analyst and investor TechDev has shared an interesting analysis comparing Bitcoin’s current cycle to the historical performance of the Nasdaq. According to TechDev, the similarities between Bitcoin and the Nasdaq suggest that the cryptocurrency market could be poised for an exciting upward trajectory.

As investors watch these patterns closely, anticipation for the next big move in Bitcoin’s price is growing. The coming weeks could be crucial in determining whether this consolidation phase leads to another strong rally.

Bitcoin vs Nasdaq: Is a Macro Phase Imminent?

The Bitcoin market is currently in a state of extreme uncertainty, despite Federal Reserve Chairman Jerome Powell’s announcement last Friday, indicating a potential shift in policy with an expected interest rate cut in September.

Although this news initially sparked optimism, the broader market remains concerned, reflecting the complex dynamics at play in this area.

However, amidst this uncertainty, some investors and analysts maintain a positive long-term outlook for Bitcoin. Among these analysts is TechDev, which recently provided an analysis of Interesting analysis Comparing the current monthly chart of Bitcoin with a two-month chart of the Nasdaq from 2014. At that time, the Nasdaq was trading at around $12 before embarking on a massive macroeconomic rally that eventually reached its current levels near $70.

TechDev’s analysis suggests that Bitcoin may be on the cusp of a similar macroeconomic rally, predicting a scenario in which Bitcoin could see a massive surge that mirrors the historic Nasdaq. This comparison is particularly compelling given the market structure and similarities between the two charts.

While immediate market sentiment is cautious, with many traders still wary of potential downside risks, the longer-term confluence indicated by TechDev analysis provides a more bullish outlook.

If Bitcoin follows a similar path to the Nasdaq, it could be poised for a major upward trajectory in the coming months, defying the current market uncertainty and paving the way for new all-time highs.

Bitcoin price movement

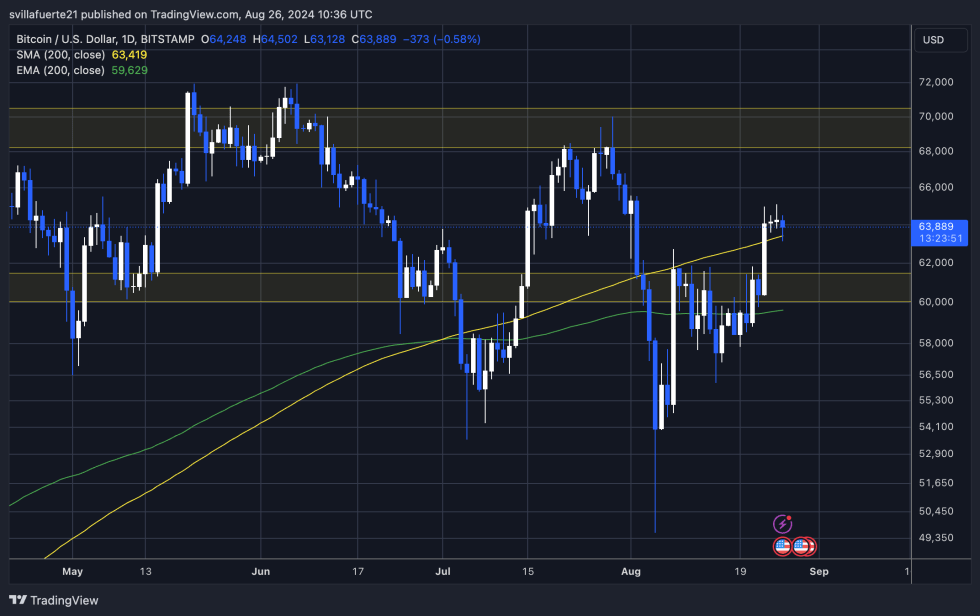

Bitcoin is trading at $63,800 at the time of writing, which is above its daily average of $200. Moving Average (MA)) at $63,420. This is an important development, as three consecutive daily candles have closed above this level, indicating bullish strength.

The 1D 200 moving average is a crucial indicator for determining trend continuation, and holding above it suggests that BTC may be ready to move towards higher levels.

However, the market is not without risks. There is still a possibility that Bitcoin price could test the low demand around the $61,300 level, which would maintain the overall bullish structure. Testing this level may be necessary to gain momentum for the next rally, but missing the 200-day moving average would be a concern.

A break below this crucial moving average could signal a weakening of the current uptrend and could signal a shift in market sentiment. Therefore, holding the 200-day moving average remains vital to maintain Bitcoin’s bullish outlook.

Cover image from Dall-E, chart from Tradingview

Comments are closed, but trackbacks and pingbacks are open.