Bitcoin rose 7.7% in the past 24 hours after Donald Trump won the US election. This victory sparked a positive market reaction, with Bitcoin surpassing all-time highs and reaching new price levels, sparking excitement among investors. Many are speculating that this may be just the beginning of a bigger rally.

Key data from CryptoQuant shows a sharp increase in US demand for Bitcoin, which is in line with market optimism. Trump’s win, coupled with the anticipation surrounding the Federal Reserve’s upcoming interest rate decision, adds further momentum to Bitcoin’s upside.

These factors are likely to drive more institutional and retail investors into the market, pushing demand higher.

As Bitcoin continues to trade in uncharted territory, all eyes are on how the market will react to these macroeconomic events. If BTC can maintain its upward trajectory, we may see more explosive growth in the coming days. However, with volatility expected to continue, market participants should remain cautious and monitor key developments closely.

Bitcoin rises with Trump’s victory

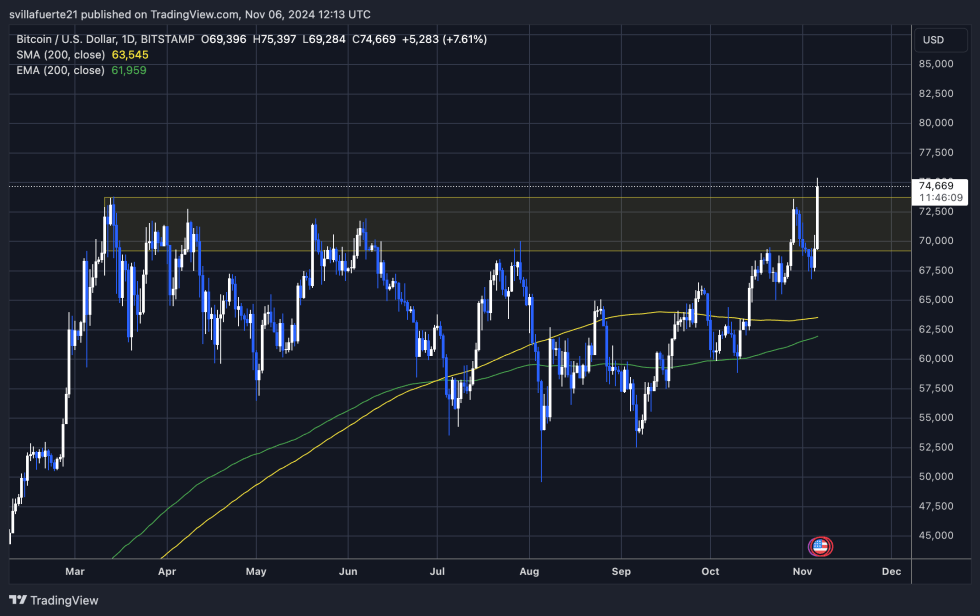

Bitcoin finally broke through its all-time high of $73,974, hitting a new peak at $75,400. The rally was driven by the excitement following Donald Trump’s US election victory, with many investors anticipating a pro-crypto agenda under his leadership. Trump’s outspoken support for cryptocurrencies has sparked renewed optimism in the market, sending Bitcoin prices soaring.

but, According to key data from CryptoQuantthe rise in the price of Bitcoin is not solely attributable to Trump’s victory. Their analysis highlights a positive rise in the Coinbase Premium Index, which is a strong indicator of rising demand for BTC at US Coinbase, the largest cryptocurrency exchange in the country, and plays an important role in gauging investor sentiment.

The rise in this indicator reflects the growing desire for Bitcoin by US investors, indicating a continuation of the upward trend.

As Bitcoin continues to consolidate near its recent highs, the next few days will be crucial in determining the next phase of the rally. A massive rally could follow if BTC can maintain its current momentum and break above the consolidation area, which could send the price higher.

With strong demand from US investors and positive market sentiment more broadly, Bitcoin’s bullish outlook remains intact. The excitement surrounding Trump’s victory and the continued rise in demand indicate that the market is poised for significant growth in the coming weeks.

BTC intervenes in price discovery

Bitcoin is trading at $74,600 after surpassing its all-time high of $73,974, which was set in March. This surge has pushed the price into uncharted territory, a phase that usually signals the beginning of a massive BTC rally.

However, to confirm the breakout and maintain bullish momentum, BTC must close above the previous all-time high, or at least above the $70,000 mark. A strong confirmation may indicate that the rally is not over yet and could pave the way for further gains.

Despite the positive momentum, the next few days are expected to be very volatile. Due to the unpredictable nature of the market, Bitcoin could see a pullback to lower demand levels around $69,300. This potential decline could be a jolt to highly leveraged trades and allow the market to recalibrate before rising.

Traders and investors will be watching the price action closely to determine if BTC can hold above key support levels in the coming days. The market’s reaction to volatility and continued investor demand will likely set the tone for the next phase of Bitcoin’s price movement.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.