Brent Crude Oil News and Analysis

- Fighting continues on multiple fronts as diplomatic efforts do little to calm tensions

- Brent crude oil edges higher ahead of the weekend

- IG client sentiment hints at continued bullish momentum as traders pile into shorts

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

Fighting Continues on Multiple Fronts as Diplomatic Efforts do Little to Calm Tensions

Recent visits from US President Joe Biden and UK Prime Minister Rishi Sunak have yielded mixed results. After a crucial meeting between Biden and leaders of Arab nations was cancelled earlier this week, discussions between the presidents of the US and Egypt resulted in an agreement to facilitate aid to Gaza via Egypt in a suitable manner. While a definite timeline could not be provided, a White House spokesman confirmed it would occur in the coming days. Iran has spoken out against potential plans of a ground offensive by Israel, warning that doing such could spark ‘pre-emptive action’.

Brent Crude Oil Edges Higher Ahead of the Weekend

Oil prices are on pace to achieve a second successive week of gains. Traders will be mindful of last Friday’s surge in prices as the market geared up for a potential ground offensive into northern Gaza.

While today’s price action has been calm in relation to one week ago, prices are still edging higher as tensions remain worrisome. Oil now approaches the September swing high around $95.90, with the psychological level of $100 not out of the question further down the line. The effect of the geopolitical conflict more than compensates for the effect rising US yields and a strong dollar typically have on global commodity markets. Support appears around the prior swing lows near $89.00.

Oil (Brent Crude) Daily Chart

Source: TradingView, prepared by Richard Snow

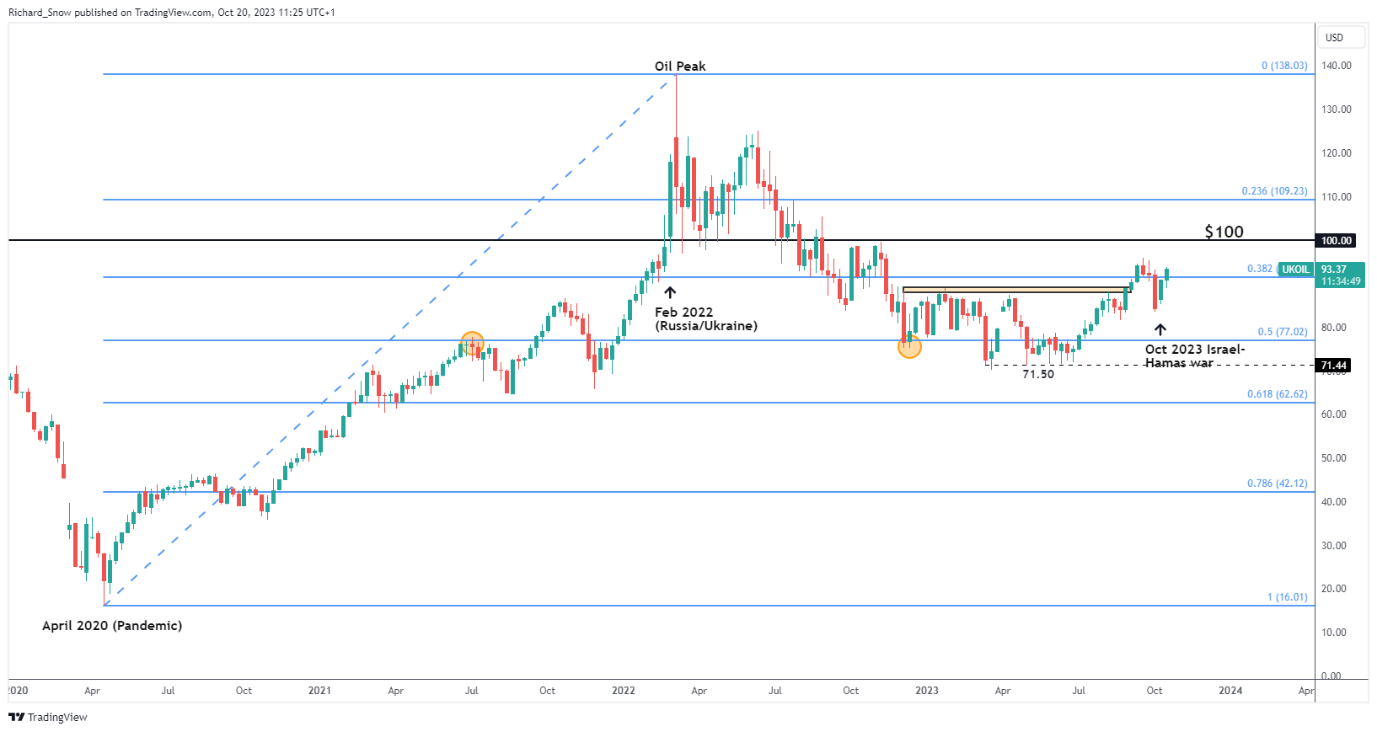

The weekly chart shows just how far oil prices can rally in the face of global crises and large-scale conflicts. The Russia-Ukraine war amplified the impressive recovery as the world reopened after forced lockdowns in response to the outbreak of Covid-19. Prices have broken above the 38.2% Fibonacci retracement of the broader Covid-inspired move from 2020 to 2022.

Oil (Brent Crude) Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

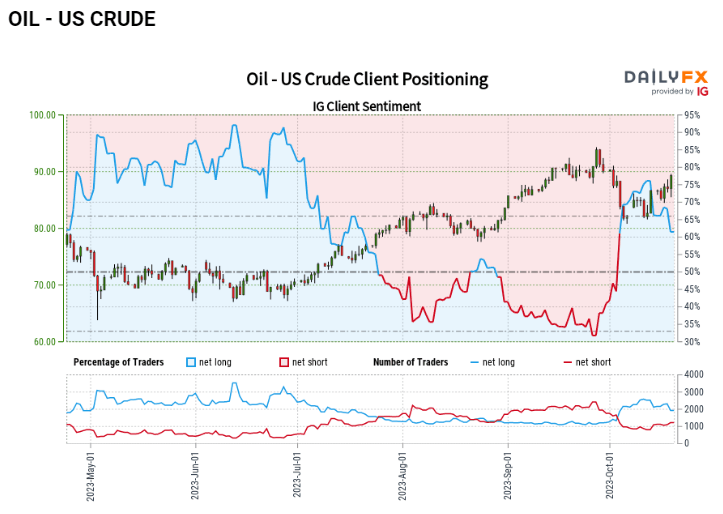

IG Client Sentiment Hints at Continued Bullish Momentum as Traders Pile into Shorts

Shorter-term accumulation of short positions in WTI oil, provides a contrarian bias via the IG client sentiment tool.

Oil- US Crude:Retail trader data shows 61.31% of traders are net-long with the ratio of traders long to short at 1.58 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil– US Crude prices may continue to fall.

The number of traders net-long is 14.65% lower than yesterday and 24.76% lower from last week, while the number of traders net-short is 13.46% higher than yesterday and 57.02% higher from last week.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil – US Crude price trend may soon reverse higher despite the fact traders remain net-long.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX