Tomorrow's headline number won't tell the whole story

Article content

All eyes will be on Canada's jobs numbers tomorrow for clues not only about how the economy is performing but also about what the Bank of Canada might do next.

Article content

Last month we got a surprise. An increase of 25,000 jobs was expected, but instead the economy lost 2,200 jobs and the unemployment rate rose to 6.1 percent, the highest level in more than two years.

In fact, outside of the pandemic, Canada's unemployment rate has not exceeded six per cent since 2017.

Advertisement 2

Article content

But jobs numbers are volatile and difficult to predict, so tomorrow's reading is very likely to rebound, economists say.

However, if we look beyond the headline number, there are reasons to believe that Canada's labor market is actually weaker than it appears, CIBC economist Andrew Grantham says in a recent note.

The first is the economy's dependence on public sector employment, which serves to mask weakness in the private sector. Government jobs contributed more than 60 percent of job growth over the past year, CIBC says. It estimates that if these jobs grew in line with population and affected workers did not find work elsewhere, Canada's unemployment rate would be 0.6 per cent higher.

Then there is the thorny question of counting non-permanent residents, who have seen their job prospects deteriorate further over the past year.

The number of non-permanent residents has risen by about 1.5 million since 2019, according to population estimates, but Statistics Canada's labor force survey tally indicates an increase of only 600,000.

“With unemployment rising among landless migrants who have been outnumbered far more than the rest of the population over the past year, it is possible that the unemployment rate would actually be higher if a larger proportion of this group were included in labor market data,” Grantham said.

Article content

Advertisement 3

Article content

CIBC estimates it will be 0.2 per cent higher. Although this may not seem like much, the difference has only occurred over the past nine months, which may indicate a weaker trend in the labor market than the headline numbers indicate, Grantham said.

The reason this is important is because CIBC suspects the Bank of Canada is using labor market data as a guide to assess slack in the economy.

“For this reason, understanding some of the idiosyncrasies of the labor market, and how, for example, the headline unemployment rate may not be a perfect guide to a recession in the economy, will be important in determining when and how quickly interest rates should rise. Get down,” Grantham said.

One thing we know the Bank of Canada will be monitoring is wage growth, which rose 5 per cent in March. However, RBC economists Nathan Janzen and Abi Shaw say other indicators suggest this too may be slowing.

Payroll employment numbers showed wage growth about two percentage points lower than the labor force survey, and the Bank of Canada's business survey suggests slower gains ahead.

Register here To get Posthaste straight to your inbox.

Advertisement 4

Article content

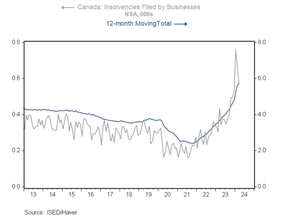

Don't be fooled by one month's data is the lesson learned from today's chart.

During the past year, the largest number was in accommodation and food services, which constituted 15.5 percent of the total. Construction accounted for 13 percent and retail 11 percent.

“All three reflect discretionary spending (e.g., lack of renovations hitting construction), which has been suffering amid rising interest rates,” Kaushik said.

- The Bank of Canada issues its assessment of risks to the financial system in its Financial System Review

- Update on 2024 wildfire season forecast for Ottawa, with Ministers of Natural Resources, Environment and Emergency Preparedness

- The Critical Minerals Conference in Vancouver explores the role of the critical metals and mining industry in the global energy transition and the financial and regulatory policies needed to support the growth of British Columbia's mining sector.

- Earnings: Canadian Tire Corp Ltd, Chartwell REIT, Baytex Energy Corp, MDA Ltd, Brookfield Corp, Quebcor Inc, iA Financial Corp Inc, Sun Life Financial Inc, ARC Resources Ltd, IAMGOLD Corp, Wheaton Precious Metals Corp, Pembina Pipelines Corp.

Advertisement 5

Article content

About a third of all S&P 500 stock trades are now executed in the last 10 minutes of the session, and new evidence emerging from Europe — where the pattern is similar — suggests this trend could hurt liquidity and distort prices, giving new ammunition to critics. From the global boom in passive investing. Find out more on FP Investor

Editorially recommended

-

![Canadian dollar]()

This “important driver” of the Canadian dollar has been broken

-

This rising GDP figure was only seen during the recession

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line in aholloway@postmedia.com With your contact information and the general gist of your problem and we will try to find some experts to help you while writing your family finance story on this topic (we will keep your name out of it, of course). If you have a simpler question, the FP Answers team led by Julie Cousin or one of our columnists can try it out.

Advertisement 6

Article content

McAllister on Mortgages

Want to learn more about mortgages? Mortgage strategist Robert McAllister's Financial Post column can help you navigate this complex sector, from the latest trends to financing opportunities you won't want to miss. Read it here

Today's post was written by Pamela Heaven With additional reporting from Financial Post, Canadian Press and Bloomberg staff.

Do you have a story idea, pitch, blockbuster report or suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don't miss the business news you need to know – add Financialpost.com to your bookmarks and subscribe to our newsletters here.

Article content