Core inflation slowed in the United States and accelerated in Europe, according to the latest readings, while central bankers in both regions signaled their willingness to raise interest rates further.

Article content

(Bloomberg) — Core inflation slowed in the United States and accelerated in Europe, according to the latest reading, while central bankers in both regions indicated they were ready to raise interest rates further.

Advertising 2

Article content

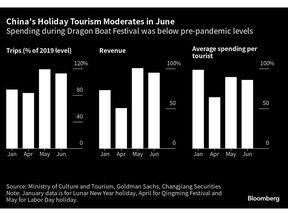

In China, where the economy was expected to experience a massive rebound this year, problems continued to pile up. On top of weak consumer spending and slumping housing, holiday tourism eased last month and industrial profits continue to fall.

Article content

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

United States and Canada

US consumer spending – the main driver of the economy – has lost ground for most of this year, portending weak growth ahead while also helping to cool inflation. This vulnerability contrasts with recent data that otherwise paints a picture of a resilient economy rather than one on the brink of contraction.

Canadian inflation slowed to its weakest pace in two years and core measures eased, reducing – but not removing – pressure on the central bank to raise interest rates again this month. Policymakers may have to raise interest rates again for the second consecutive month in July if the GDP and jobs numbers continue to point to an overheating economy.

Article content

Advertising 3

Article content

Europe

Core inflation in the Eurozone accelerated in June to an annual gain of 5.4% from 5.3% in the previous month as the cost of services rose significantly. With inflation initially driven by shocks including the pandemic and Russia’s war in Ukraine, concerns now center around strong demand for services such as travel, and accelerating wage gains to make up for lost income.

Business expectations in Germany have deteriorated to their lowest levels this year, evidence that Europe’s largest economy is struggling to consolidate recovery after the latest recession.

Asia

This year was supposed to be the year when the Chinese economy, freed from the world’s toughest Covid-19 restrictions, returned to help boost global growth. Instead, halfway through 2023, it faces an array of problems: slowing consumer spending, a crisis-ridden real estate market, declining exports, falling youth unemployment, and high local government debt.

Advertising 4

Article content

China’s consumer-driven recovery shows more signs of losing momentum as spending on everything from holiday travel to cars and homes slows, adding to expectations of more stimulus to support the economy. Spending on domestic travel during the recent Dragon Boat Festival holiday was below pre-pandemic levels.

Profits of China’s industrial firms continued to decline in May, reflecting the impact of weak demand and an ongoing contraction in factories. Lower profits are likely to continue to weigh on business sentiment, which was already declining.

developing markets

Zimbabwe’s annual inflation rate has raced to triple digits for the first time in five months after multiple devaluations of the local currency sent prices soaring. The new measure was chosen as the agency said it better reflects the country’s economic realities because it tracks prices in US and Zimbabwean dollars, unlike the previous benchmark which only assessed costs in terms of the local currency.

Advertising 5

Article content

Pakistan has received preliminary approval from the International Monetary Fund for a $3 billion loan programme, which will reduce the risk of a sovereign debt default. The IMF loans are crucial in helping the South Asian country manage $23 billion in external debt payments for the fiscal year starting in July, more than six times its foreign exchange reserves.

world

Sweden’s Riksbank raised borrowing costs and said it expected to do so at least again this year, while Pakistan’s central bank unexpectedly raised interest rates to a record high at an emergency meeting. Kenya raised its benchmark interest rate to a seven-year high in an unscheduled meeting.

—With assistance from Emma Dong, and Carl M. Lister. Yap, John Liu, Yujing Liu, Vasiah Manji, Godfrey Marwanika, James Meijer, Ray Ndlovu, Reed Beckert, Randy Thanthong Knight, Zoe Schnewes, Fran Wang, Allen Wan, Alexander Weber, Daniela Wei and Yihoe Shih.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation