AUD/USD trading points analysis

- Markets rejected the Australian Building Permits data.

- Upcoming data this week will force the AUD/USD.

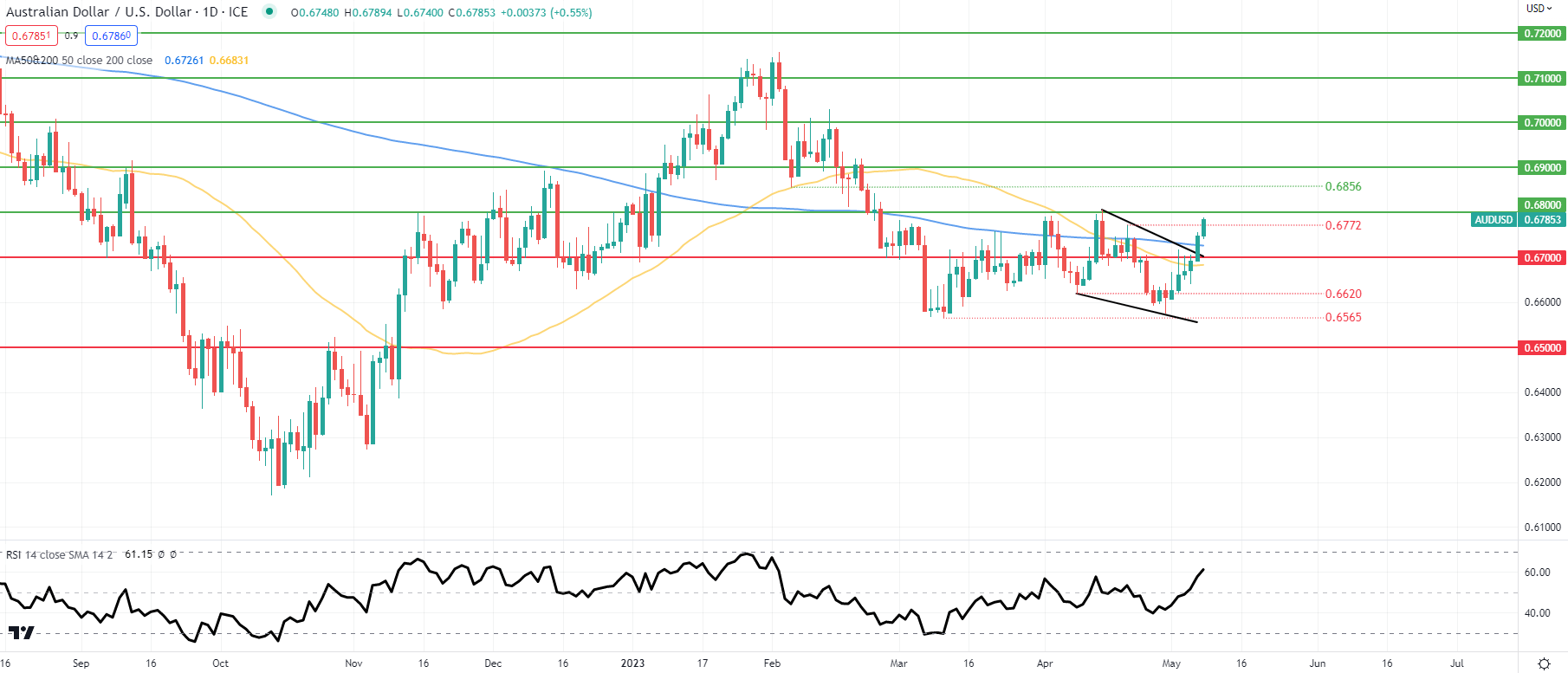

- The breakout of the falling wedge of the AUD/USD currency pair may be cut this week.

Recommended by Warren Vinkitas

Get your free AUD forecast

Australian dollar basic background

The Australian dollar extended its gains from last week as risk sentiment improved after the Nonfarm Payrolls report. AUD/USD will be affected by two major announcements, including the US Consumer Price Index and Australia’s 2023 Federal Budget. Treasurer Jim Chalmers will be in the spotlight with a focus on a cost-of-living package intended to help mitigate the impact of inflationary pressures.

Today’s data centered around the Australian housing markets but with mixed data, the Australian dollar largely rejected the release and responded to dollar weakness. Additionally, Australian commodity exports increased slightly which includes wheat, iron ore, and gold to name a few. Given that many markets are off today, liquidity is likely to remain thin with low trading volumes. In the absence of surprise announcements or data, the price movement of the AUD/USD pair should remain in a relative range and be influenced by technical factors.

Foundational knowledge of the trade

Commodity trading

Recommended by Warren Vinkitas

Economic calendar

source: DailyFX Economic Calendar

Technical Analysis

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

AUD/USD daily chart

Infographic by Warren Venketas, IG

The breach of the recent falling wedge (black) pattern on the AUD/USD daily chart could be room for more bullishness, but if the US CPI comes out hotter than expected, the bears could jump back into the market and target the moving average 200 days (blue) once more.

Key resistance levels:

Key support levels:

IG Customer Sense Data: Surprising

The IGCS shows that retailers are currently on board long On AUD/USD, with 51% of traders who are currently holding long positions. At DailyFX, we usually take a contrarian view of the resulting crowd sentiment but due to the recent changes in long and short positions, we are reaching a short-term bullish bias.

Contact and follow Warrenon Twitter: @WVenketas

Comments are closed.